‘Venture capital’ investment platform Further taps Yoti to onboard retail clients

Further is an investment platform that connects retail investors to venture capital funds, from as little as £1,000.

Further, a London-based startup scaling an FCA-authorized investment platform, has selected digital identity provider Yoti to streamline the customer onboarding process, making it faster and easier for people to invest in their chosen funds.

The investment platform connects retail investors with venture capital funds, at scale, and with minimum investment levels, thus small investors to gain access to venture funds, from as little as £1,000.

Venture capital fund investment opportunities available on the platform include a variety of well-known UK tax-advantaged and international venture capital fund managers.

Yoti strengthens Further’s KYC/AML under UK FCA rules

Further is required by FCA rules to provide appropriate identity evidence for investors when transactions take place in order to prove that all investors seeking to invest in a fund via Further are who they say they are.

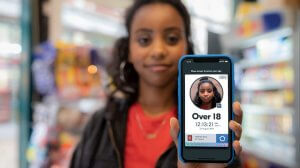

Yoti provides frictionless onboarding and faster processing times with its digital identity checks that take less than five minutes to complete, thus strengthening Further’s KYC and AML processes.

Rob Tominey, Chief Executive Officer at Further, commented: “We’re thrilled to be working with Yoti on identity verification and AML, which has been seamlessly integrated into Further’s onboarding process. To deliver a high quality, premium, trustworthy experience for today’s investors, it was important that we found a tool with a user experience that matched our own and was straightforward to use across devices – and Yoti have delivered on this. We look forward to growing Further alongside the team at Yoti.”

John Abbott, Chief Commercial Officer at Yoti, said, “We’re really pleased to be working with Further to power the next generation of financial products. Our identity verification technology will strengthen and streamline their customer onboarding, and create a frictionless and secure experience. There’s a growing desire for better experiences from consumers and our technology can fast track processes that historically have taken up significant time and effort. Individuals can pass identity verification checks quickly and focus on what’s important – their investment decisions.”