The Pound is safe… but only for now

Are you, the electronic capital markets business, afraid of a Jeremy Corbyn government? You certainly should be….

As far as treacherous government and abominable leadership qualities are concerned, it is perhaps fair to say that England, the country which is home to London, the birthplace of capitalism, has not witnessed such an assault on civil democracy since since the 1816 rejection of reform societies.

Back then, in every town all over the country, but particularly in the industrial midlands and north, open-air public meetings were held in Birmingham, Manchester and elsewhere to demand the right to vote, which England’s ‘ancient constitution’ had once allowed to all male citizens yet denied them this time.

This may appear paltry, however a magnified version of the same situation is possible once again, and will be anathema to any sensible person who is used to a calm, well organized, pragmatic British economy which has ever since the industrial revolution heralded the world’s greatest inventions, the largest contribution to world business and to this day has a 300 year tradition of rock solid, world dominating Tier 1 financial services.

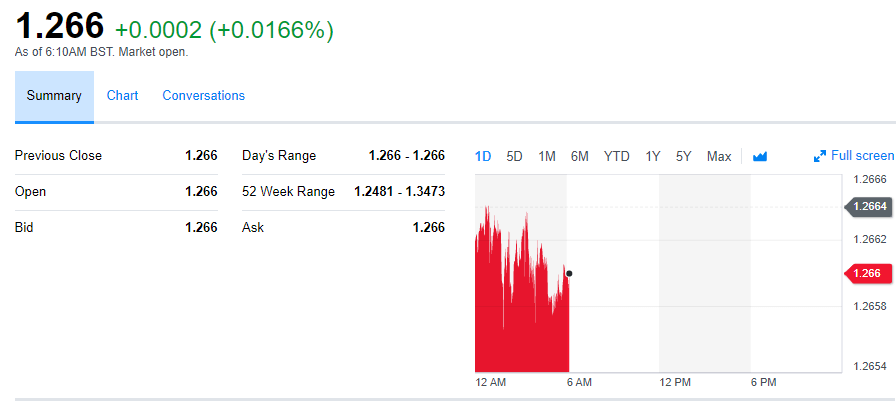

There is a very good reason why the British pound is continually the strongest currency in the world without faltering.

