Brexit Drama May Punish the British Pound and Friends- Op Ed

The Brexit hype has already caused reaction in the markets. This will continue leading up to vote day. José Ricaurte Jaén gives his thoughts on what to expect in the coming week.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

What a surprise; don’t you think? No rate hike.

It’s difficult to know what do to next. There is a debate between calling Elvis Presley for advice regarding the world economy or start playing live Jeopardy with Central Bankers to figure if anyone of them knows what to do next.

No reason to deny that our current reality; we are going through challenging times, but as well, enough funny moments.

The Fed has its issues. However, BoE (Bank of England) is about to end with a broken arm, and the pain will be severe, guess what? The immediate consequence will be a rate cut within the next six months after the event of the quarter; Brexit.

Now… Do I think the media has done a decent job explaining the reality of the event? Oh Yes! They have done a fantastic job sharing lots of Gloom, Boom, and Doom. (Thanks, Dr. Faber)

Those facts are genuine and please, expect nothing better even if we experience Bremain; the damage is done. Once the dust settles, we are going to understand the value of community and hard work.

Painful, Terrific, Unknown. Those are the words used by the few labeled as experts, willing to go on TV and write all the reasons why the UK must stay a part of the “EU Community.” The facts spread and debated were not of the value being in the union creates to all UK participants…oh no!

Most of them were on the chaos “they” may experience “if” leaving with many terrible scenarios and consequences of this “pain spreading” to the rest of Europe.

Yes, the media did a fantastic and reliable job promoting a biased view.

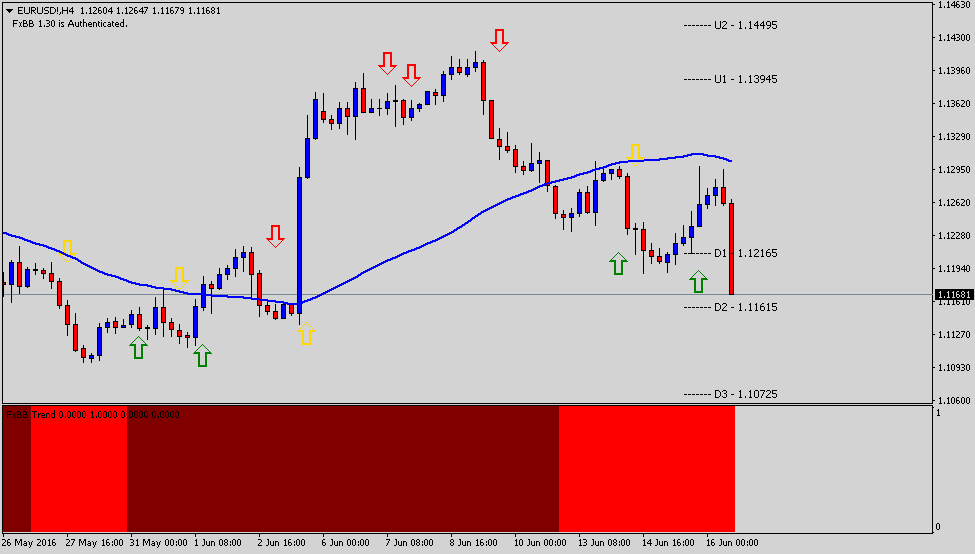

EURUSD

Resistance: U1 1.1394 Support: D3 1.1072

If you were Mario Draghi, let’s face it, you will be sad. Why? Well, for starters, you have a rebel in the house and second your boat is sinking. Yes, add to that the fact your economic policies are just outdated and building tough times ahead for the EU community.

Let’s think pre-Brexit the value (not price) for the EURUSD, something around 1.2230/1.2650 range. Thanks to the extremists and negative cloud over the In-Out reasoning; what is next for the Euro value? I believe 0.8700 cents!

This new price will not happen overnight as many thought, au contraire; the future will come slowly and surely. It may just well be a silent end for the 10-year-old experiment.

In the short-term, not even 10x Fed rate hikes will save the single currency. However, after the “vote” it can easily move up something close to +300 pips, but the issue will be the resistance zone around 1.1610.

Make sure to shadow the 50 SMA on H4 and the Daily Chart for possible shorts at least until next week.

