Weekly FX Recap: When The Dust Settles There Are No Winners; Just the New – Op Ed

We all know the dust is going to settle, after a while you figure there are no winners; the market structure just changes and a new plan is required.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

When hardworking folk approach me to help them understand more about online trading, the first action help them understand that we are not Vegas, and there are no Blackjack bonuses if they beat the house.

Trading is one of the most authentic businesses and wealth creation mechanism available in three main timeframes: short, medium and long-term.

Note the wording, online trading, and trading. Why? You, the neighbor next door, your kids and even your pets! Everyone is a trader. Yes, think it twice. We are constantly trading or exchanging ideas, items and others.

We trade different assets, for example, time as a non-renewable resource is traded between employees and employer. You venture in the job market, later apply for a specific position, then an interview is set and “if” things go as expected you get the opportunity to be part of something bigger with your contract that includes a compensation package.

What happens after 14 wonderful years when things get tough for your employer and organization?

Well, evidently you may feel the value added is not appreciated or compensated as you deliver so much quality work. During the good times you were receiving bonuses and working with the best talent available.

Let’s add names to these figures, because the employer is Germany and the organization is the European Union or community if you prefer that name. When we trade, the value set and exchanged among the participants may change based on the three timeframes mentioned at the beginning.

The key to success in trading is not only have and entry plan, but to design your worst case scenario and “What to Do” in if it eventuates. Vote In or Out, the damage is done, in the next 12 months, Grexit may be back and let’s not even mention the words “Italy”.

We all know the dust is going to settle, after a while if you are smart you will figure there are no winners; the market structure just changed and a new plan is required.

EURUSD

Weekly – Resistance: 1.1612 Support: 1.1089

Last week, I shared what we all know, the Euro in my opinion is doomed and at some point, within the next year, may easily trade at 0.87 cents.

Do you remember when it traded at 1.6000? A few years later, 1.0440 is low and new challenges arise every quarter.

From a Technical View, don’t forget about the 50 SMA. It is providing strong support around 1.1089; bears have not found success there and over the last weeks, probably 4x the bulls conquered the area.

I’ve added a triangle formation just to share a tradable perspective.

Sellers may be back around 1.1550/1.1620, however, if there is a break and a close above 1.1622, on the short-term the euro could move quickly into a new range to trade closer to 1.1878

Short-lived? Yes, just keep in mind, this is forex and exchange, so it can easily range between 1.1522/1.1878 for the next six months.

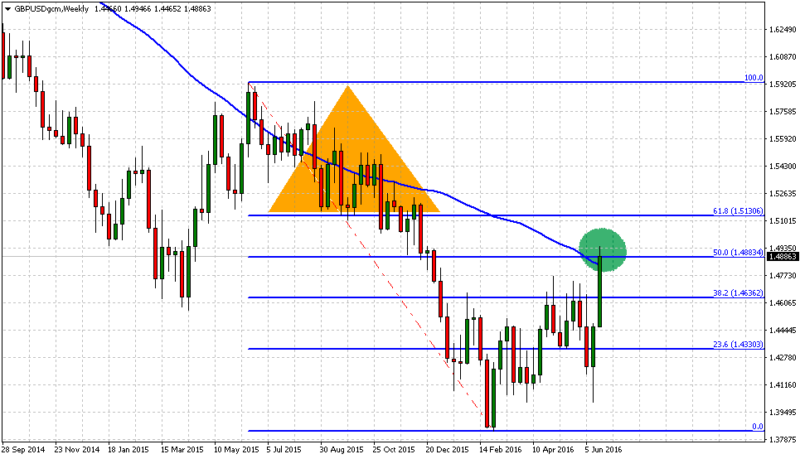

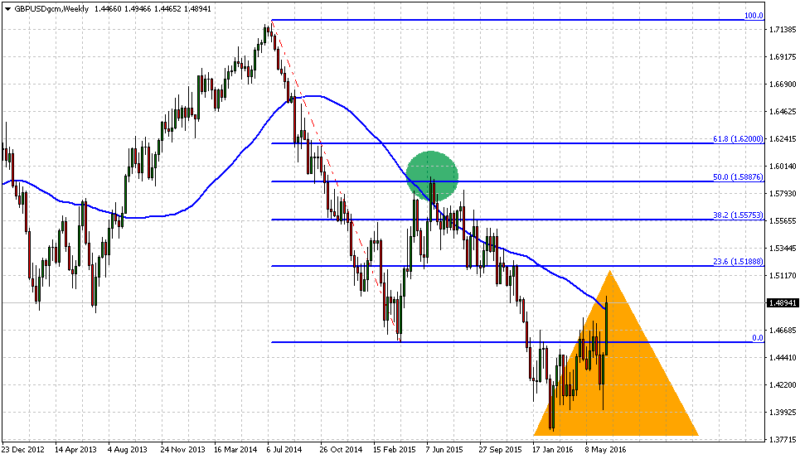

GBPUSD

Weekly – Resistance: 1.4946 Support: 1.4330

Let’s jump into the Technical View; many ideas were shared over the last two weeks about Brexit and Bremain. I think it is time to really look at the levels and the new trading range we may need to trade in the next two weeks.

