Weekly FX Recap: Lucky Seven, Voodoo, and Forex Trading- Op ed.

Sometimes you wonder; how do they do it? Is there a magical formula to trading the markets? Then, as you feel certified and qualified by obtaining a fancy business school degree, the only possible answer is to call it pure Luck or even worse; Voodoo.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

Sometimes you wonder; how do they do it? Is there a magical formula to trading the markets? Then, as you feel certified and qualified by obtaining a fancy business school degree, the only possible answer is to call it pure Luck or even worse; Voodoo.

Martin H. Samuel (another Voodoo master similar to Ed Thorp and Ken Uston), created this game named Lucky Seven. It is funny to package so much fun inside a box and later realize that the scheme runs on a mathematical approach where players accumulate points. Again, this remarkable coincidence between random luck and old school math is just hilarious.

Oh, wait! Is that accumulation just like distribution? It cannot be like total pips for the month and trading year. This can’t be; the similarities with overbought and oversold timeframes have nothing to do with players’ turns and random sequences; not at all.

Take time to calculate the numbers over and over again until you realize the odds can be in the favour to risk takers, the ones willing to follow the unconventional wisdom.

Next time you think about trading just remember the patterns, cost per trades, risk distribution and math approach; none of them need luck or voodoo.

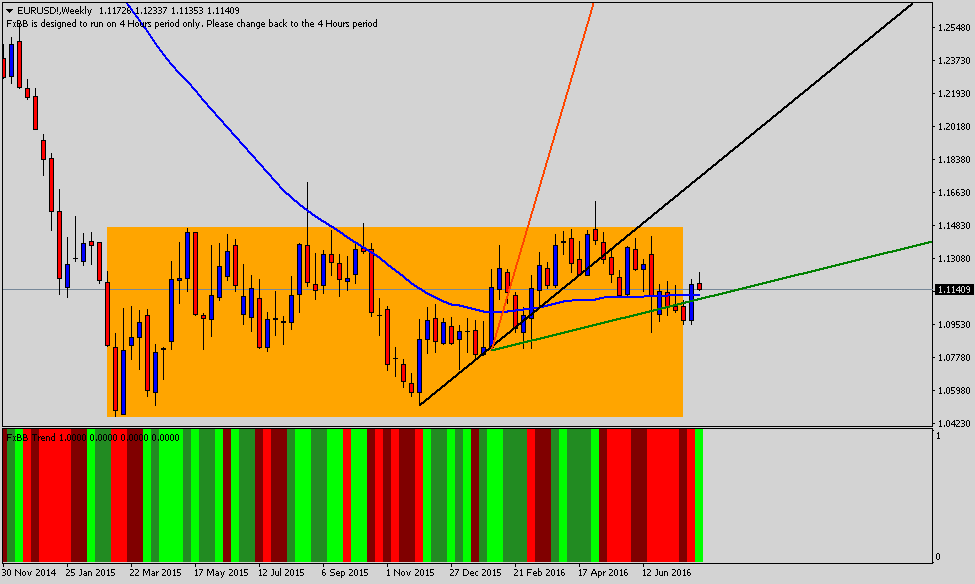

EURUSD: The Walking Zombie

Weekly – Resistance: 1.12337 Support: 1.09521

Have you heard about Amtrak? If you haven’t, I do not blame at all. You see that Amtrak is not as famous as Deutsche Bahn in Germany or Rail Europe in New York. Maybe, I should not say “not famous” a better statement can be “not as effective as” its counterparties.

For as long as I remember (and I am only 33 years old) the “Trak” has been a zombie company making no profits (although, I heard the made a dime the other day; who knows) and eating government funding like a boss to keep the operation alive. Why not accept the current situation and reorganize the business?

Same story with the Single Currency and the European Community, both structures keep towing along like a zombie doing more harm than good. Please, save the stories and how things were even worse before the union comments; time to live the now. The hanging cat needs a quick fix to prevent future misunderstanding that can lead to a bad breakup with the remaining members.

