Top 5 Most Reliable KYC Technology Providers

The financial sector’s trade evolution has led to the emergence of several financial markets that provide excellent opportunities for wealth creation. However, it has also given rise to many fraudulent organisations that attempt to steal money from traders. KYC providers developed and offered KYC technology to combat criminal activity in the field of trading and investing.

What Does KYC Provider Stand For?

KYC (Know Your Clients) service providers offer services to businesses and financial institutions to help them verify the identity of their customers. KYC services are essential in preventing fraud, money laundering, and other financial crimes. These providers use various methods, including biometric verification, document verification, and database checks, to ensure customers are who they claim to be.

KYC service providers can benefit businesses by reducing the risk of fraud and financial crime, improving compliance with regulatory requirements, and enhancing customer experience by streamlining the onboarding process. Moreover, KYC services can help financial institutions identify politically exposed persons (PEPs) and individuals or entities with a higher risk of economic crime.

KYC Technology: Its Value and Significance for Digital Businesses

In today’s digital age, businesses increasingly rely on digital channels to engage with customers and conduct transactions. This shift has brought about numerous benefits, including increased efficiency and convenience. However, it has also created new security risks as cybercriminals seek to exploit vulnerabilities in digital systems. As a result, businesses must take proactive measures to safeguard their operations and customers’ data.

KYC technology is one of the most effective ways to enhance digital security. KYC technology is a set of procedures and tools businesses can use to verify the identity of their customers and ensure that they are who they claim to be. This technology provides additional protection against fraud, identity theft, and other types of cybercrime.

KYC technology has numerous benefits for digital enterprises. First, it helps establish trust between businesses and their customers. By verifying the identity of their customers, companies can demonstrate their commitment to security and build a reputation for reliability and integrity. Additionally, KYC technology can help businesses comply with regulatory requirements, such as anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Why To Use KYC Technology Providers?

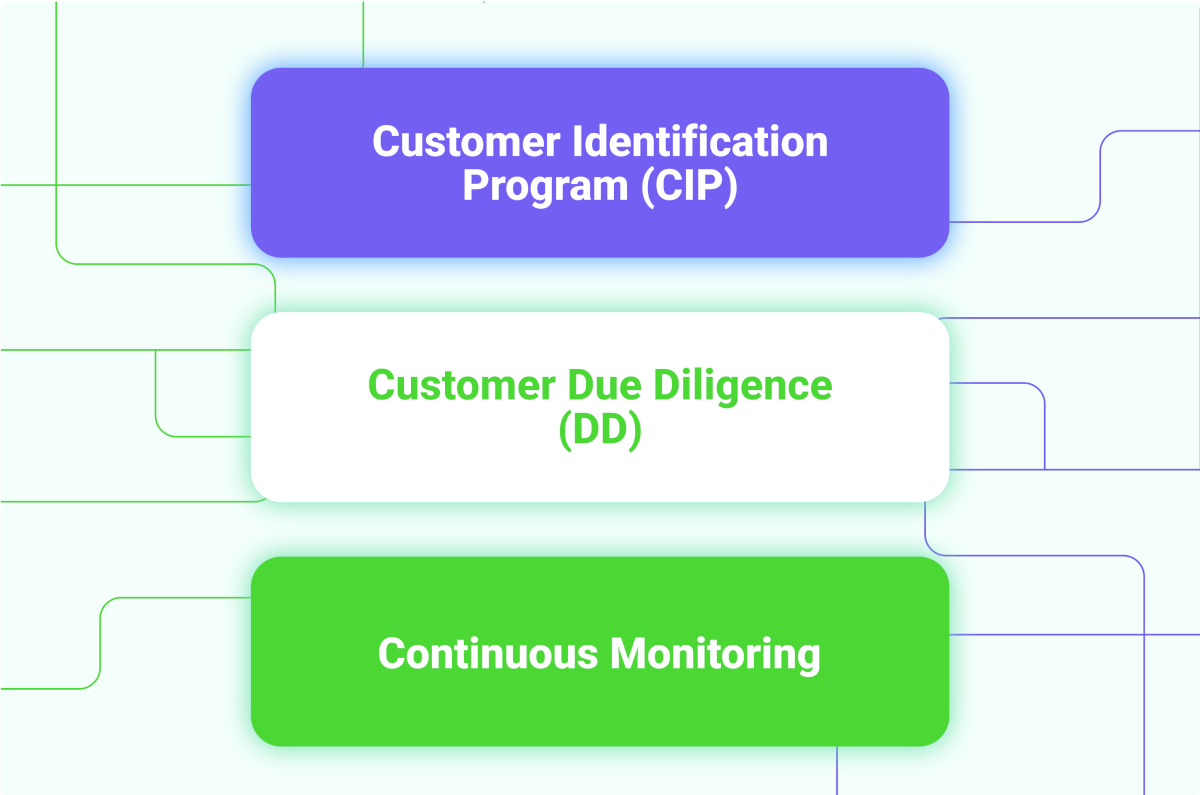

Using KYC service providers is becoming increasingly important in the business and financial sectors. These providers offer a range of services that help verify customers’ identity and ensure that they meet regulatory requirements. By using KYC services, providers, businesses and financial institutions can better manage risk, prevent fraud, and comply with legal and regulatory frameworks.

KYC services providers offer a variety of services that can be tailored to meet the specific needs of a business or financial institution. These services may include identity verification, document authentication, background checks, and risk assessments. The use of these services can help reduce the risk of fraud and money laundering, as well as improve the overall security of the organisation.

The Top 5 KYC Providers Your Company Should Take Into Account

There are a large number of KYC providers on the market, but below are 5 examples with outstanding service and features that differentiate them from other solutions.

Shufti Pro

Shufti Pro is an AI-powered identity verification system that offers KYC and AML screening solutions. It has a vast database containing profiles from national and international law enforcement agencies and financial regulators. Shufti Pro’s AML-based data checks help protect companies from financial risks and monetary penalties.

Trulioo

Trulioo was established in 2011 and is based in Toronto. The company provides other businesses with tools to authenticate user identities and verify data accuracy. Trulioo’s services also enable the verification of documents submitted by users. The company has access to 450 different data sources, including credit bureaus, cell phone carriers, and open APIs of government agencies, which are utilized to authenticate the identity of remote customers.

Ondato

Ondato has developed a KYC technology that has been tried and tested and is a reliable solution for financial institutions. It automates the process of customer (individual and corporate) registration and KYC data collection and monitoring (ODD), reducing compliance resources and data management.

Fractal ID

Fractal, a fintech developer based in Germany, has created Fractal ID – a platform that verifies identity for KYC/AML purposes. This service provides rapid and accurate global verification, boasting a conversion rate of over 40%, higher than industry standards.

The verification process involves using OCR and facial recognition to authenticate national IDs and passports. Fractal ID adheres to bank-level KYC/AML regulatory standards and complies with GDPR.

Sumsub

Sumsub is a KYC/KYB/AML solution that helps companies with user authentication and document verification. It uses machine learning and AI to compare documents and determine if a live person is present. It supports 6,500 document types from over 220 countries.

Conclusion

The KYC process is an essential part of verifying the identity of a user, whether they are trading in financial markets or engaging in economic transactions with other individuals or legal entities. This technology provides an affordable solution in the fight against money laundering and is a valuable asset for any business in the financial sector.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.