How To Use The Best Cryptocurrency Market Indicators

Predicting which direction the price of crypto will move is not easy. This is why indicators should be utilised to help traders predict price movements more accurately and give them a clearer picture as to what action buyers and sellers are likely to take next.

Those new to the world of cryptocurrency trading can feel a bit overwhelmed at the thought of using any kind of technical and market analysis. However, as any experienced trader will confirm, they are a vital tool for anyone seeking a profitable outcome. The good news is that anyone can become an effective crypto trader and build a solid foundation by mastering the basics. In doing so, you can trade crypto confidently, armed with a powerful set of tools.

In fact, one of the most important advantages of crypto and blockchain is that much transaction information is stored in a database called the public ledger, access to which is free. Using this data, you can build indicators and extract data to use to your benefit. Here are our top 4 market indicators for crypto traders.

SOPR

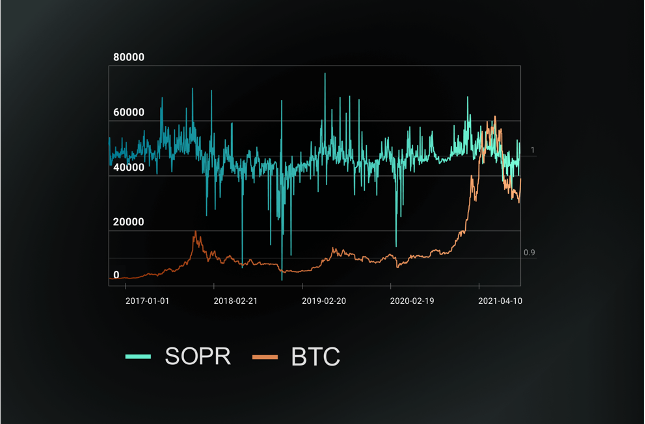

The idea behind SOPR (Spent Output Profit Ratio) indicator is that as the ledger stores data on each transaction, together with the price at which someone sells tokens, we are able to see at every point how many people are at a profit or loss at any given time. Its main use is to highlight potential bottoms in the market.

SOPR does this by measuring the overall state of profit or loss in the market and measuring the difference between the buy and sell prices using a ratio of the selling price over buying price. If the ratio reveals a value greater than 1, it means that market participants are selling at profit and vice versa for values of less than 1. A consistent indicator reading above 1 shows that the asset is in a bull market.

CVDD

CVDD (Cumulative Value Days Destroyed) indicator uses the data collected regarding the time that each transaction occurs to calculate how many days each person holds tokens in their wallet.

In this case, when coins are moved from an old to a new investor, the transaction which carries a USD value, additionally destroys a time value that is related to the length of time that the original investor held their coins. CVDD works by tracking the cumulative sum of this value-time destruction as coins pass from old to new investors as a ratio to the market age. CVDD has a tendency to rise consistently in value. It is a useful tool to frame a rising lower bound for a market bottom amid a bear season and has historically pinpointed the bottom of the market accurately.

Stock To Flow Model

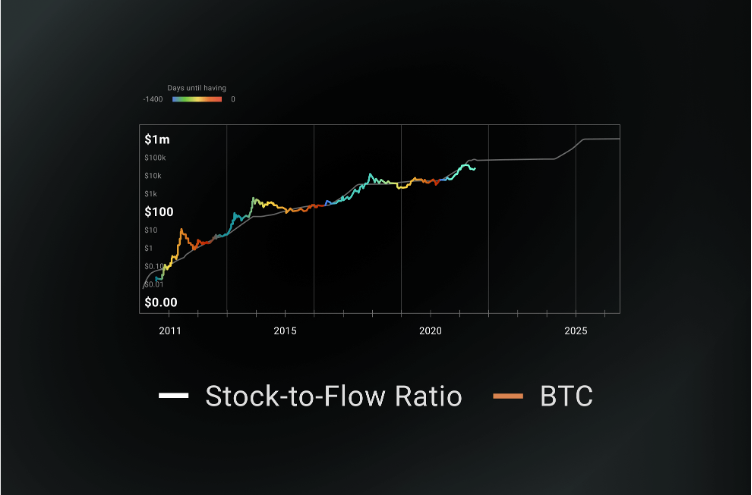

The Stock to Flow ratio measures how much the quantity of an asset increases over time, against how much of it is currently in existence. This model is one of the most frequently used on the market based on the assumption that scarcity drives value. A higher ratio indicates that the asset is increasingly scarce and is, therefore, more desirable as a store of value. Hence, Bitcoin is an asset with limited supply which halves every 4 years and by 2140 their production will cease. This scarcity drives its price.

The Stock to Flow model hence attempts to predict the price of Bitcoin based on this factor. Despite a few minor criticisms, the ratio has been used successfully to build a statistical model and has until now, been an effective tool for outlining the track of price movements, generally performing very well.

Hash Rate

The Hash Rate indicator is based on the hash rate and although not a true indicator as such, is one of the most important metrics for the health of the Bitcoin network, especially for those new to the market. The hash rate is basically the amount of computing power that BTC miners generate at any given time and measures how actively miners operate the system, create new blocks and process new transactions. How well does it predict the price? Arguably, not particularly well, but it is still regarded as one of the most important ‘indicators’ as it shows you how secure the network is at each point in time.

In summary, there is a lot of information on the blockchain which is open to everyone for use. The Public Ledger is an open-source providing the means for traders and investors alike to get hold of this data and use it to build their own indicators to the best of their advantage.

It should be stressed that care should be taken when applying these models to any trading activities, but by using some of the most important techniques outlined above, they offer a lot of potential when it comes to maximising your profits.

Cryptocurrency Market Indicators