Standard Chartered introduces public portal for real-time tracking of cross-border payments

The portal offers the ability to trace all cross-border payments cleared through Standard Chartered’s major clearing centres to its clients, as well as to their corporate and retail clients.

Standard Chartered today announces the launch of SC GPI Track, a publicly accessible portal that offers the ability to trace all cross-border payments cleared through the Bank’s major clearing centres to its clients, as well as to their corporate and retail clients. This way, Standard Chartered has paved the way in providing an enhanced cross-border payment experience for its clients.

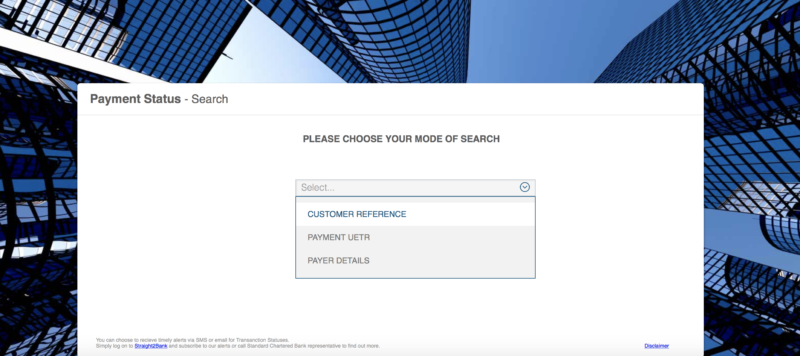

Through the portal, Standard Chartered’s clients and their counterparties can obtain the status of any payments the Bank has processed in real-time, by simply entering SWIFT’s unique end-to-end transaction reference (UETR) associated with the cross-border payment on the public portal.

Alain Raes, Chief Business Development Officer at SWIFT said,

“For far too long, the industry wanted to believe that a slow, opaque and costly cross-border payment was a technology problem. With SWIFT gpi, the global financial system has demonstrated that transparent and traceable cross-border payments are a reality today. On average, 40% of gpi payments are credited to end beneficiaries within 5 minutes and 50% are credited within 30 minutes. Standard Chartered, as an innovative and forward-thinking institution, understands the apt reuse of their SWIFT infrastructure in a practical way. With the launch of SC GPI Track, corporations and financial institutions will be able to further facilitate e-commerce by moving money faster. We view that as a sign of leadership, foresight, and innovation.”

Participants in the SWIFT Global Payment Innovation (GPI) initiative aim to bring greater transparency to the routing of electronic payments. Recently, online trading major Interactive Brokers, which is one of the participants in SWIFT GPI, introduced functionality to let its clients track in real-time the progress of wire withdrawals from their IBKR account. In addition, this functionality will help clients of the company better understand the costs associated with wire transfers, including the fees taken during each leg of the transaction and, if applicable, foreign exchange rates.