USDJPY has surged to levels last witnessed in 2022. Should we consider opening a short position?

The recent resurgence of the US dollar has propelled USD/JPY to new heights, touching levels not seen since 2022. This surge comes against the backdrop of stable short-term yields and ongoing economic data that fails to signal a significant slowdown, prompting questions about the extent of current monetary easing measures.

USD/JPY has broken above the 2022 high, reaching 151.97, driven in part by the Bank of Japan’s recent rate hike. However, Finance Minister Suzuki’s warnings regarding unwarranted yen depreciation indicate potential intervention in the FX markets if the trend persists. The yen’s performance, being the second worst among G10 currencies since the rate hike, underscores concern of speculation-driven movements.

USDJPY 4H Chart

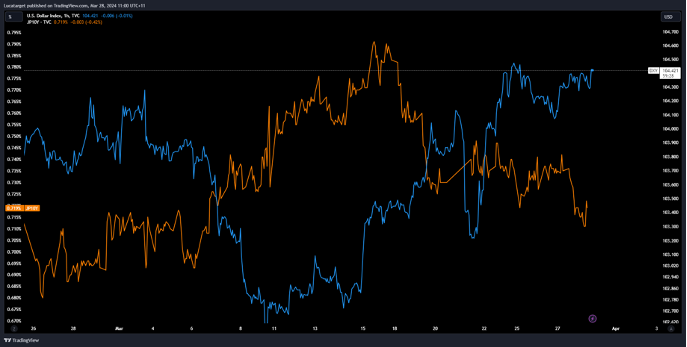

Analysts observe a correlation between yield spreads, USD/JPY, and the Dollar Index (DXY), suggesting a possible overshoot in spot prices. While option-related barriers may temporarily restrict further upward movement, continued momentum could prompt intervention from both the Ministry of Finance and the Bank of Japan.

DXY (Blue) & JP10Y (Orange)

Comparisons with 2023, when USD/JPY saw a sharp reversal from its peak, highlight the impact of US inflation and yield fluctuations. Despite lower yields and sticky inflation, indicators like consumer confidence reveal growing concerns about future consumption patterns, particularly as credit card delinquency rates soar to levels not seen since the Global Financial Crisis.

The divergence between large-cap and small-cap stocks further reflects the strain of high interest rates, with small firms bearing the brunt. Analysts suggest that without clear signs of an economic slowdown in upcoming data releases, expectations for a June rate cut may diminish, potentially strengthening the US dollar through the second quarter.