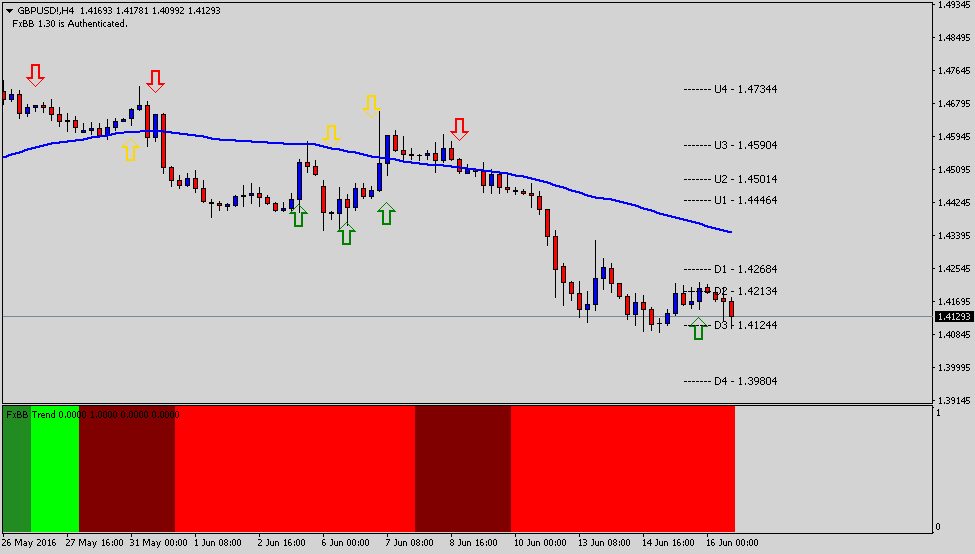

GBPUSD

Resistance: D1 1.4268 Support: D4 1.3980

It is not about having many friends that make you a happier individual. There is a better chance of success if you only have three close friends.

How many participants do we now have in the European Union? 28 participants and they mentioned something about the economic-political union.

Brexit is the confirmation that politics are above any other commitment you can make as a nation. Brexit is the genuine manifestation that money does matter, and no one is willing to sacrifice it for the good of the many.

Brexit is a unique moment in history when tangibles make more sense than the book theories. There is enough evidence to support testing 1.3980 and levels below this price. It will be something new and scary for the British Pound.

How low might the Cable trade in the next 12 months? Don’t be scared just trade the facts and past performance. Go back in time and review how the Scottish vote cracked the pound close to 1.6880 (for those that don’t recall this was the high two weeks before the vote) to the current levels.

Forget about 1.5000 GBPUSD; It’s gone and done! We should all be ready to welcome a new high around 1.4320 and lower.

Cannot be that hard to picture, the entire European system is rocked and as a consequence of the adjustment to the downside; BoE will cut key rates to 0.25%.

