Swissquote adds new digital payment cards to mobile app

The latest version of the Swissquote trading mobile app adds new digital payment cards (free of charge) in 12 currencies.

Swiss provider of online financial and trading services Swissquote Group Holding SA (SWX:SQN) has just rolled out an enhanced version of its mobile app for Android and iOS devices.

The new version of the Swissquote trading mobile app adds new digital payment cards free of charges in 12 currencies. The company has also added the ability to deposit funds with a payment card via the mobile app.

In the preceding version, the login process has been improved. Let’s note that traders will have to enter their Level 3 card again after the update. Further, traders can view their assets and transactions of a product from its quote detail.

The unit price is now displayed in the history of the cryptocurrencies transactions. The Mobile Level 3 setting has moved back to the Mobile Level 3 section.

That version also saw the Pulse (social trading network) removed.

The version of the solution rolled out in May this year offered a completely redesigned account overview. It also includes one’s Payment Cards, Documents and Payments. In addition, traders got the ability to group their Payment Card transactions by currency.

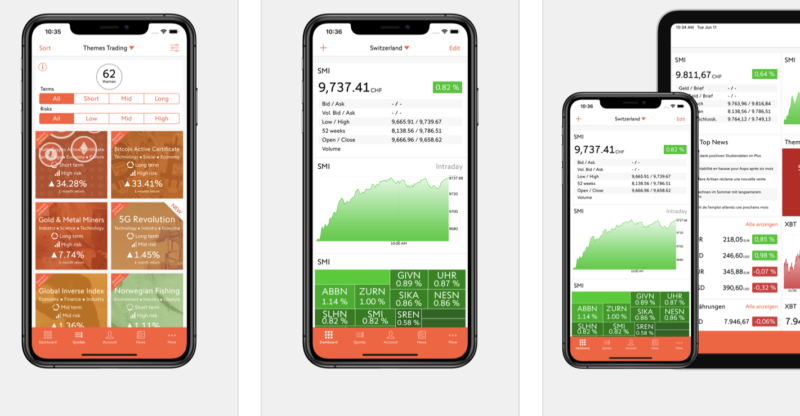

The Swissquote mobile app enables trading in shares, bonds, funds, options and futures, indices, warrants and derivatives. The app also offers Themes Trading: for investment ideas based on the major current trends.

In addition, traders are able to find the latest financial information about several million products and to make use of high-performance financial analysis tools. They can also create and personalise lists of their favourite products and monitor their daily or historic evolution with the help of clear graphs.