Women vs Men: ‘Gender investment gap’ is the next issue to address

“Perceived self-biases may limit women from realizing their full potential in investing. With the right support and resources, investment can become a powerful tool that can redefine a woman’s financial resilience.”

A recent survey conducted by online trading app Moomoo revealed how wide is the gap between men and women when it comes to investing in Singapore, Hong Kong, United States, Canada, and Australia.

Moomoo’s first global women investor survey unveiled the confronting challenges and needs of women retail investors. Besides finding that female investors are planning to invest more in the future, their overall stock market outlook is almost neutral: a slightly bullish rate at around 5.3 out of 10 in the survey.

Low investment confidence among women

Notably, the survey revealed a relatively low investment confidence level for women, with data collected from 2,288 users of moomoo and its sister brand Futubull across the five major markets showing a significant gender confidence gap.

North American female investors demonstrated the highest average confidence level at 5.28 out of 10, almost 1 point behind the average level of North American males. The gender gap was noticeable in every market surveyed, as can be observed in the image below.

Gender gap in decision-making

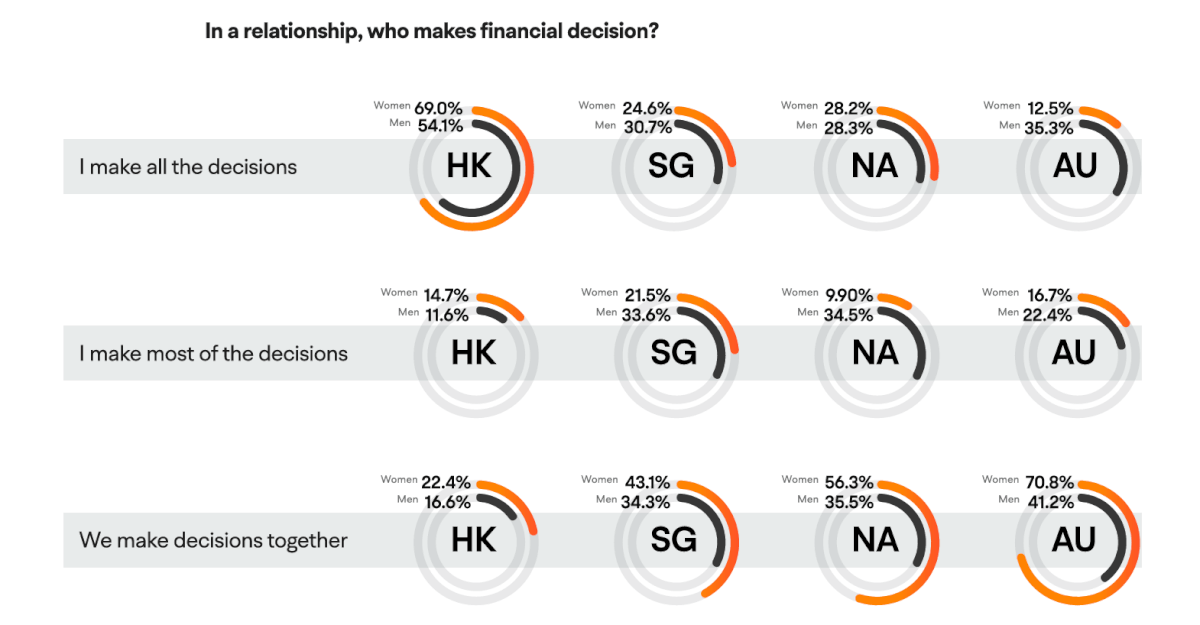

The survey also found that, in a relationship, female investors are inclined to make financial decisions together with their partners: 70.8% Australian females and 56.3% North American females said they make financial decisions together with their long-term partners.

The gender gap shows itself again on this matter: Only 41.2% and 35.5% of male investors from Australia and North America, make financial decisions together with their long-term partners.

Notably, surveyed Singapore and Hong Kong female investors overall show smaller gender differences in investment confidence, compared to North American and Australian peers. 54.1% of females in Hong Kong said they make all financial decisions by themselves when they’re in a long-term relationship.

“Perceived self-biases may limit women”

This survey pinpointed three major obstacles to investing for female investors across all five markets, including limited capital, fear of unknown risks, and limited experience and knowledge of investing. Pioneering financial and investing education, the moomoo team introduces multiple solutions to help female investors navigate their investment journey with resilience against fear.

Erika Chiang, CMO of Moomoo SEA, said: “Perceived self-biases may limit women from realizing their full potential in investing. With the right support and resources, investment can become a powerful tool that can redefine a woman’s financial resilience.”

As ESG investing continues to gain momentum globally, a higher percentage of women acknowledged the importance of integrating ESG factors into their investment decisions. In Australia, 38.3% of female investors find ESG very important in their investment decisions, versus 24% reported by male investors. In Singapore, Hong Kong and North America, over 70% of women think ESG are very important/somewhat important factors in investment.