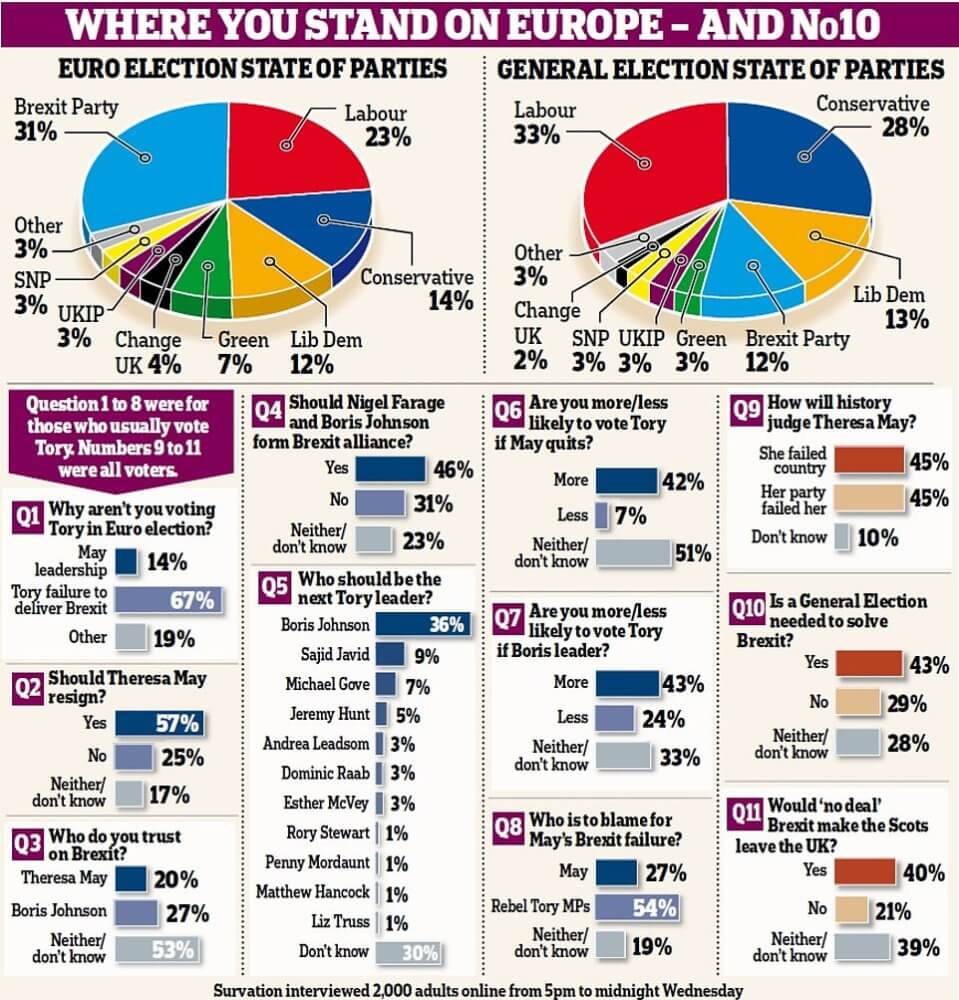

Yesterday’s European Union elections which took Britain’s electorate to the polling stations yesterday may appear irrelevant to the global financial and fintech sector, however it is more than relevant, and could potentially create a landscape changing scenario that may go one of two ways.

Britain has a political system as dyed-in-the-wool as its rock solid banking and industrial system, in that there have only ever really been two parties of significance since the second world war, both fully respected and recognized as democratic parties of complete transparency, that being the capitalist Conservative Party, and the staunch socialist Labour Party, one funded and led by large business and entrepreneurial free marketeers, and the other funded by trade unions and the public sector.

Now, however, such an appalling mess of leadership has occurred, especially incumbent Prime Minister Theresa May’s treacherous assault on democracy by attempting to cancel the result of a democratically decided exit from the European Union, which if successful would pave the way for a non-democratic Britain, and allow pretty much every electoral decision by the public to be overturned, which is a dangerous possibility indeed, especially given the power-mad communist-sympathizing extremism which has punctuated the 40 year political career of the opposition party.

An overturning of the Brexit referendum would play into Jeremy Corbyn’s anti-freedom and anti-business hands, and allow his cabinet to place their metaphorical hands round the neck of every business enterprise in the UK, and destroy international trade relationships. Show me a communist country which has any market on the global stage and whose populace does not live in abject fear and poverty?

Why is this important right now, you may ask?

Yesterday’s results from the polls show that Britain is a modern and urbane nation, and that its informed and pragmatic population will quietly not tolerate a de-facto dictatorship and assault on its freedom.

The result also demonstrates that Britain is absolutely confident that it needs to be an independent nation in order to remove the European millstone around its neck and to flourish as a global leader on the international market – and I mean leader, not participant.

Nigel Farage, once regarded as a caricature ‘Little Englander’ has proved himself to be anything but that, and has absolutely raced to victory in the European elections, demonstrating that Britain wants its own economic freedom.

Cornishman Mr Farage was a futures broker, with his own firm Farage Futures in the 1980s in London, hence his experience in the Square Mile at a time during which electronic institutional trading was at its inaugural stage has left its mark, and Mr Farage understands the reasons why Britain’s capitalist conservative economic might differs tremendously from the totalitarian socialism and revolutionist ideology of mainland Europe.

After leaving the famous private school Dulwich College in 1982, Farage decided to skip university, choosing instead to follow a similar path to his father and brother – his father Guy Justus Oscar Farage was a well-known stockbroker and his brother Andrew became a broker on the London Metal Exchange – and work in the City as a commodities trader.

Far from a wealthy influncer in the City, Mr Farage was an entrepreneur at an early age and his political career has followed that same non-conventional path.

Whilst this is great news for the UK at the moment, there is now a very real possibility of a socialist government at the impending general election.

Yes, whilst the British economy and its sovereign currency is safe from being plundered by bright red hands in Westminster and Brussels at the moment because of Mr Farage’s single policy of ensuring Brexit happens, a socialist government in the UK would be a disaster.

Just three years ago, there was a substantial amount of discourse mounting in London with regard to the European Union’s predilection for the intrinsically socialist Tobin Tax on transactions that are placed in trading financial instruments.

That has now gone completely quiet, as Britain opposed it on principle and has managed to fend it off, however in 2013, eleven European Union member states, all of which were led by left-wing governments, announced their wish to move ahead with introducing a financial transactions tax.

At that time, the nations – which include France and Germany – intended to use the tax to help raise funds to tackle the debt crisis, and the tax had the backing of the European Commission which was reinforced after the 2014 election the highly unpopular Jean-Claude Juncker as President.

The other countries that wished to introduce it were Italy, Spain, Austria, Belgium, Greece, Portugal, Slovakia, Slovenia and Estonia, all nations with absolutely no place in the world’s highly advanced financial markets economy. Greece’s government accountants, when not asleep for half of the day, cannot tell the top from the bottom of their balance sheets, Italy is rife with corruption, Portugal is agrarian, Belgium has invoked outright bans of retail electronic trading instruments and Slovakia, Slovenia and Estonia have absolutely no Tier 1 bank presence.

