“Mind The Gap!” – The life and times of a man on the move Episode 63

Shirts being ironed with heavy metal, an insight into why Hong Kong’s HKEX would buy London Stock Exchange, and an arrogant approach by a non-entity

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

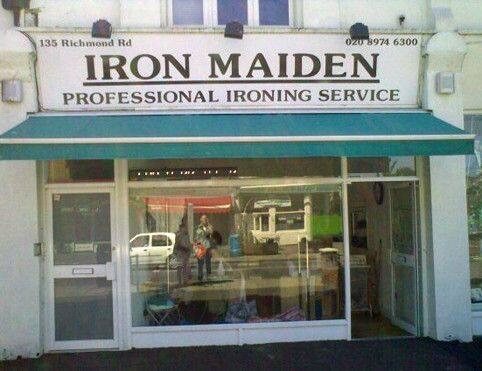

Monday: Guitar riffs or a metal cabinet?

In the very pleasant outer London suburb of Richmond Upon Thames, life is quite genteel. Manners, social graces and Waitrose organic sustainability are mainstays of daily interaction.

As I ventured out of my Central London domain into the leafiness of suburbia, I noticed a rather amusingly named small business, providing its service to the many thousand City commuters who live in Richmond Upon Thames and work in the Square Mile.

I personally happen to like Iron Maiden (the band, not the 19th century metal cabinet!). Maybe the musical abilities of Steve Harris are also appreciated by the chattering classes of West London, or is he a bit too ‘East End?” One thing’s for sure, there is no ‘Fear of the Dark’ in this particular part of town.

Wednesday: Hong Kong’s derivative escape route

Communism may well be one of the more recently invented methods of operating a country’s central government, but it is by far the most destructive.

Since its dawn around 100 years ago, it has wreaked brutality, poverty, war and crime on its subjects, and has been overturned long ago in favor of traditional free market capitalism in pretty much every nation that attempted to encapsulate its population with it.

Except for in mainland China, the world’s economic and manufacturing powerhouse.

China, a country that I have been to several times and actually worked next to business owners across the entire land, has adapted the Marxist system to favor a business environment that has massive purchasing power, a huge central government that has a department for literally everything and an empowered population who see the communist government as a management consultancy, investor and strategist.

The outside world, however, is blocked. China’s totalitarian government has complete control and a neatly organized set of data on every individual, plus shareholdings in pretty much every entity in the land to the extent that its businessmen cannot survive without the huge backing of the government.

It is control via social and economic empowerment. Very clever indeed.

Hong Kong, however, is a different matter. It spent a long period of development under a lease by the British crown, which ended in the mid 1990s with Chris Patton packing his bags and the Chinese government taking the land back and designating it a Special Administrative Region.

This means that although subject to monitoring and communist policy, Hong Kong was allowed to maintain its own administration and be somewhat open, leading to huge international business built on the back of British colonial banking giants (British/Chinese firm HSBC and British/South African entity Standard Chartered for example) whilst the Chinese government poured resources into Hong Kong to turn it into the incredible global city it is today.

It was inevitable, however, that in the end the government would want to begin to internalize Hong Kong behind the ‘silicon curtain’ of China, something not at all relished by Hong Kong residents who rather rashly took to the streets, and certainly not by Hong Kong’s financial services sector.

HKEX last week began to put official bids in to acquire the London Stock Exchange.

This may appear a feat and a half, but London Stock Exchange needs the money and has done for some time. My dear pal, who spent 25 years as CFO of the London Stock Exchange until 2007 when he resigned following the acquisition of Borsa Italiana used to regard the last year at the firm as “another day at the coal face.”

HKEX needs the ‘out’ from the clutches of the communist government, and LSE needs the money.

The FCA would probably be OK with it as long as the two entities can prove that a merger like that doesn’t create a massive local liquidity monopoly as it would if the Germans had bought it.

Thatt was completely political and in my opinion (and in the opinion of several British politicians including Lord Myners) LSE does not want German ownership and the UK government doesn’t want Germans in charge of its markets from Frankfurt, as this would be far too dangerous and ‘war by proxy’ which is one of the drivers for Brexit.

If it is Hong Kong though, that may be considered an ideal Asia Pacific execution venue and a potential route to dedicated connectivity to other Asia Pacific venues via HKEX.

