What Does the SVB Crisis Mean for the US Dollar and Cryptos?

US banking sector distress due to the SVB collapse led to doubts over interest rate hikes and the decline of the US Dollar, while safe-haven assets thrived.

The latest NFP figures have been released, but all investors are focusing on the US banking sector this morning. The collapse of SVB, the US’s 16th largest bank, has caused distress in the US markets and globally. Silicon Valley is the US’s tech center and accounts for ⅓ of the US’s venture capital.

The SVB last week aimed to raise capital while voicing some concern over its performance and the effect of higher interest rates. This triggered a lack of confidence, and many depositors looked to withdraw deposits. However, by Friday, depositors could no longer access their funds.

A real sign of relief for depositors is the Federal Reserve, and the US Treasury has announced that all deposits will be guaranteed. Wells Fargo has come out advising there seems to have been a clear lack of fund diversification, leading to the bank’s failure.

So how is SVB influencing tradable assets?

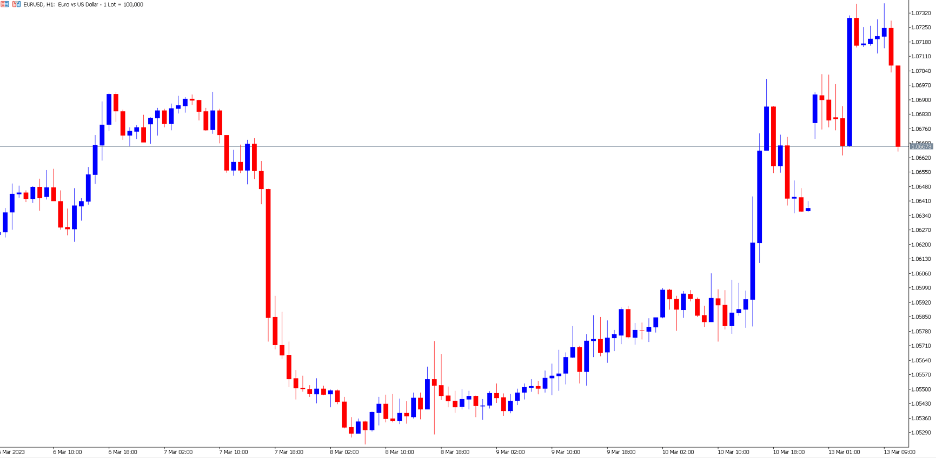

EUR/USD – Higher Rate Hikes in Doubt?

Investors can see a clear correlation between the SVB developments and the US Dollar largely. First, investors are contemplating whether the Federal Reserve will keep raising interest rates to 6%. The chief Economist at Goldman Sachs, Jan Hatzius, is advising the bank no longer believes the Fed will hike interest rates at the next FOMC rate decision. If the Fed does indeed take a more dovish stance, the US Dollar can be negatively affected. However, this cannot be certain unless we receive confirmation from the Fed.

The SVB development is also mainly linked to the US market, and Europe has more or less zero exposure. Again, this is considered negative for the Dollar.

The exchange rate price during this morning’s Asian session continues to move against the Dollar. The EUR/USD has increased in value for 4 consecutive days and is now trading at almost a 4-week high. The decline in the US Dollar largely drives the price movement. The US Dollar Index declined by 0.60% during this morning’s trading session.

Regarding technical analysis, indicators and price action signal an upward trend and a retracement. The EUR/USD opened on a bullish price gap measuring 0.39%, and the price has crossed a new high. Currently, the price is trading within the upper Bollinger band and above the Ichimoku trading cloud, which indicates an upward trend. However, the price has formed divergence at the stochastic oscillator in the 15-minute timeframe, which is why a retracement may form. Currently, the volatility levels are likely to remain high, and traders will be monitoring the direction of the price.

Most economists have advised that the Federal Reserve hopes for a low CPI reading tomorrow afternoon. If the CPI announcement is lower than 0.4%, the Fed may opt not to hike 0.50%. The less hawkish Fed is only due to the risk to the banking sector. The employment figures on Friday continue to point towards a strong employment sector. The NFP figure remained high, reading 311,000, and the unemployment rate was confirmed as 3.6%.

