Zero-fee broker Freestoxx launches trading platform powered by Devexperts

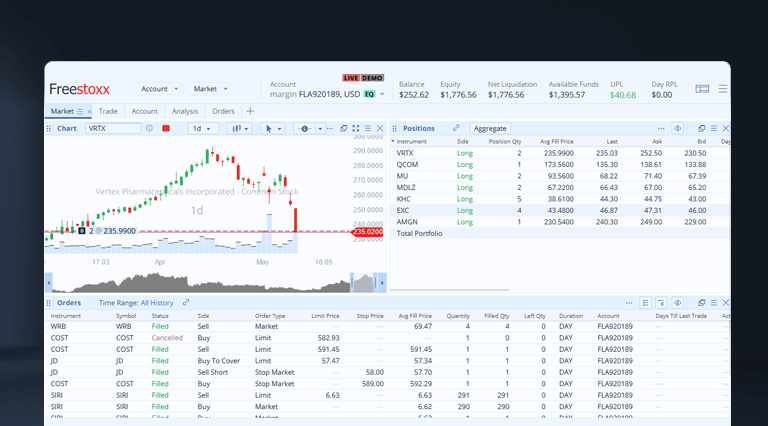

Freestoxx, a brand name and commission-free trading service of WH SelfInvest, has rolled out a new trading platform powered by Devexperts’ multi-asset trading solution, DXtrade.

Freestoxx now operates as a white-labeled version of DXtrade, offering its traders a cross-platform service available on the web and as a mobile app. Its parent, WH SELFINVEST S.A., was founded in 1998 and is currently regulated in Luxemburg. Based on its European passport, the company maintains branch offices in France and Germany, as well as representative offices in Switzerland, Belgium and the Netherlands.

Devexperts offers DXtrade as a SaaS (Software-as-a-Service) product, designed for brokers offering all types of asset classes and satisfying requirements of all major regulators. The global financial software provider has expanded the platform features to provide both broker clients and traders with a revamped web UX/UI, new functionality for subscription management, ex-dividends, and cash movements, among many others.

Commenting on the news, Dominic Schorle, Project Manager at WH SelfInvest said: “Buying US stocks commission-free, with best execution in place and superior user-friendly technology via web and app is a major development for retail investors in Europe.”

“We are proud to have partnered with WH SelfInvest to bring next generation trading tools to one of the preeminent neobrokers in the DACH region. As a leader in this space, Freestoxx is raising the bar for trading platforms in the EU while also giving investors unprecedented access to global markets,” added Michael Sprachman, VP of Brokerage Trading Platform.

DXtrade launched in May 2020 and managed within such a short period to onboard major names onto the trading platform as liquidity providers. The white-labeled solution offers brokers’ dealers and administrators many of the benefits available from existing bespoke platforms, but with the efficiency of a customizable backend to help set up risk management or segment their traders.

Brokers are also able to determine everything related to the layout and set-up, including the back-end configurations and user interface. They also benefit from ex-dividends and cash movements widgets alongside management of subscription to 3rd-party services. These built-in tools add a higher degree of automation and customisation to allow brokers to enhance the user experience, improve both client acquisition and retention, as well as create custom offerings for multiple client segments.