On the Technical View, medium-term the weekly chart is the only chart you need to trade in 2016. After selling underwater, below the bullish green trendline and the 50 SMA, the euro made an excellent effort to grow momentum while attacking 1.12337. Of course, that did not work as that resistance faced historical Bear pressure. As long as 1.1095 is guarded, all hopes are welcome to lift this zombie from the ground.

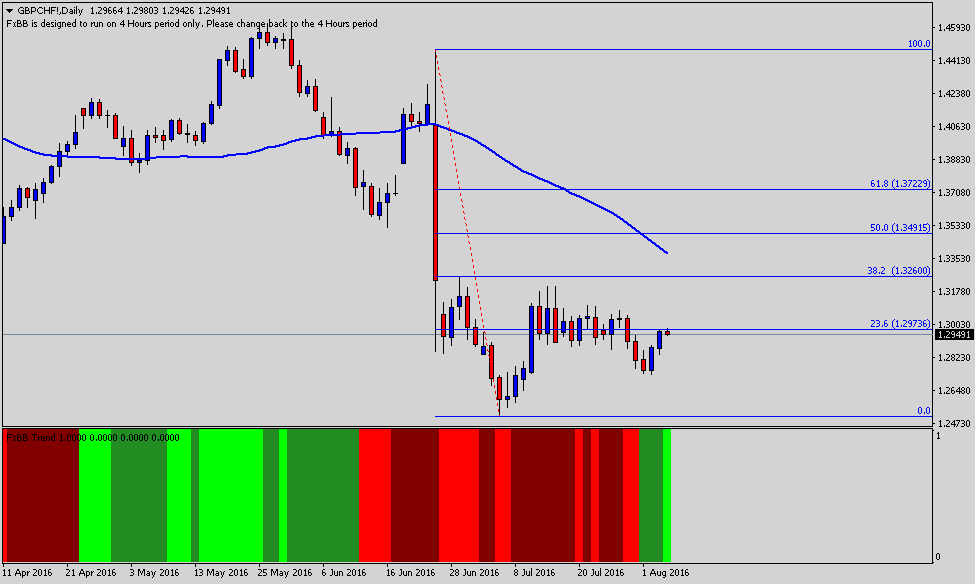

GBPCHF: Risk-on…for now

Daily – Resistance: 1.31971 Support: 1.27311

In the beginning, rate cuts were a fantastic tool to keep the economic ghosts under control, just as a quick reminder, I am talking about the bad boys: inflation and deflation.

Nowadays, the story is way different; it’s a joke! Everything is worth a show in Vegas that I cannot deny will be crowded even if they have a two shows every day for five years.

If the Bank of England swings a cut in August to sort of prevent things getting worse in the future, then who is going to save them later when the real problems arise? Make no mistake Germany is not going to be a good neighbor that is granted.

On the Technical View, short-term the currency cross Great British Pound versus the Swiss Franc, shares an interesting view. If you note on the daily chart, from the beginning of the year, it has been adjusting to the downside sort of sending a message to all traders and investors: things are about to change.

As you can observe, the price is not too far from the Fibonacci 23.6% (1.29736) if we have a break and open above this significant resistance, Bulls may find the momentum to push higher into a bullish trading range.