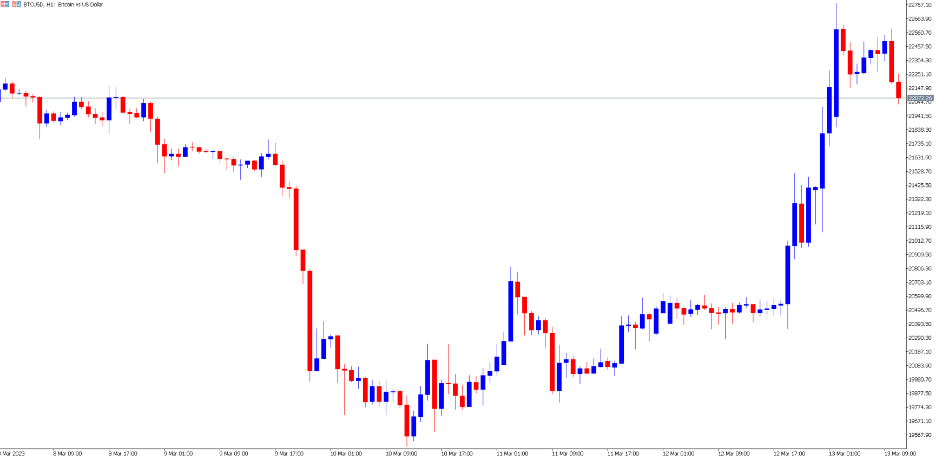

Bitcoin – Investors Consider Cryptos as an Alternative

Investors over the weekend have clearly explored alternatives to the US Dollar and equities. For sure, investors have heavily bought US bonds and have even invested in Gold. Gold has increased by 3% since Friday’s market opening. However, the cryptocurrency market has also climbed even though the market is highly correlated with the market’s risk sentiment. Bitcoin and cryptocurrencies, in general, are an easy alternative to the Dollar and have climbed by 4% today.

The total cryptocurrency market capitalization has increased by more than 7% over the past 24 hours, and Bitcoin’s market share has climbed to 42.26%.

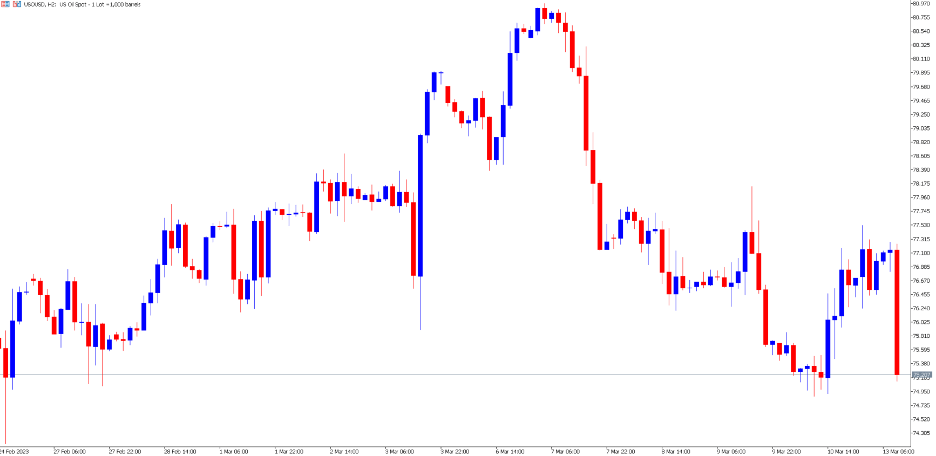

Crude Oil Down, but Analyst Still Stick to Price Range

Crude oil is also experiencing higher levels of volatility and has declined by 1.20% over the past 2 hours. The main concern for oil exporters and companies is if the economy is now at a higher risk of a recession. However, most analysts still believe the asset’s price is likely to remain within the $10 price range unless the SVB crisis turns into a banking crisis.

Though investors should note that some positive factors are also influencing the price of crude oil, the labor market in the US is still extremely strong, and a less hawkish Fed is known to be positive for oil. Traders should also note that analysts expect higher volatility during tomorrow’s CPI release for all assets, including oil.

Summary:

- Depositors cannot access funds at SVB as the Fed and US Treasury step in. Investors fear the SVB crisis will develop into a banking crisis.

- The US Dollar significantly declines due to the SVB collapse and as interest rate hikes in doubt.

- US Employment figures show a strong employment sector and a resilient economy.

- Safe haven assets, bar the US Dollar and other alternatives, thrive as Dollar significantly declines.