OECD brings heavy “Brexit Tax” to the table after Obama’s speech

US President Barack Obama’s intervention on the referendum discussion, saying the UK would be at “the back of the queue” for American trade deals in case of majority of the “yes” vote, sparked backlash from Vote Leave campaigners. London mayor Boris Johnson considered Obama’s “lectures” as paradoxical and very odd. Now, the Organization for Economic […]

US President Barack Obama’s intervention on the referendum discussion, saying the UK would be at “the back of the queue” for American trade deals in case of majority of the “yes” vote, sparked backlash from Vote Leave campaigners. London mayor Boris Johnson considered Obama’s “lectures” as paradoxical and very odd.

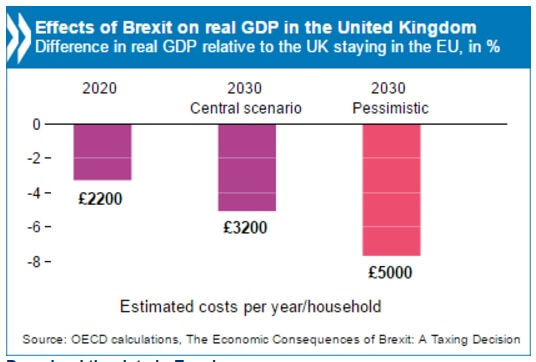

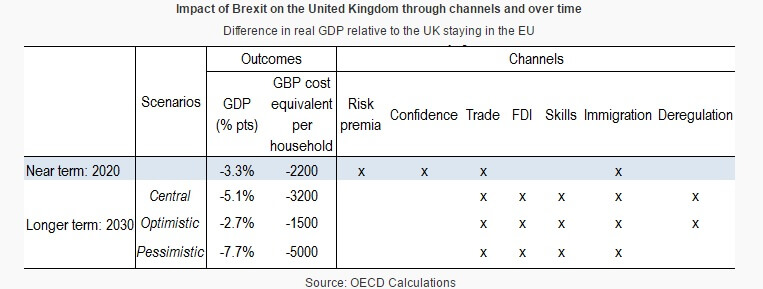

Now, the Organization for Economic Cooperation and Development (OECD) has published a report that estimates a loss of 3% GBP by 2020, equating to £2,200 per household. Uncertainty is already pressing costs to pile up, according to the institution.

After ‘Brexit’, UK trade would then initially be governed by World Trade Organization rules, leading to higher tariffs for goods and to other barriers in accessing the Single Market, notably for financial services, says OECD, adding that bilateral UK-EU trade would contract. Only by 2023, the UK could partially offset UK trade after concluding a Free Trade Agreement with the EU, but with higher costs in accessing the market than the current situation.

Immigration is estimated to account for half of the UK GDP growth since 2005, with more than 2 million jobs created, and expected restrictions to the free movement of labor from the EU and a weaker UK economy after ‘Brexit’ would leave a dent in demographic dynamics, and become an additional cost to the economy.

Adding to the financial shock beyond the UK, magnified by the weakening GBP against its counterparts, the projected hit would be a 3% of UK GDP by 2020, and a 1% GDP loss in the European Union.

Substantial longer term structural changes would be a cut in Foreign Direct Investment (FDI) inflows, notably from the EU, lower openness and innovation, less technical progress and productivity.

Cost of opportunity show ‘Brexit’ could be a bad move: “Fiscal savings from stopping net transfers to the EU budget are likely to be 0.3-0.4% of GDP per year, which is a relatively small amount. Lower GDP growth would weigh on the fiscal position significantly, limiting the scope to use the net EU budget savings to relax fiscal policy”, said the document, estimating that by 2019 the budget deficit would be higher by 0.9 p.p. of GDP. Also, the study does not take into account in its estimations the fact that remaining in the EU could lead to additional GDP growth due to further development of the Single Market.

OECD Secretary General Angel Gurría spoke about ‘Brexit’ at the London School of Economics: “Leaving Europe would impose a Brexit tax on generations to come. Instead of funding public services, this tax would be a pure deadweight loss, with no economic benefit.”