LSE needs the cash, we know that – its been an acquisition target for years. So if the London Stock Exchange needs a cash injection, UK post Brexit wants its freedom and can get into APAC markets by having one entity with direct connectivity to multi asset in Hong Kong, Singapore and potentially other key markets with advanced derivatives exchanges such as South Korea, and HKEX gets to get away from the grip of the Communist Party which is the way Hong Kong is going.

It may happen. Especially if Britain is free to do deals with any nation properly after Brexit. Hong Kong’s main market infrastructure and banking is british, too so is aligned.

One problem is that HKEX’s infrastructure is obsolete. For them, the acquisition would be great but for LSE – I am not so sure in terms of technology. A large investment and teams of outsourced but dedicated solutions architects would be needed. Plus, the Chinese factor is compelling. But why should LSE care? Aside from the money, of course.

I guess that’s a way of them getting out of the hands of China’s communist government that wants to internalize Hong Kong. I think it is a good move if they can afford it. Let’s remember, they bought London Metal Exchange previously, so that alludes to the intention but LSE integration would be a major task.

Before jumping the gun, have HKEX and LSE considered technology implications of the merge?

Software veteran Lev Lesokhin knows the main reason for failed mergers is IT integration. He contacted me last week and stated that HKEX was forced to halt trading only last week, blaming a software bug for disruptions. Combined with LSE opening almost two hours late due to a ‘technical software issue’ just last month, Lev is very concerned without essential software due diligence prior to the proposed merger, further disruption could be inflicted on the financial market.

To avoid IT failures during integration, HKEX and LSE need to gain a deeper understanding of each others’ IT infrastructure using Software Intelligence: a deep analysis of software architecture.

Lev Lesokhin, EVP of Strategy and Analytics at CAST, commented:

“Mergers and acquisitions aren’t just pieces of paper, they’re a merger of all resources and talent too. A core component is computer systems. Nobody wants to be left with a Frankenstein’s monster to deal with, possibly in perpetuity.”

“The best way to avoid a disastrous clash is to gather as much intelligence as possible beforehand, putting the software of respective companies through an MRI-like scan. With a solid knowledge of what exactly is in front of them, the respective IT teams have a rationale to base an in-depth migration on giving them an immediate edge in the race for that perfect match.”

No doubt there will be many software firms jumping on this. Takes me back to the good old days!

Thursday: Watch out for Amun, and its bizarre attitude.

In this well established and conservative industry whose leaders are astute and committed (which is one of the many reasons I love the FinTech and electronic trading business enough to still be enthusiastic after 29 years) it is very rare that anyone should show a less than pragmatic approach to promoting their services.

This week, I was contacted by a very strange individual from a firm that I have never heard of, demanding that I compare his, er, whatever it is called, to established FX and CFD companies with well respected, properly designed trading topography such as Saxo Bank.

Ordinarily, I would dismiss such a notion and ignore it, but this particular individual, based in Zurich (if that can be believed), decided to see the red mist when I refused to make such an odd comparison.

His initial approach was curt and ambiguous, but gave the impression that he wanted to be included in a 2017 article by FinanceFeeds which researched the USD/BTC facilities being expanded by firms such as Swissquote, Saxo Bank and IG Group to retail traders via their proprietary platforms.

In particular, we looked at the then-new Exchange Traded Notes which Saxo Bank launched to track Bitcoin against the Dollar.

As you all know, I am very much not a fan of any digital asset related stuff, I think it doesn’t belong in our industry and has largely been a fad for the islands which nobody is now interested in, but this particular individual from Amun, which claims to make investing in digital assets as easy as buying shares. It says that investors can buy or sell Amun digital asset ETPs listed on the SIX Swiss Exchange via their bank or broker.

Is it an exchange? Is it an affiliate? What exactly is it? Who knows.

What we do know however is that when I refused to add their ‘services’ to any such research on mainstream companies with established platforms as per the aforementioned, his rag was well and truly lost.

“You wrote an article about our competitors but did not mention us and we have the best, safest, most liquid transparent products on the market” he said. Really?

Upon explaining that we do not participate in working with unknown crypto firms, he said “I’m sorry! Did I misread the title of the article you wrote?”

When asked why such a tone was being taken, he reminded me once again of our research, included a screenshot, and stated “In case you are reading what I sent you from your fone (sic) and not your desktop, here is what you wrote.”

I am well aware of what was written, however fail to see how major firms with proper long term multi-asset trading environments such as IG Group or Saxo Bank relate to a blockchain chancer that has no standing in this industry.

It was more the persistence and arrogance that drew me toward highlighting this. Should you come across them, my advice is Caveat Emptor.

Wishing you all a super week ahead!