Tesla Stock Uptrend Expected Due to Battery Advancements and Government-Pushed EV Adoption

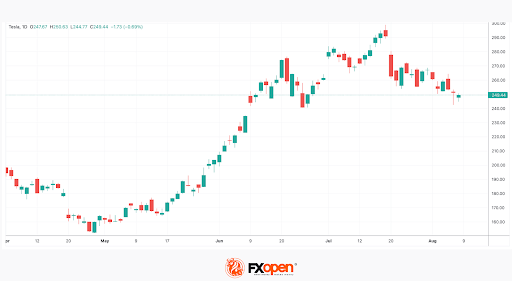

In recent times, Tesla has encountered a noticeable decline in its stock valuation. This dip follows a significant drop in mid-July, as Tesla shares plummeted from $293 per share on July 18 to $260 per share on July 21. This downward trend has persisted, with the stock price now resting at $251. Nevertheless, a positive change seems to be on the horizon, as the price has displayed a slight uptick.

While Tesla is renowned for its stock’s volatility compared to other technology giants based in Silicon Valley, the recent downward trajectory can be attributed to various factors. One prominent factor contributing to this shift is the ongoing discourse in the United Kingdom and several North American and European nations regarding the potential prohibition of fossil fuel-powered automobiles, potentially as early as 2030. Moreover, concerns surrounding the environmental repercussions of battery manufacturing have engendered uncertainty within the EV sector. Nonetheless, recent progress has shed light on Tesla’s technological superiority, resulting in a resurgence in the company’s stock performance.

The Pivot Towards Electric Vehicles

The surge of electric vehicles has been gaining momentum lately, spurred by heightened apprehensions about climate change and the aspiration for greener, more sustainable transportation alternatives. Several governments, including that of the United Kingdom, have been contemplating measures to outlaw the sale of new internal combustion engine (ICE) vehicles, aiming to expedite the transition to electric cars. While the feasibility and democratic aspects of such an approach are debatable, the notion is presently a prominent topic. This shift towards adopting EVs presents both opportunities and challenges for automakers, Tesla included.

While the prospect of government-mandated ICE vehicle restrictions could enlarge the market for EVs, it concurrently raises concerns about the environmental effects of battery production, particularly the extraction of minerals like cobalt and lithium.

The Cobalt and Lithium Discourse

Traditionally, critics of electric vehicles have contended that mining cobalt and lithium for EV batteries contributes to environmental degradation and exploitative labour practices in specific mining locales. This stance has fueled ongoing deliberations about the feasibility of electric cars.

However, recent developments have spotlighted Tesla’s unique advantage in this sphere. Roughly half of Tesla’s vehicle batteries currently in operation do not rely on cobalt or lithium, reducing dependence on these contentious minerals. Tesla’s emphasis on battery research and development has also facilitated exploring alternatives like manganese and iron, potentially supplanting cobalt and lithium. Additionally, the advent of solid-state battery technology holds the promise of further diminishing reliance on these minerals in the future.

Media Backing and the Surge in Tesla Stock Values

In recent weeks, the dialogue about EVs and Tesla’s environmental footprint has undergone a remarkable transformation. Prominent automotive analysts and media platforms that were once sceptical of electric cars have now thrown their support behind the EV movement.

The emergence of credible reports debunking the notion that electric vehicle production is more ecologically damaging than conventional ICE vehicles has bolstered public acceptance of EVs.

As broader backing for EVs and Tesla’s environmentally conscious battery innovations spreads, investor sentiment has experienced a positive shift. Investors are now banking on Tesla’s capability to navigate the evolving automotive landscape and capitalise on the escalating demand for electric automobiles.

In Conclusion

Tesla’s stock prices have encountered fluctuations in recent weeks, primarily influenced by ongoing deliberations surrounding the potential ban on fossil fuel-powered vehicles and apprehensions concerning battery production’s environmental impact. Nevertheless, the recent upturn in media endorsement for electric vehicles and Tesla’s inventive battery technology has revitalised investor trust in the corporation.

As the world strides toward a more sustainable future, Tesla’s dedication to EV technology and its commitment to mitigating the environmental consequences of battery production position the company to capitalise on the burgeoning market. With an increasing number of nations contemplating bans on new ICE vehicle sales, Tesla’s stock trajectory is likely to be moulded by its capacity to navigate these shifting dynamics and sustain its vanguard position in the EV sector.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.