How does technology fuel the customer experience? asks Julie Menacho, Global Head of Market Technology Sales at CME Group

Live report from FinTech Exchange 2016, Chicago, Illinois In keeping with the fast paced, ultra modern ethos of Chicago’s long established providers of institutional financial technology, this year’s FinTech Exchange 2016 conference began its discussions with 10 minute slots during which senior executives described their product and the innovation methodology that their company provides. Introduced […]

Live report from FinTech Exchange 2016, Chicago, Illinois

In keeping with the fast paced, ultra modern ethos of Chicago’s long established providers of institutional financial technology, this year’s FinTech Exchange 2016 conference began its discussions with 10 minute slots during which senior executives described their product and the innovation methodology that their company provides.

Introduced by prominent industry figure Rod Drown, Senior Managing Director of Global Products and Services at Cantor Exchange, the sessions began, under the name of “Lightning Round” Executive Managing Director, Global Head of Market Technology Sales at CME Group.

Mr. Drown explained “The rules are simple! Each presenter has 10 minutes to discuss his product or solution. I am looking forward to hearing about the new technology that we can expect” before handing the floor to Julie Menacho, Global Head of Market Technology Sales at CME Group.

Ms. Menacho began by posing the question: “How does technology fuel the customer experience?”

“It’s probably relevant that I share with you what I consider to be market technology. We can talk about many aspects but I think it is best to focus on what we are looking at now, which is market data, cloud hosting and vendor partnerships.

“We are parnters with many of the attendees here today, and I want to talk about the foundation of those partnerships” said Ms. Menacho.

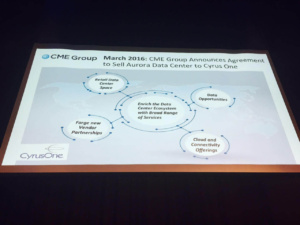

CME sold data center to CyrusOne in March

“In March, we decided to sell our data cetner” explained Ms. Menacho. “As you can see, we are not a real estate company, we focus on our markets which is our core business, so it was best to sell the data center and then take a futuristic look to build on services that we do not have the time and focus to do right.”

“We wanted to form a partnership with CyrusOne, about 50 out of the several hundred customers that trade ont hat facility are service providers from telecoms to software firms and internet connectivity.

“We want to build on a lot of those services, they are multiplying. We still want to keep our data center, to offer more space options and can offer some retail services and forge new partenrships with CyrusOne, they have energy market connections, as well as cloud hosting companies that have established connectivity. They have established connectivity to other venues via a data enter campus.”

How do we find a partner that gets us

“The groundwork is being laid now for introductory services, however where we want to take that is about more partnerships and more services than CME was doing just in the confine of colocation services.”

“Everyone is talking about data. How does CME look at data. We have real time, we have live, we can create data from our existing data, however how can this improve customer experience?” asked Ms. Menacho.

She continued “Soon, if you order data from us, and our data goes back very far, we use a giant hard drive and say that the order will be delivered in 3 weeks. This is crazy. Customers need it tomorrow! We are partnering with Amazon and Ticksmith. Amazon will host and TickSmith will deliver for customer experience. We are looking at what kind of possibilities can exist when data is more accessible. This will launch in May.”

“Partnering with FinTech Sandbox to focus on Startups in the financial technology world. CME Group and a selection of service providers offer data for free so they can build on it and create data for customers. Went to their demo day and tomorrow we will meet to talk about how to progress htis further.”

Partnerships are paramount

“We are talking a lot about partnerships. I’ve been based here in Chicago for 15 years in this industry, and it is great because I don’t just get to focus on what is happening in Chicago. I go to London and take a close look at projects such as Level39 and InnovateFinance.

What do customers need, what is trending? How can CME be a part of it? We do not necessarily want to be the disrupters and creators, but to be able to demonstrate that partnerships and open access, as well as having an understanding of the landscape is very important – Julie Menacho, CME Group.

“Sometimes we want to create it , sometimes the market needs it, but mostly partnerships will drive value” she explained.

I’ve been working on CME partner services, on an online search tool on CMEGroup.com in which any vendor that has any type of service will have a home on our website. People will be able to search, find out what services are available from vendors in one centralized place.”

“We were getting calls from Japan, Singapore, London, and even Chicago with users saying that they don’t know where to go for these services, whether networking events, conferences or referrals.. It was difficult. We are launching it as an outreach to the community – better intel to customer base.”

“We can also monitor trends of new services. We also needed a startup thing too. Nice gateway, start small, going to build on it. What can be done to fuel that, which leads me on to our CME Venturesa arm which we are now aligning to the technology portfolio to encourage R&D allocation to new services like digitization, cloud services, adaptive security and next gen big data. Made 10 investments in 2 years” she concluded.