UK regulator registers decrease in passporting notifications from firms in Q1 FY2019/20

The significant drop in the volume of cases received in the quarter to end-June 2019 might be expected in the current Brexit climate, the FCA says.

The UK Financial Conduct Authority (FCA) has published the Authorisations Quarterly Key Performance Indicators (KPIs) for the first quarter of FY2019/20. The data provides an insight into the work of the FCA’s Authorisations Division during the three months to end-June 2019.

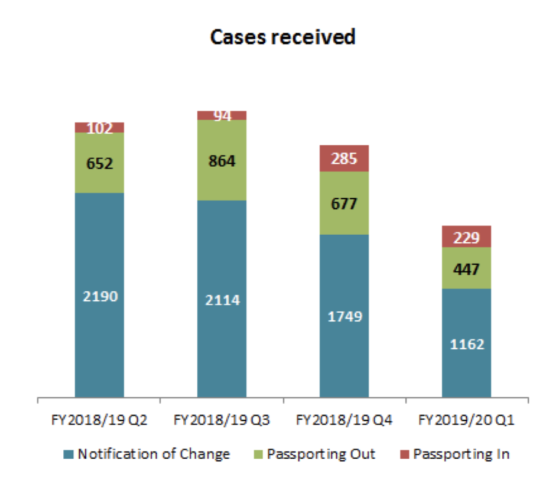

The “passporting in” cases received in the first quarter was 229, markedly down from the 285 such cases received in the prior quarter. There was a drop in the volume of “passporting out” cases too.

“There was a significant drop in the volume of cases received this quarter which might be expected in the current Brexit climate”, the regulator commented.

“We continue to see steady volumes of Passporting in notifications from firms and we continue to proactively signpost firms and national competent authorities to the TPR (Temporary Permissions Regime)”, the FCA added.

In May, the FCA confirmed the extension of the deadline for notifications for the TPR to October 30, 2019. As previously guided, TPR would allow EEA-based firms passporting into the UK to continue new and existing regulated business within the scope of their current permissions in the UK for a limited period, while they seek full FCA authorisation. This regime will also allow EEA-domiciled investment funds that market in the UK under a passport to continue temporarily marketing in the UK.

In September, the FCA published draft directions under its Temporary Transitional Power (TTP). The TTP, as FinanceFeeds has reported, offers the FCA flexibility when it comes to applying post-Brexit requirements, allowing firms to transition to a new UK regulatory framework. The directions are set to become effective on exit day if the UK leaves the EU without an implementation period.

Pursuant to the directions, firms do not generally need to prepare now to meet the changes to their UK regulatory obligations related to Brexit. However, in some cases, firms must take reasonable steps to comply with post-exit obligations from exit day.

Firms that will have to make changes on exit day are:

- firms subject to the MiFID II transaction reporting regime, and connected persons (for example approved reporting mechanisms);

- firms subject to reporting obligations under European Market Infrastructure Regulations (EMIR);

- EEA Issuers that have securities traded or admitted to trading on UK markets;

- investment firms subject to the Bank Recovery and Resolution Directive (BRRD) and that have liabilities governed by the law of an EEA State;

- EEA firms intending to use the market-making exemption under the Short Selling Regulation;

- firms intending to use credit ratings issued or endorsed by FCA-registered credit ratings agencies after exit day;

- UK originators, sponsors, or securitisation special purpose entities (SSPEs) of securitisations they wish to be considered simple, transparent, and standardised (STS) under the Securitisation.