Your Ultimate Guide to Core Banking

The competitive environment of the banking industry pushes banks and financial institutions to respond to constraints and challenges affecting their core business. The winning bank’s strategy to keep its market power is achieved by using core banking software.

Turning to core banking solutions enables businesses to revive products, modernize service offerings, and capture market share.

Would you like to be able to target profitable niches in the value chain and breathe new life into your business?

Let’s explore the concept of core banking in detail, its advantages, and its importance for the welfare and efficiency in the banking sector.

What is Core banking?

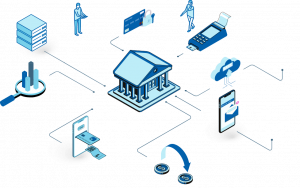

Core banking is a back-end system that sustains banks by connecting multiple branches of the same bank to deliver 24/7 real-time services for customers. The range of banking operations consists of service loans, withdrawals, deposits, new account opening, interest calculation, CRM, and other management or accounting activities.

The word CORE (Centralized Online Real-time Environment) indicates that financial services can be accessed in real-time no matter where you are. The bank is perceived as a single entity, thanks to which the customers use their bank account and perform transactions from any location in the world.

What are the advantages of Core Banking?

It can modernize your offering

Quickly adapt to new market patterns and deliver top-notch financial services that the customers will choose once and for life. In order for banks to remain relevant to their customers and stand out among the competitors, it’s not enough to simply digitize traditional banking services.

You must modernize the offer with more comprehensible products and services. In this context, powerful core banking software can serve as a strong base for creating the value-added service embedded into your bank.

It is very affordable to invest in

Cut down on the infrastructural and operational costs and wisely invest the money into your business. The banking facility of core banking systems doesn’t require the physical presence of customers in the branches, as most of its attributes can be replicated online.

For instance, Crassula’s fully branded Banking-as-a-Service Core-Banking software ensures AI-driven performance of these services that will not only facilitate cost reduction but also unlock new sources of revenue generation.

It can extend your proposition

Crassula’s core banking business model allows you to deliver seamless service integration across multiple channels and networks. Your customers will access numerous banking facilities through channels such as online banking, mobile apps, web interfaces, and administrative panels.

Implementing a core banking system is a step towards having maximum control over all the banking services and payment options being provided through these channels. You will monitor everything right on the spot, identify transaction issues as they emerge and proactively provide the relevant service. Manage all aspects of interaction with your customers across all the integrated channels in a matter of seconds, not hours.

Services Core Banking has to offer

Essentially, the core banking system is responsible for deposits, withdrawals, and credit processing, calculating interests, servicing loans, managing customer relationship management activities, and providing floating new accounts.

All these services aim to enable freedom of account transactions as well as a simplified and secure banking experience. Software-based platforms such as Crassula make core banking systems that will ensure the fast execution of services.

Praised by its users, the platform combines a full range of financial products and services with a prepackaged core banking infrastructure that you can launch in less than a month.

Thanks to its technology, you can handle contract opening applications, repositories, customer refunds, payments, reporting, regulatory compliance, accounting, and system supply more efficiently.

Why is Core Banking a necessity?

To keep up with technological advancements, businesses and banks of all sorts need a core banking platform. The core banking mechanism helps to optimize operations and maximize revenue while keeping client satisfaction at a decent level.

Building and maintaining a payment solution from scratch is highly cumbersome and costly. In addition to that, legacy systems are checkups require more resources. Core banking financial services is a considerable saving of time and effort.

It is enough to choose a reputable platform with ready-made white-label interfaces to embed banking features like accounts, cards, or payments, advanced analytics, and various propositions into your workflows and UX. And while your financial product is developed, you focus on marketing and sales.

Final words

Core banking is an excellent response to the ever-increasing demands of your existing or potential clients that want a flexible, robust, and secure payment solution. It simplifies banking processes and makes it very easy to seamlessly automate, launch, and maintain, thanks to the API technology. And most importantly, such solutions protect your company’s and client’s data from financial crime.

This is a sponsored post. We have not independently verified its content and do not bear no responsibility for any information or description of services that it may contain . Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you seek independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review https://financefeeds.com/disclaimer/.