Weekly FX Recap: Mind The Gap; Mind The Consequences – Op Ed

When you make a decision you must be prepared to embrace and face with serenity all possible outcomes; after all, you were meant to be informed and ready make the call in the first place.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

When you make a decision, you must be prepared to embrace it and face with serenity all possible outcomes; after all, you were meant to be informed and ready make the call in the first place.

And that’s why you thought “I am making the right decision”.

Wait, maybe and just maybe, you are one of those individuals that speaks his mind without further evaluation of each thought?

It seems that the new long-term value or expectation need not go above the 2-year mark, however there is no benchmark within reach that can measure new paradigms.

If things run smoothly for 2 years, we are fine. That’s what many may think, right?

The next generation, wait, what next generation? After all, “stagnant wages” is a myth and the millennials are going back to their parents’ houses because they love living with mum and dad.

There are many factors combined at this stage that we cannot deny:

- Europe’s demographics aren’t in the best shape.

- Stagnant wages are not a myth.

- The Rogue Bird aka the United Kingdom (which in results terms post-Brexit seems to be England and their rural mates)

- Debt to GDP the United Kingdom ranks somewhere around 88.80% moving at a good rate towards 100%

- Added stress + uncertainty in the long-term hurts “business as usual” and just because you need to active “article 50” and may take 4 months, it does not mean the Vote Out is gone. Yes, short-term it looks good on the surface, especially as markets recovered in a “V” shape this week.

Stay with me for a moment, before we jump to the charts and technical levels, sometimes I wish a number of people would think twice. I say this as a well-traveled, experienced professional trader. If you strive to operate in what a few considered the path to follow, that’s great! However, things don’t always work as expected, and even the most calculated path can lead to unexpected surprises.

So, every time you are going to make a decision think about the Brexit drama and make sure to mind the gap between your thoughts and actions because if you do not. Now, where’s the “undo” button gone?

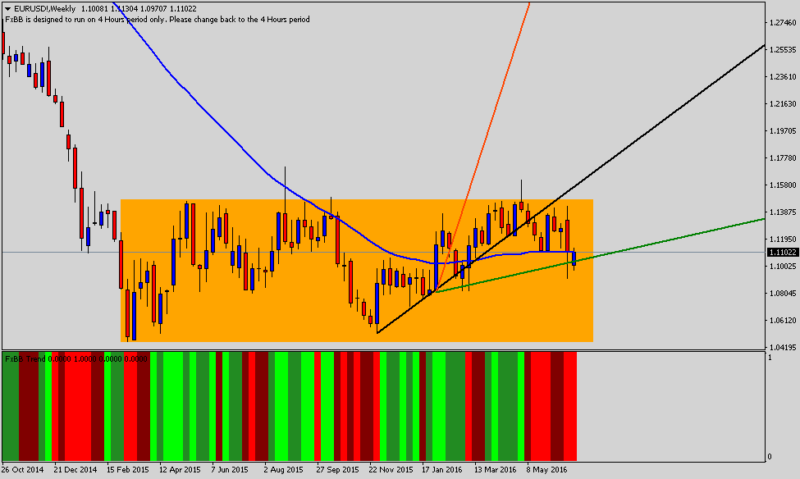

EURUSD

Weekly – Resistance: 1.1426 Support: 1.0973

On Monday this week, as expected, there were many headlines across mainstream media ranging from Bloomberg to the Financial Times, but only one caught my eyes.

It did not surprise me that Mr. Jim Rogers had a few bold things to share with the public and those always willing to stop and listen to a man that generated 4200% in 10 years.

The main idea is to add long positions on the US dollar, but why? Rogers, a pragmatic investor, explained how most participants are already long Gold and Yen, but the US dollar seemed behind the game as a “Safe Haven” only a 3% appreciation during this period.

Are those observations vague? Let’s see. The Single Currency as we are aware is not having the best time. Dollar bulls rushed and moved the pair as low as 1.0973.

On the Technical View, not only breaking the 50 SMA on the weekly chart is a major issue, but the bullish trend line (green) is vulnerable. Without the UK, chances for the EURUSD to recover towards 1.2122 are slim even impossible. (note: forget about Fed hikes this year or the next year)

Sadly, I will build a solid short position against the Euro.

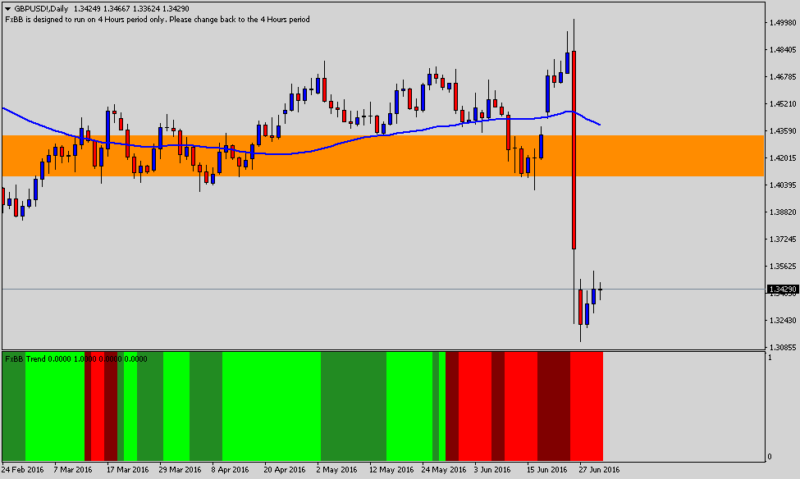

GBPUSD

Daily – Resistance: 1.4044 Support: 1.3110

I am not sure why individuals think they live on a financial island. Time to face the awful truth: We are all in the same boat.

