August volatility makes its marks on institutional platforms as EBS volumes soar 22% over July

EBS, the electronic brokerage division of British interdealer broker ICAP plc (LON:IAP) has today announced its trading metrics for the month of August 2015, adding further to the evidence pointing toward last month’s sharp upturn in trading activity across the entire retail and institutional sectors. Trading volumes on EBS amounted to $100.3 billion for August, a […]

EBS, the electronic brokerage division of British interdealer broker ICAP plc (LON:IAP) has today announced its trading metrics for the month of August 2015, adding further to the evidence pointing toward last month’s sharp upturn in trading activity across the entire retail and institutional sectors.

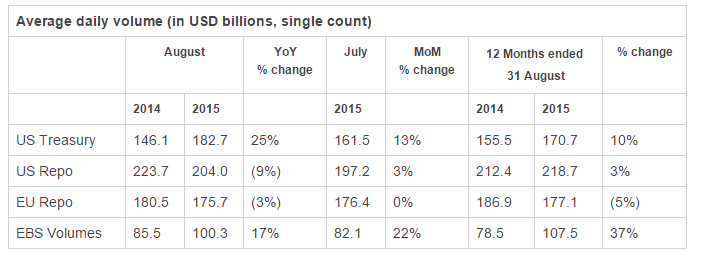

Trading volumes on EBS amounted to $100.3 billion for August, a dramatic 22% increase over July’s $82.1 billion total volume, further amplifying the battle for supremacy between EBS and Thomson Reuters’ FXall electronic communication network among institutional non-bank trading platforms.

Having restored its monthly combined volumes to above the $100 billion mark, EBS remains prominent and can show a clean pair of heels to recently acquired Hotspot FX, whose volumes during August languished approximately a quarter of that traded on EBS.