Administrators of LQD Markets (UK) Ltd: 555 client claims agreed to date

To date, administrators have agreed 555 client claims for an approximate amount of $4.38 million.

LQD Markets (UK) Limited was one of the FX brokers that ceased operations in the aftermath of the “Black Swan” events in January 2015. The first reports by the joint special administrators showed a substantial deficit in the company’s accounts. This has made the work of Baker Tilly, now RSM Restructuring Advisory LLP, much harder.

Today, the Joint Special Administrators from RSM have published their Fourth Report on the case, covering the period from August 2, 2016, to February 1, 2017.

To date, administrators have agreed 555 client claims for an approximate amount of $4.38 million. That does not seem like much of a progress being made, as a year earlier, the JSAs said they had agreed to the claims of 546 clients, totaling $4,342,982.11. These claims have been sent to the Financial Services Compensation Scheme (FSCS), so that claims for FSCS compensation can be made. At present, FSCS has paid compensation in relation to 320 claims submitted by clients of the broker, totaling approximately $2.75 million.

The administrators continue to pursue client debtors – they have instructed debt collection professionals from a number of jurisdictions (including Switzerland, Italy and Hungary) to assist with the collection of debts worth about GBP 382,576 from 12 client debtors.

The investigation into the LQD Markets (UK) deficit continues, but it is hampered by a formality, as the Creditors’ Committee has to be restructured. Until the investigation into the reasons for the deficit is complete and the Committee votes with regards to whether further costs should be incurred and actions taken against third parties, the special administrators will not be in a position to distribute funds to clients. In case the Committee decides not to continue the investigations and not to pursue any claims, the administrators will make an application to Court to set a bar date for clients to submit their claims. Otherwise, the filing of application with Court will be delayed.

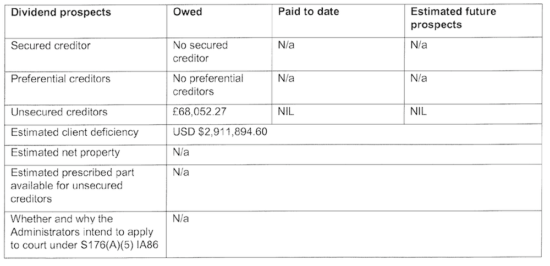

The latest report confirms that the client deficit is $2,911,894.60, much higher than the sum estimated soon after the broker filed for administration.