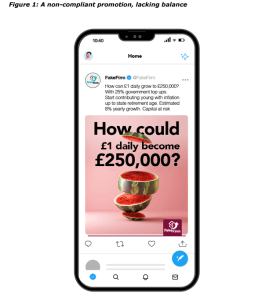

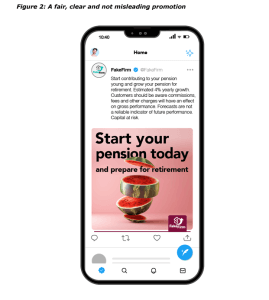

UK FCA wants to revamp social media guidance toward 50% reduction in high-risk investors

“We want people to stay on the right side of our rules, so we’re updating our guidance to clarify what we expect of firms when marketing financial products online. And for those touting products illegally, we will be taking action against you.”

The UK Financial Conduct Authority has announced it plans to take another significant step in its work to combat illegal and non-compliant financial promotions.

The proposals for new social media guidance are aimed at modernizing the information firms should use when promoting financial products or services online. The new guidance will attempt to reflect the current ways social media is being used to advertise financial services and products.

According to the FCA, this guidance will also support the UK regulator’s Consumer Investments Strategy outcome of seeking a 50% reduction in the number of retail consumers investing in high-risk investments (HRIs) who demonstrate a low-risk tolerance or characteristics of vulnerability by 2025.

“What we expect of firms when marketing financial products online”

Lucy Castledine, Director, Consumer Investments at the FCA, said: “We’ve seen a growing number of ads falling short of the guidance we have in place to stop consumer harm. We want people to stay on the right side of our rules, so we’re updating our guidance to clarify what we expect of firms when marketing financial products online. And for those touting products illegally, we will be taking action against you.”

The FCA has been ramping up its scrutiny of online, often illegal, financial promotions, recognizing the significant increase in the notoriety of ‘finfluencers’ and the potential for consumer harm taking place online.

The FCA has also teamed up with the Advertising Standards Authority to help educate consumers and influencers about the risks involved in promoting financial products. This work has included an infographic, roundtable discussions and live events to build up awareness of the harm that can take place.

FCA engagement has also helped secure changes to the advertising policies of several Big Tech companies to only allow financial promotions that have been approved by FCA-authorised firms. The regulator will be continuing this engagement to ensure more is done to protect consumers.

FCA will ban incentives to invest in crypto

The consultation follows the announcement of new advertising rules for crypto firms marketing to UK consumers.

From October 8 2023, the FCA will ban incentives to invest in crypto, such as ‘refer a friend’ bonuses. Firms must also introduce clear risk warnings and a 24-hour cooling period to give first-time investors the time to consider their investment decision. These measures are similar to the regime in place for other high-risk investments.

The new social media guidance supports two of the FCA’s core commitments set out in the 2023/24 business plan to reduce and prevent serious harm and set and test higher standards.