Worldpay marks 84% Y/Y increase in net revenues in Q3 2018

On a GAAP basis, net income dropped steeply due to transition, acquisition and integration costs and intangible amortization incurred in connection with the Vantiv, Inc./Worldpay Group plc transaction.

Payments technology company Worldpay Inc (LON:WPY), which was formed in January this year through Vantiv, Inc.’s acquisition of Worldpay Group plc, has earlier today reported its financial results for the three months to end-September 2018.

In a filing with the London Stock Exchange, Worldpay said its net revenue increased amounted to $1,017.9 million in the third quarter of 2018, up 84% from the result of $554.2 million registered by Vantiv Inc. in the equivalent period a year earlier. Had the Vantiv Inc./Worldpay Group plc transaction closed on January 1, 2017, net revenue would have increased by 9% on a pro forma basis as compared to the prior year period.

On a GAAP basis, net income per diluted share attributable to Worldpay, Inc. dropped 98% to $0.01 as compared to $0.57 in the prior year period. The GAAP decrease was attributed to transition, acquisition and integration costs and intangible amortization incurred in connection with the Vantiv, Inc./Worldpay Group plc transaction.

Adjusted net income per share increased 17% to $1.05 as compared to $0.90 in the prior year period.

“I am excited about the momentum that we are building in the marketplace as the newly combined Worldpay,” said Charles Drucker, chairman and co-chief executive officer of Worldpay. “We are winning because we offer our clients a powerful value proposition that includes a unique combination of global reach, innovative technologies, and tailored solutions that differentiates us from our competitors.”

Adjusted EBITDA amounted to $496.8 million or 48.8% of net revenue in the third quarter, representing 10 basis points of margin expansion as compared to Vantiv’s results on a stand-alone basis in the same quarter a year earlier. Had the Vantiv, Inc./Worldpay Group plc transaction closed on January 1, 2017, Adjusted EBITDA margins would have expanded by 150 basis points on a pro forma basis over the prior year period.

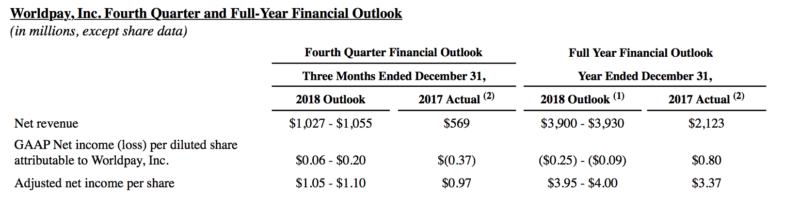

Below one can see the details of the company’s forecasts for the rest of 2018.