TD Ameritrade’s retail FX business rebrands amid Charles Schwab integration

Nearly one year after Charles Schwab closed its $22 billion acquisition of TD Ameritrade, the latter’s retail FX business rebranded as the company streamlines operations.

According to the Commodity Futures Trading Commission (CFTC), TD AMERITRADE FUTURES & FOREX LLC has changed its brand name to CHARLES SCHWAB FUTURES & FOREX LLC.

Charles Schwab said earlier this year that it plans to retain and integrate the former rival’s thinkorswim and thinkpipes trading platforms. At the time, the company anticipated the integration between the two largest publicly traded discount brokers to take up to three years following the close of Ameritrade takeover.

The merger creates an online brokerage behemoth with nearly $7 trillion in client assets and more than 30 million brokerage accounts. The process will also include the educational offerings and tools accompanying them, as well as TD Ameritrade’s institutional portfolio rebalancing solution iRebal®.

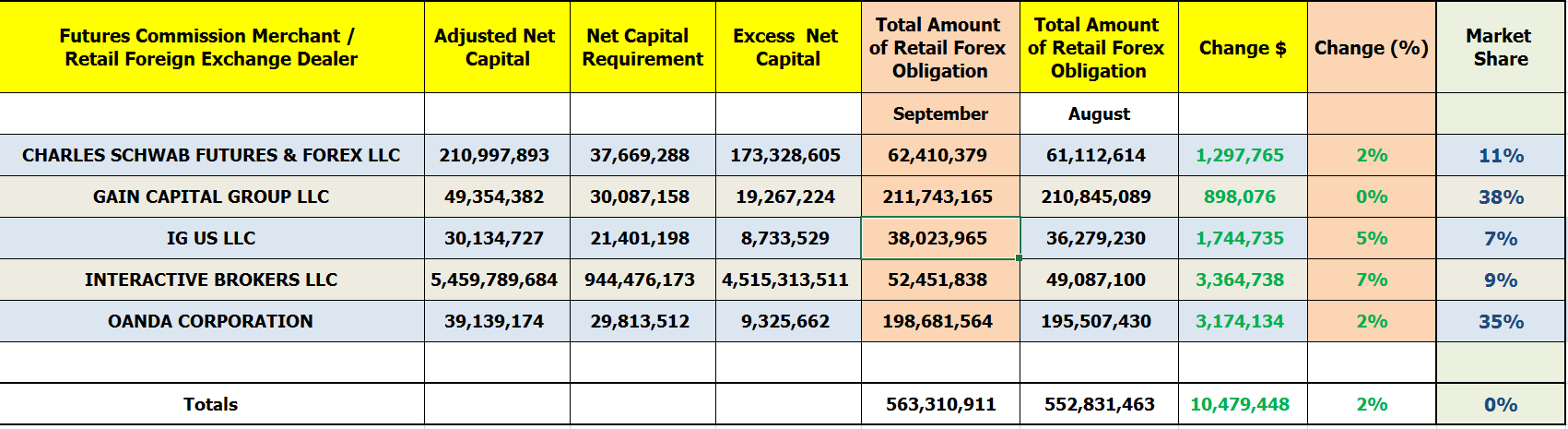

Elsewhere, the CFTC’s monthly report, which covers data for FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, shows a total marginal change month-over-month in retail FX deposits.

The FX funds held at registered brokerages operating in the United States came in at $563 million as of September 30, 2021. That was higher by 2 percent month-over-month compared with $552 million reported in August.

According to the CFTC dataset, the five FX firms reported a positive change in Retail Forex Obligations. Interactive Brokers was the top performer in the reported period, having grown its client deposits by $3.36 million, or 7 percent, at $52.4 million.

Meanwhile, FX retail deposits held at IG US was higher by two percent and currently stands at $38 million, commanding a 7 percent share of the US retail market. The US arm of Canada-headquartered brokerage firm OANDA Corporation also saw its client balances rise 2 percent to nearly $199 million.

Meanwhile in September, GAIN Capital reported a zero percent change though it increased retail funds by $900k.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on September 30, 2021 – for purposes of comparison, the figures have been included against their August counterparts to illustrate disparities.