Worldpay stockholders approve deal with FIS

At the special meeting held on July 24, 2019, Worldpay stockholders voted on proposals relating to the merger.

In line with earlier reports by FinanceFeeds, on July 24, 2019, payments technology company Worldpay Inc (NYSE:WP) held a special meeting of its stockholders. The meeting was held in connection with the proposed business combination of Fidelity National Information Services, Inc. (FIS) and Worldpay.

At the Special Meeting, Worldpay stockholders voted on and approved proposals relating to the merger. The number of shares of Class A common stock, par value $0.00001 per share, of Worldpay issued and outstanding as of the record date for the Special Meeting was 311,276,676. Present at the Special Meeting, in person or by proxy, were holders of Common Stock representing 240,144,585 votes, which constituted a quorum of the Special Meeting.

The stockholders voted in favor of adoption and approval of the Agreement and Plan of Merger, dated March 17, 2019, by and among FIS, Wrangler Merger Sub, Inc. and Worldpay.

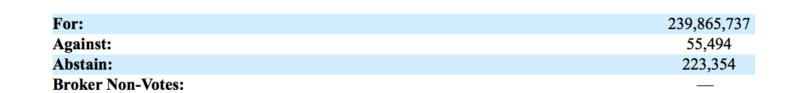

Here are the voting results for this proposal:

The proposal for certain compensation payments that will or may be made to Worldpay’s named executive officers in connection with the Merger pursuant to existing agreements or arrangements with Worldpay was also approved.

In March this year, FIS, Worldpay and Wrangler Merger Sub, Inc., a wholly-owned subsidiary of FIS, entered into the merger agreement, pursuant to which FIS has agreed to acquire Worldpay. At the effective time of the merger, each share of Class A common stock, par value $0.00001 per share, of Worldpay, will be converted into the right to receive (i) 0.9287 shares of common stock, par value $0.01 per share, of FIS, together with cash in lieu of fractional shares, if any, and (ii) $11.00 in cash.