Z Holdings and LINE announce business integration to push further into AI, FinTech, commerce

SoftBank and NAVER have submitted a letter of intent to the board of directors of LINE with a proposal to take LINE private.

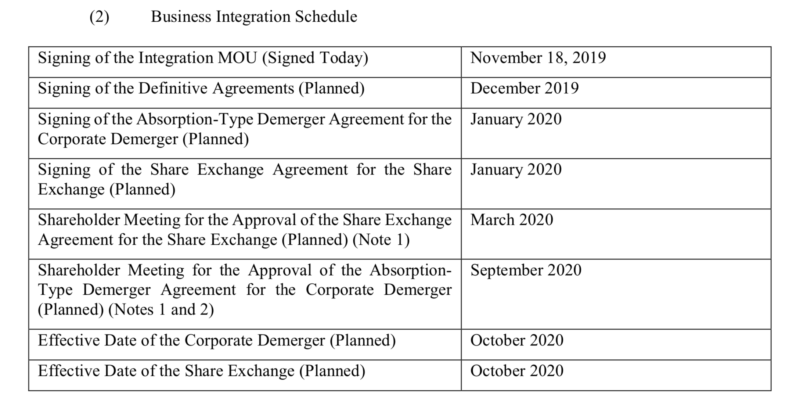

There has been a major development on the M&A front today, as SoftBank Corp (TYO:9434), NAVER Corporation, Z Holdings Corporation, and LINE Corporation announce that they have reached agreement regarding the business integration on an equal basis of ZHD and its subsidiaries and LINE and its subsidiaries.

SoftBank and NAVER entered into a non-binding memorandum of understanding, dated November 18, 2019, and submitted a non-binding letter of intent, to the board of directors of LINE with a proposal to take LINE private by launching a joint tender offer by SoftBank and NAVER to acquire all of the outstanding common stock and others of LINE, excluding the shares, share options, and convertible bonds that are already owned by NAVER or by LINE as treasury shares, and certain other post-tend offer transactions.

ZHD, the publicly listed integrated company following the Business Integration, is expected to be a consolidated subsidiary of SBG and SoftBank.

The Business Integration will be conducted on an equal basis by ZHD and LINE with the aim of forming a business group that can overcome significant domestic and global competition through the ZHD Group and the LINE Group bringing together their business resources and pursuing synergies in respective business areas as well as implementing business investment targeting growth in areas such as AI, commerce, Fintech, advertising and O2O.