Administrators of Reyker Securities aim to complete reconciliation of client assets by mid-Jan 2020

The Joint Special Administrators are reviewing the best and final offers received for Reyker’s business.

Smith & Williamson LLP, the Joint Special Administrators of Reyker Securities, have provided an update to the clients and creditors of the firm that entered administration in October 2019.

The Administrators aim to complete the reconciliation of all client assets by mid-January 2020 at the latest.

Separately, the JSAs are reviewing the best and final offers received for Reyker’s business and expect to share details of their preferred transferee with the regulatory bodies this month with a view to being able to advance negotiations of the detailed contractual terms upon which those assets may be transferred in January 2020.

In addition, the JSAs are developing a bespoke client portal so that clients can agree their final claim to Custody Assets and Client Money which will facilitate the implementation of a Bar Date and Distribution Plan and the safe transfer of Client Assets to the transferee, being a new regulated broker. Such a process hinges on successfully concluding the aforementioned negotiations and the proposed transferee being willing and able to receive a wholesale transfer of all client assets.

The first meeting of the Clients’ and Creditors’ Committee is set to be held in January 2020.

The administrators continue to liaise with the Financial Conduct Authority (FCA) and Financial Services Compensation Scheme (FSCS) with regard to the progress of the administration and potential claims that may arise from clients in the event there is any shortfall in assets returned to clients. The administrators’ initial assessment is that, if and where the costs of the process are met from client holdings, the majority of eligible clients will be covered by the FSCS compensation scheme.

The administrators intend to work with the FSCS so that any compensation due to eligible clients may be paid direct to the JSAs and in advance of any transfer to the New Regulated Broker. This os poised to mitigate the need for any eligible client to submit a claim to the FSCS themselves and facilitate a transfer of each eligible clients’ assets in whole.

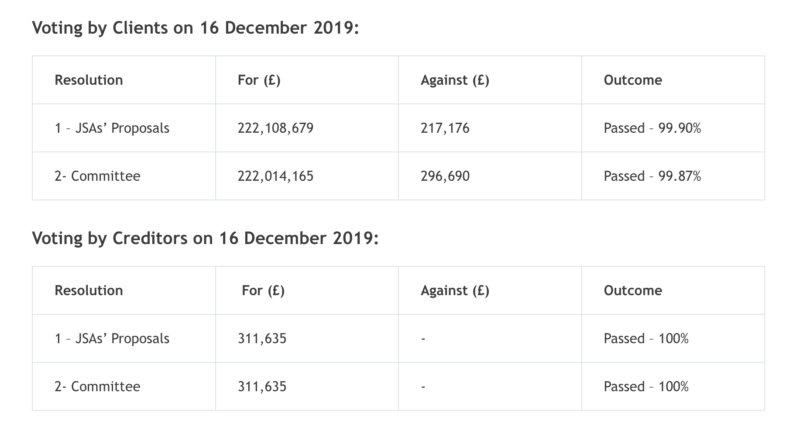

A meeting of Reyker’s clients and creditors was held on December 16, 2019 at which the following resolutions were passed by both the clients and creditors by a significant majority:

- Resolution 1 – THAT the JSAs’ Proposals (as previously circulated) are approved; and

- Resolution 2 – THAT a clients’ and creditors’ committee be established.

Additional information on the outcome of the meeting may be found in this notice.