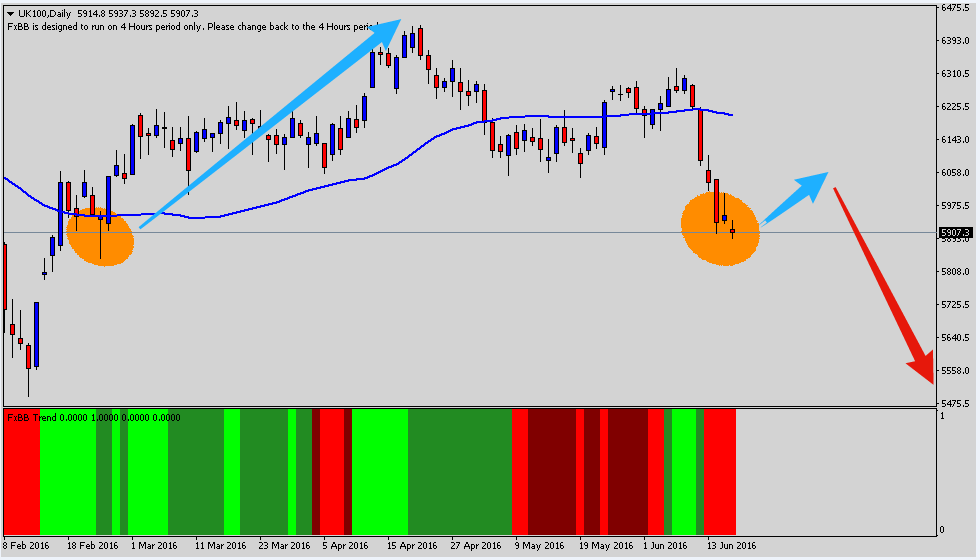

FTSE 100

Resistance: 6055.30 Support: 5837.60

Yes, everything shared so far is positive news. How come? Short and Medium-Term, there is no doubt it will be painful. That’s why the traditional investment strategy “buy and hold” does not always work. Let me rephrase it; there are more effective ways to manage your positions.

Diversification into different industries and more assets can be one of many solutions, but we cannot be blind as things get difficult. Speculators and large institutions move their money from the markets; and? Yes, you know the answer: The smart money takes over!

It is a 20-year analysis on achieving yearly targets close to 7.5% on retirement accounts. According to this paper, it was not rocket science to get there; you just needed to have something close to 80% of your assets in bonds. In the year 2016, that’s not applicable anymore.

Brexit delivers many timing opportunities such as FTSE 100.

On the Technical View, the setup on the daily timeframe is ready to move towards a double-bottom pattern which could be an opportunity to add more long positions from a basket of high-quality stocks or long the index.

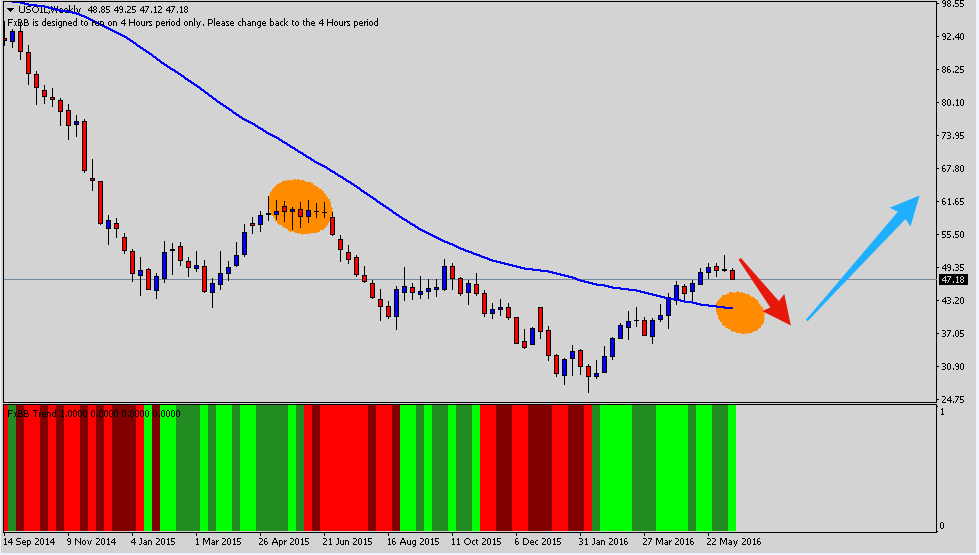

WTI Crude

Resistance: 51.15 Support: 43.30

First off, we shared a basic rule (hope it keeps working): weaker dollar equals higher commodity prices. If you were a Hedge Fund manager trading crude; was the 50.30/51.15 range attractive to sell or buy more? Again, as many other times, we know the answer to this question.

The trading environment in multiple asset classes poisoned, lack of volume and lots of managers playing the career game, therefore, they are taking little to zero risk which may not be the most attractive outcome for investors or the market itself.

Commodities aren’t different from spot FX in that demand-offer dynamics rule them as if you were looking to buy a new flat in the most expensive residential zone in London.

On the Technical View, we are trading a bullish trend; every dip seems the perfect opportunity to add long positions.

How low can we go from here? Judging the weekly timeframe, we may expect prices to adjust towards crude 50 SMA and why not below it for couple days?

Keep an alert on your trading platform around the 43.10/41.00 support zone if you are thinking to go long. That’s where I expect lots of buyers to make a spectacular comeback.

Happy days for Risk-Off traders, but as everything in FX; it may not last long.