Trading Technologies lures Bloomberg veteran Gavin Miller

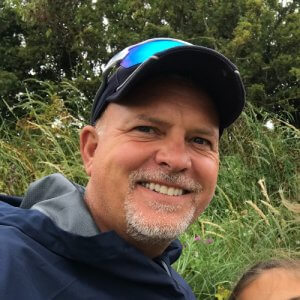

Chicago-based Trading Technologies has just hired former BGC’s executive and Bloomberg veteran Gavin Miller as its newest director of EMEA sales within TT’s fixed income division.

Gavin Miller is a seasoned professional with an extensive background in the financial and technology sectors. He joins Trading Technologies from BGC Partners where he spent nearly five years, having originally joined the interdealer broker after it finalised its acquisition of Algomi, a company specializing in fixed income aggregation and surveillance technology.

Algomi was acquired by BGC Partners in 2020, leading to the integration of its bond trading software and pre-trade analytics business with BGC’s electronic trading and software division, Fenics. After this merger, Miller assumed the role of Managing Director of Institutional Sales, overseeing the Lucera LUME Alfa product.

Miller’s career trajectory boasts a long-standing association with Bloomberg, where he dedicated over two decades to various roles. His roles at Bloomberg included serving as Global Head of Sales and Account Management for Global Markets Electronic Trading, Global Head of Fixed Income, Currencies, and Commodities Electronic Sales, and Global Head of Fixed Income Electronic Trading Sales.

Before his time at Bloomberg, Miller had a stint as a credit trader at Salomon Smith Barney, now a part of Morgan Stanley Wealth Management.

In his capacity at TT, he will leverage his extensive experience and versatile skill set to develop the company’s fixed income pricing, execution, and workflow solutions for both buy-side and sell-side clients.

“I am very pleased to be starting a new role with Trading Technologies. With a focus on Fixed Income Pricing, Execution and Workflow solutions for both the buy side and sell side, I look forward to catching up with you soon,” Miller wrote in a Linkedin post.

The TT platform provides market access and trade execution through the software-as-a-service (SaaS) delivery model. In addition, the solution provides access to major international exchanges and liquidity platforms. The platform already serves a wide variety of users, including proprietary traders, brokers, money managers, CTAs, hedge funds, commercial hedgers, and risk managers.

Earlier in June, Trading Technologies unveiled a new venture called TT FX, marking its entry into the foreign exchange (FX) sector. This expansion into a new asset class comes after TT’s acquisition of AxeTrading, a provider of fixed income trading solutions in March.

The newly established TT FX unit is led by Tomo Tokuyama, who held the position of Head of Trading at First Quadrant, a quantitative fund based in Los Angeles.