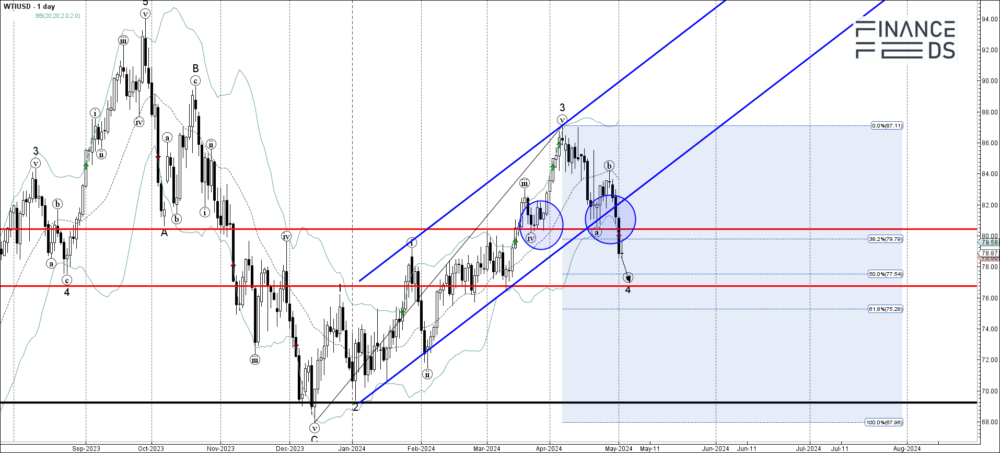

WTI Technical Analysis Report 2 May, 2024

WTI crude oil can be expected to fall further toward the next support level 76.75 (former monthly low from March and the target price for the completion of the active wave c).

– WTI under strong bearish pressure

– Likely to test support level 76.75

WTI crude oil under the strong bearish pressure after the price broke the support zone lying at the intersection of the key support level 80.40 (low of wave iv from March, as can be seen from the daily WTI chart below), support trendline of the daily up channel from January and the 38.2% Fibonacci correction of the previous upward impulse from December. The breakout of this support accelerated the c-wave of the active minor ABC correction 4 from the start of April.

Given the global risk on sentiment affecting the energy markets , WTI crude oil can be expected to fall further toward the next support level 76.75 (former monthly low from March and the target price for the completion of the active wave c).

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.

The information does not constitute advice or a recommendation on any course of action and does not take into account your personal circumstances, financial situation, or individual needs. We strongly recommend you seek independent professional advice or conduct your own independent research before acting upon any information contained in this article.