TradeStation works on AI-based chatbot

The newest of the TradeStation Sandbox projects is an AI-based chatbot that helps traders find new trading opportunities while keeping them connected to the markets.

TradeStation Sandbox, a fintech accelerator and think-tank program, continues to give birth to new projects, with the latest one codenamed “SandBot”.

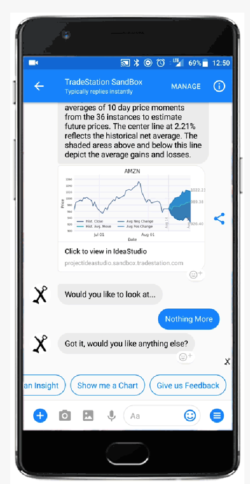

SandBot is an AI-based chatbot that helps traders find new trading opportunities while keeping them connected to the markets. It allows traders to get the price of a stock, ETF, or futures contract by entering a few key strokes.

SandBot is also able to investigate an idea that interests a given trader. The bot will produce suggestions and the trader gets to decide which combination of symbols best meets his/her goals. For those who need more detail than just a quote, SandBot can quickly provide a chart so that traders can visualize recent trends.

SandBot is also able to investigate an idea that interests a given trader. The bot will produce suggestions and the trader gets to decide which combination of symbols best meets his/her goals. For those who need more detail than just a quote, SandBot can quickly provide a chart so that traders can visualize recent trends.

In addition, traders in need of new trading ideas may ask SandBot for unique insights and trading ideas on symbols of their choosing to uncover hidden relationships between key historical events and stock performance.

With the assistance of SandBot, traders can also view snapshots of popular US market indices and various futures commodity segments. The bot also provides snapshots of a number of indexes from Europe and Asia, as well as of popular Forex symbols.

Two projects of TradeStation’s Innovation Lab are currently inactive – Lumos and Sidekick, whereas two projects are active – Sandbot and Eva. Eva harnesses the power of machine learning, AI and big data analytics, to help traders connect events to opportunities. She (or it) enables traders to find, test, and trade sophisticated ideas born of quant-level analysis. EVA provides information on what to trade, when to trade and how to trade it. Exemplary questions in which EVA is an expert include “What happens to the S&P 500 when the Nikkei 225 is up 5% in a single day? ” or “How should I trade Apple before the ex-dividend date?”.

TradeStation Sandbox is hosted and operated by TradeStation Technologies, Inc., a software development company which owns all technology and other intellectual property used by its affiliate, TradeStation Securities, Inc.

TradeStation has been changing its image and offering to suit younger clientele. In July this year, John Bartleman, President of TradeStation Group, announced that the company was undergoing a rebranding as it seeks to cater for a growing clientele, including more millennials and younger traders.

“Today, we are taking technology into a new direction – with more mobile and web-based offerings, and go after a much broader audience of traders”, Mr Bartleman said back then.

The new projects the Sandbox is working on should not come as a surprise, therefore. Mr Bartleman said back in July that that mobile is about 20% of TradeStation usage right now.