Jeremy Corbyn’s policies echo this line of thinking.

The Tobin tax was originally proposed to target the FX market when it was orchestrated by James Tobin in the 1970s, and whilst Britain has managed to remain free from it’s burden until now, Jeremy Corbyn is a staunch advocate of implementing it.

In September 2015, Jeremy Corbyn and Shadow Chancellor and equally leftist John McDonnell made a schedule to meet four times per year with a seven-strong group comprising of economic academics (rather than business leaders) one of which was Anastasia Nesvetailova, a self-designated ‘expert’ on the international financial sector and its role in the global financial crisis of 2007-09. Ms. Nesvietailova, is an academic who spends her day in the classroom rather than the boardroom, thus is a theorist and has no practical experience. Just the type of policy advisors favored by the left.

During one particular conversation, the Labor Party’s support for the implementation of the Tobin Tax on all trading transactions was raised, as was, rather alarmingly, the potential of a Britain free of dominance of the financial sector.

Bearing this in mind, it is worth looking at John McDonnell’s credentials and viewpoint.

Mr. McDonnell is a former trade unionist who backs renationalizing banks and imposing wealth taxes. He actually lists “generally fomenting the overthrow of capitalism” as one of his interests in the Who’s Who directory of influential people. He also advocates the complete public ownership of all banks.

Mr McDonnell has served as Chair of the Socialist Campaign Group in Parliament and the Labour Representation Committee, and was the chair of the Public Services Not Private Profit Group. He is also Parliamentary Convenor of the Trade Union Co-ordinating Group of eight left-wing trade unions representing over half a million workers

The thought of Tier 1 FX desks being run by teams of ‘entitled’, unaccountable gray cardigan-wearing Caravan Club members with civil service pension plans should be enough to send the entire industry striking up prime brokerage relationships in Hong Kong, New York and Singapore.

Mr McDonnell has also said publicly that if he was able to, he would have assassinated Margaret Thatcher in the 1980s, a comment that when challenged, he retracted and said it was “a joke”.

Well, Mr McDonnell, that kind of extreme anti-business mentality combined with a will to bring the entire financial markets sector to its knees in the rebellious quest for overthrowing capitalism is not welcome.

Mr McDonnell wrote in 2012 that a financial transaction tax would halt “the frenetic, madcap speculation in the City” and raise money for infrastructure investment.

“If the City resists then let’s make it clear that capital controls would follow,” he said in a piece for Labour Briefing, a left-wing website.

He has also said he wants to take the power to set interest rates away from the Bank of England and to give it back to government. This would reverse a decision by the Blair government to let the central bank decide monetary policy.

If his choice of senior cabinet ministers is not enough to ensure that this odious relic of the dark days of socialism stays out of office, Mr. Corbyn’s affection for Venezuelan communist dictator Hugo Chavez should do the trick.

In 2013, Mr. Corbyn tweeted “Thanks Hugo Chavez for showing that the poor matter and wealth can be shared. He made massive contributions to Venezuela & a very wide world” just after president Chavez passed away.

The hard-left policies of Mr Corbyn’s idol Hugo Chavez have left a once-rich nation brutalized and devastated and with 2,200% inflation, strict capital control laws and an inability to do business with any free market nations.

Venezuela shows quite clearly just how catastrophic socialism is. So you might then expect those well-meaning folk who held up Chavez as a paragon to admit their mistake. Naomi Campbell, Diane Abbott, Seumas Milne and Owen Jones in the UK; Sean Penn, Oliver Stone and Michael Moore in the US. Not a peep from any of them.

Hugo Chavez’ successor Nicolas Maduro has turned out to be a first class economic incompetent. In 2016, imports collapsed by more than 50% (largely due to socialist trade sanctions) and the economy nosedived by 19%.

Capital controls and the seizure of corporate and personal assets is one of the main pillars of socialism, and I am aware of a great many business leaders, both in my professional and social life, who have taken steps to remove their wealth from the UK prior to any general election to avoid capital controls and then a plundering by Mr Corbyn’s hate mongers.

Trade clearing all takes place in Britain, so does the majority of Tier 1 liquidity provision. This would always still happen as Britain’s infrastructure and expertise places it as the only center in the world for global financial markets activity, however these institutions may well conduct their business in Britain but keep their capital in, for example Singapore or Hong Kong.

Britain cannot afford to give away its prowess like that, hence the binary potential outcome should be on everyone’s watch, whether running a business in Britain or otherwise.