Because we cannot avoid the drama, there are many financial newsletters digging into the next crisis (we cannot catch a break) and therefore I am not sure why many traders continue to act on what they already see as a past event. Grexit and Italy are up!

If you were not reading the news during the Brexit referendum period, the size of the upcoming blow to the European financial system is between 350 to 380 Billion euros. Banks have close to 200 Billion euros in non-performing loans.

Ever wondered why the British were abandoning ship? Now you know!

On the Technical View, if you are happy and celebrating a “V” recovery, I am glad that you are enjoying it. How long do you think it will last?

Market Gurus and Super Traders, make a useless effort to call market tops and bottoms to make a name for themselves.

Let’s work on a different perspective, what about if you “Hedge” your exposure to the British Pound. Sounds fair enough? But! Whether you like it or not the Pound is plummeting and may very well continue its decline as no more German support.

Remember: Together we conquer; divided…

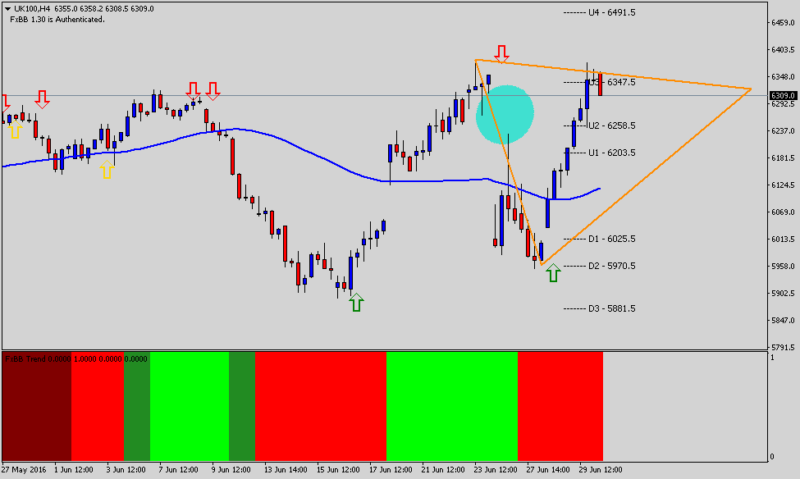

FTSE 100

H4 – Resistance: 6491.50 Support: 5881.50

When companies cannot hire the right staff easily. If companies do not know where the boat is heading. If companies cannot do business as usual; do you know what happens next?

They switch off their engines.

Do you have any idea how long it takes to turn that on? Imagine a big factory working at its max capacity; you are the manager looking to expand and suddenly, boom! The rules of the game may change in 2 years; What do you do?

On the Technical View, once again the “GAP” theory became a reality, and the FTSE 100 covered the downside from 6315.15 to 6089.90. Business as usual…look again.

I believe private investors are not willing to risk-commit more funds into “new buys” at these levels. Another scary downside may create the best buying scenario for pension funds and those willing to play the game at the best levels.

As the index bluffs its way towards 6600, the upside is limited, and a short makes more sense by the minute.

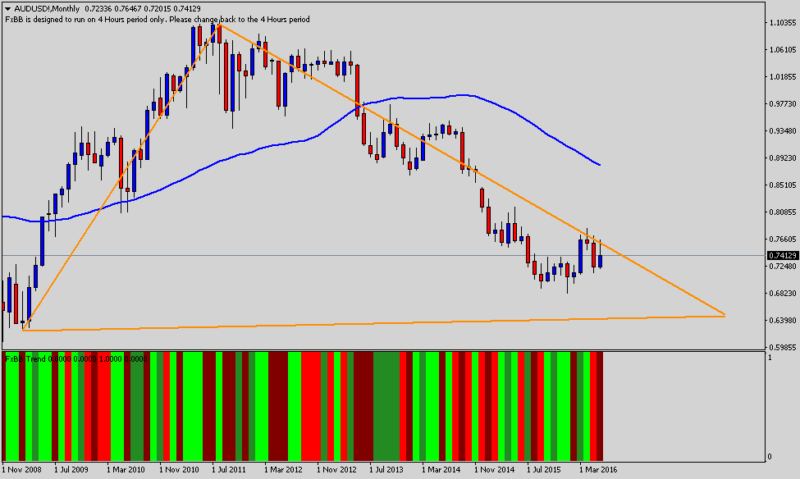

AUDUSD

Monthly – Resistance: 0.7682 Support: 0.6458

H4 – Resistance: 0.7589 Support: 0.7301

Tend to forget things real quick? Nobody talks about China; no one writes about it much. That does not mean things are a fairy tale that end, but they seem to be under control (for now).

On the Technical View, short-term the bullish momentum is in place. Around the trading zone, 0.7350/0.7300 buyers are active.

However, long-term there is this sense of limited upside. Why? Take a look at the Monthly chart; it is evident since July 2011 the Aussie dollar trends lower not higher; with a few exceptions.

If prices move higher and closer to 0.7680, I wouldn’t doubt about adding shorts.

Yes, before I go, finally it seems the FX industry prepared for Brexit and things worked , everyone is happy, trading volumes spiked and business as usual.

Happy days for Forex Brokers, but as everything in FX; it may not last long.