Traders can now ask Interactive Brokers’ IBot to add tickers to watchlists

As the online trading world increasingly embraces AI solutions, Interactive Brokers beefs up the capabilities of its IBot.

Do you remember IBot? This is the text-based interface for the TWS platform that electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) launched in late 2016 and that has been improving ever since.

The latest enhancements to the functions of the bot including adding tickers to watchlists – that is, traders can ask IBot to add a certain ticker to a certain watchlist. All they have to do is select a watchlist from the Monitor panel and a ticker (say, IBKR) and then enter the command “Add ibkr to watchlist”. Or, they can use the watchlist name, for instance “Add ibkr to favorites” and IBot will add the ticker to one’s “Favorites” watchlist.

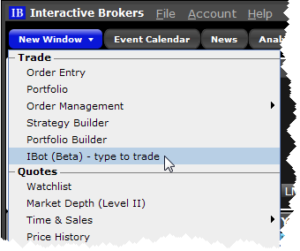

A short reminder on how to use IBot. Go to the New Window drop-down in Mosaic and select IBot (beta) – type to trade. Then you can type a command in the IBot text box. Anyone willing to see a brief demonstration should type “demo”.

A short reminder on how to use IBot. Go to the New Window drop-down in Mosaic and select IBot (beta) – type to trade. Then you can type a command in the IBot text box. Anyone willing to see a brief demonstration should type “demo”.

IBot understands commands in different areas of interest to traders, ranging from account information to charts and quotes. A typical Chart command, for example, would be “Show me 2 days price of AAPL”, which will lead to IBot returning a chart based on an educated guess. This means that traders may omit bar sizes or time ranges, and IBot will display “the most reasonable chart” based on what they entered.

Of course, there is a number of non-supported and misunderstood commands. If the traders enter a non-supported command, or one that IBot cannot accurately interpret, IBot will provide her best efforts result accompanied with a “Potentially misunderstood” warning message and an icon.

The enhancements to IBot come along with a set of other improvements in the TWS platform, including a new instrument category – US Certificates of Deposit (CDs), added to Advanced Market Scanners. The broker has recently been working on beefing up the Scanners & Columns capabilities of TWS. As FinanceFeeds has reported, Interactive Brokers has introduced new tools from AltaVista Research and Recognia.