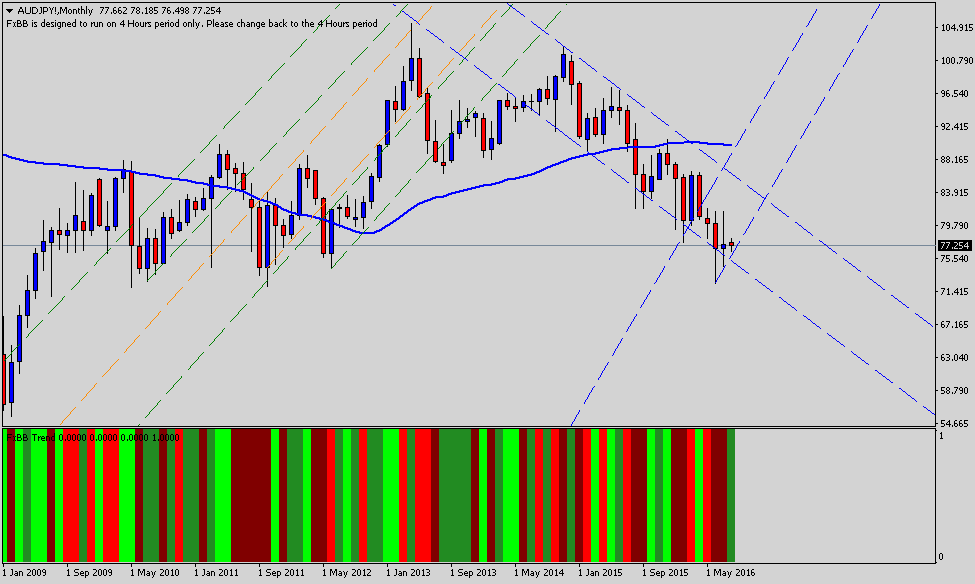

AUDJPY: History always repeat

Monthly – Resistance: 80.093 Support: 76.534

“Al Infinito y Más Allá.” Buzz Lightyear – Toystory (1995)

Look here is the truth: I am not smart nor a good trader. Do you want to know what I am good at? I’m good at taking measured risk and boy I am the best at that. You see most of my peers love to call people traders or investors; me…I am more human when it comes to communication.

Translation: It’s time to take some risk trading the Australian Dollar versus the Japanese Yen cross. I am more inclined to add on positions based on historical patterns discussed in previous publications.

If the RBA keeps slashing rates, Do you think I will stop buying? Nope, it makes no difference. The only trend you have to keep an eye on is the USDCNY, mainly because a most international trade for Australia and New Zealand is heavily directed to China and future devaluations may trigger sell-offs on the Aussie.

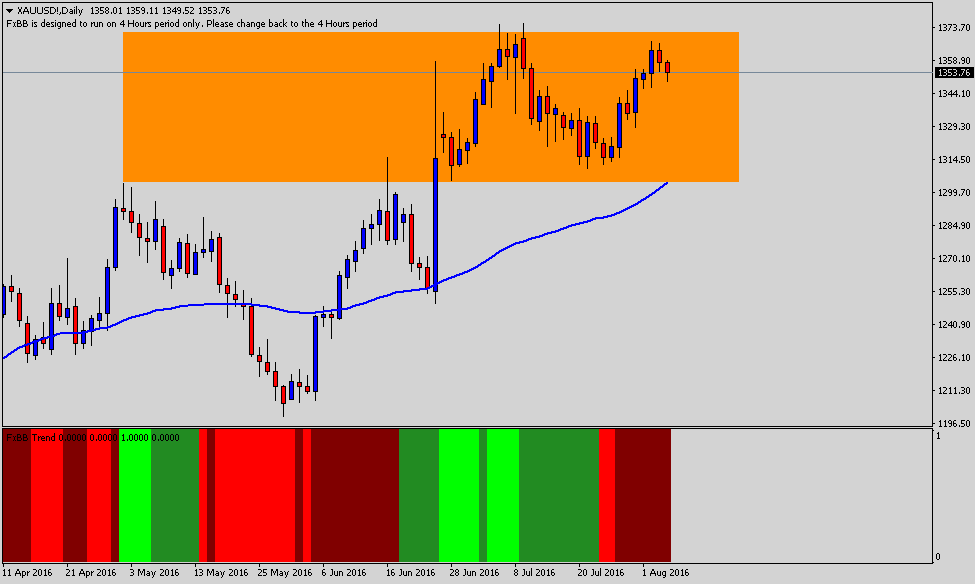

XAUUSD: I’m short and you?

Daily – Resistance: 1375.17 Support: 1305.33

I trade forex because I have no emotional relationship with the asset no matter how shining it can be. When it comes to Gold all I see are lower highs and higher lows; place your trades.

Happy days for Level Headed Traders, but as everything in FX; it may not last long.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.