America’s crusade against OTC binary options firms rearing its head again

Despite lawsuits and warnings from the CFTC, OTC binary options firms continue to sell to American customers, a practice that is illegal in the United States

Three years is not a very long time at all in the overall development and evolutionary cycle of many businesses, however in the technologically advanced world of e-commerce an electronic trading, it is a lifetime.

“Insanity is doing the same thing over and over again and expecting different results” – Albert Einstein

In June 2013, the Commodity Futures Trading Commission (CFTC) in the United States issued a public notice that it was filing a lawsuit against binary options brand Banc de Binary, one of the largest of the 80 brands that use the SpotOption platform.

This resulted in the company and its associated entities ET Binary Options Ltd, BO Systems Ltd and the firm’s owner and CEO Oren Shabbat (who also goes by the name Oren Laurent) being ordered to pay $9 million in restitution as well as a civil monetary penalty in March this year for providing off exchange binary options to American customers, which is illegal in the federal United States.

The restitution and fines far outweighed the original amount quoted in the lawsuit three years ago, and had been brought about as a result of a cease and desist order to remove a press release in which Banc de Binary claimed claimed to have an office in New York City at Trump Towers, but this was in fact a virtual office space with no significant physical presence.

The cease an desist order asked Banc de Binary to remove this press release and issue a further one stating that the company is not licensed to operate in the US, which the company duly complied with, however the CFTC subsequently discovered that the firm was continuing to solicit customers in the US from its base in Israel, whilst working under Cyprus’ CySec licensing.

This brought charges from the CFTC, and one day later, from the Securities and Exchange Commission (SEC) because the selling of off-exchange binary options products in America also violates rulings on exchange traded products.

Since then, the US authorities have not let this matter out of their sights, and in light of various criticism by mainstream press in Israel and France on the high pressure sales techniques employed by off-exchange binary options firms and the ‘zero-sum game’ element of betting against a house and not having orders placed in a live market, North America’s regulators are once again stepping up their campaign.

Like Banc de Binary, the majority of firms illegally soliciting US customers are Israeli binary brands

FinanceFeeds recently reported that 15 executives based in Israel have been placed under criminal investigation in a collaboration between the French regulator Autorité des Marchés Financiers (AMF) and the Israeli police in an investigation that targets at least five companies in the FX and binary options sectors that are the suspected operators of a fraud that totals approximately €105 million. 50 cases, involving at least 500 identified victims are being treated by the Paris prosecutor.

Thus farm two of such cases have resulted in the opening of a judicial inquiry.

The media attention in mainstream press which is taking a close look at the Israel-based binary options brands and how they sell their products to customers has been extensive and detailed recently, and government officials are now taking this seriously.

FinanceFeeds understands that the structure of corporate operations and business model employed by many binary options brokerages in Israel is representative of a complete dichotomy from those abroad, largely because the retail binary options industry in Israel did not rise up from the interbank, derivatives exchange or technology sectors that it did overseas, and was not established by financial markets professionals with strings of qualifications and shareholders to report to.

Instead, it was a spin-off from the huge gaming, affiliate marketing and sports betting businesses that are set up in Israel that market their services to retail gaming customers overseas (gambling is illegal in Israel).

The retail binary options firms in Israel are often placed in the same category as gaming, sports betting or rebate marketing because they are often operated on the very same principle, by people who own a brand privately and had generated enough capital to buy a closed-system platform and recruit sales people in various languages (usually French or Arabic) to sell, under pseudonyms and pseudo-locations, binary options to customers from a lead list that had been recycled from online gaming firms.

20 OTC binary options brands continued to solicit US customers in the last year, despite illegality

The CFTC and SEC have received numerous complaints of fraud associated with websites that offer an opportunity to buy or trade binary options through Internet-based trading platforms. The complaints fall into at least three categories: refusal to credit customer accounts or reimburse funds to customers; identity theft; and manipulation of software to generate losing trades.

Another aspect that the CFTC and SEC consider to be fraudulent involves the manipulation of the binary options trading software to generate losing trades. The regulator states that customer complaints allege that the Internet-based binary options trading platforms manipulate the trading software to distort binary options prices and payouts. For example, when a customer’s trade is “winning,” the countdown to expiration is extended arbitrarily until the trade becomes a loss.

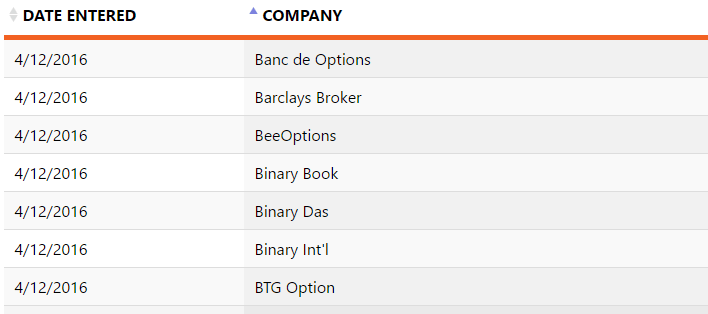

Out of the 41 companies that the CFTC has added to its red list between August last year and April this year, 20 are binary options brands based in Israel.

The red list is a compilation of foreign entities that have been identified by the CFTC as acting in a capacity that requires registration with the CFTC (to solicit American customers) but are not appropriately registered with the CFTC.

This clearly demonstrates that, despite the $9 million lawsuit against Banc de Binary and the various efforts made by US authorities to put paid to this practice, it is still alive and well.

In fact, the vast majority of the most recent entries to the CFTC red list are binary options firms.

As is often the case with American jurisdiction, the lawmakers and regulators are maintaining a close vigilance on this practice and it will most certainly be of great interest to find out what their course of action may be,