Take a look at the initial decline from 1.7160 sometime in July 2014. This happened in 2 movements:

- Crashed +-2125 pips; recovered +550 pips.

- Continuation of previous scenario +-2550; recovered +1210 pips.

Do you see the Fibonacci extensions? We are coming back to this pattern very soon.

Next, the British Pound recovered and again! Even with Scotland staying IN! It crashes again, this time not that fast, but it is the continuation of the bearish trend.

Yes, many Fibonacci Retracement traders thought it was bouncing back towards 1.6018; wrong again. It recovers half the way and declines towards the new low of 1.3835.

Can you point out the zone that acts as major resistance on the GBP/USD, after every single major crash?

Fibonacci 50.0% retracement… Have a good look at the first chart and look again at the second chart. We cannot deny a short-term Pound energetic bullish momentum after the Vote, but long-term make no mistake, I’m calling a bearish trend.

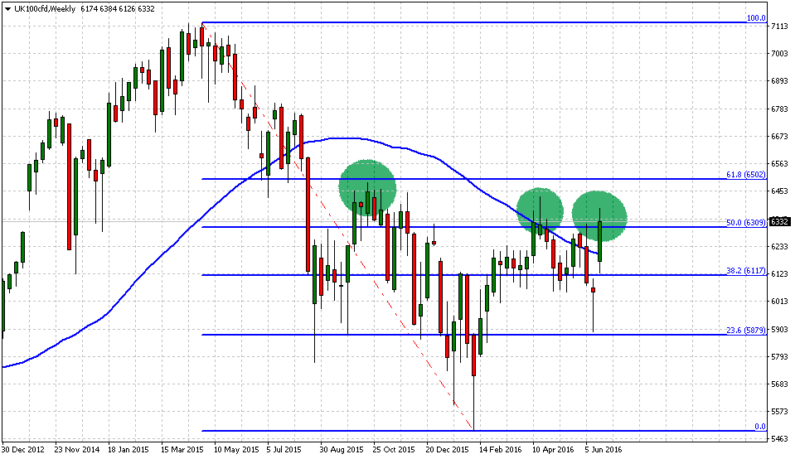

FTSE 100

Weekly – Resistance: 6430 Support: 5892

No consumption; No production. It took the index 4 ½ years to reach a new low. Before that, 4 strong attempts on the downside, false breakouts, and eventually, it broke down its 50 SMA.

That’s the entry required for the decline to accelerate.

Take your screen or notebook and turn it around; what do you see? You are right; that’s a Head and Shoulders pattern. In this particular scenario, it is the inverse version of the pattern.

Hold your horses; there are a few things that need to take place:

- BoE has to cut key interest rates to 0.25%

- Fed will not make any move in 2016.

- Bremain has to materialize without any other Grexit issues for the remainder of 2016.

If this scenario does not play out entirely, then my call is the FTSE goes back to 5500 and lower. Before I finish with this analysis, for those Risk-Reward aficionados, the Fibonacci zone 50.0%/61.8% has only 188 points of risk.

Maybe the Bank of England does not have what it takes to trigger another QE (Quantitative Easing), but the odds are in favor of the bears; bulls watch out!

XAUUSD

Monthly – Resistance: 1315.66 Support: 1061.79

Haven’t heard much of the Toronto Stock Exchange and Junior Gold Miners. Are they still around?

Another triangle formation; interesting don’t you think? There are a few things I always want to point out when working technical analysis:

- Drawing charts does not make you Picasso.

- Technical Analysis provides trading levels, probability and defines risk in points, not the whole investment allocation.

- It is a guide; not a must follow instruction booklet!

I do not mind adding real gold coins to the family collection, but there is something missing here.

If I go back to July 2014 and compare its high with the current levels, we still trade lower highs on the Monthly chart. The optimism comes from the medium timeframes where prices trade above the 50 SMA, so everyone gets excited.

Let me use the map here, with the Risk-Reward behind it: I am calling shorts @ 1263.70 – Risk 120 points.

Happy days for the EU, but as everything in FX; it may not last long.