Alibaba registers 59% Y/Y jump in cloud computing revenue in Q2 2020

Cloud computing revenue grew 59% year-over-year to RMB12,345 million, primarily driven by increased revenue contribution from both Alibaba’s public cloud and hybrid cloud businesses.

Alibaba Group Holding Limited (NYSE:BABA) today published its financial report for the quarter ended June 30, 2020.

In the June 2020 quarter, Alibaba saw its cloud computing revenue grow 59% year-over-year to RMB12,345 million (US$1,747 million), primarily driven by increased revenue contribution from both Alibaba’s public cloud and hybrid cloud businesses, reflecting higher average revenue per customer.

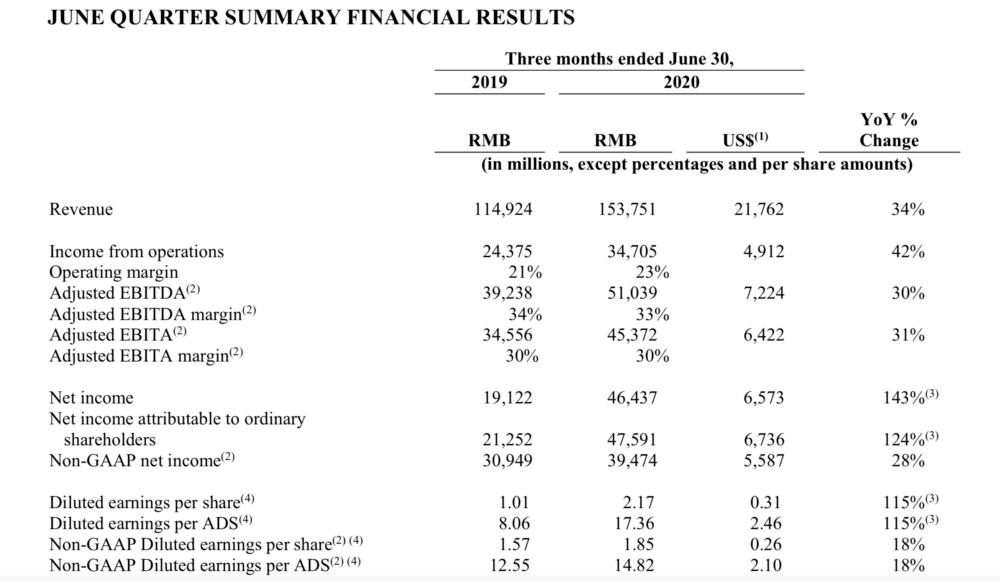

Across all segments, revenue for the quarter ended June 30, 2020 was RMB153,751 million (US$21,762 million), an increase of 34% compared to RMB114,924 million in the same quarter of 2019. The increase was mainly driven by the robust revenue growth of Alibaba’s China commerce retail and cloud computing businesses.

Th number of annual active consumers on Alibaba’s China retail marketplaces reached 742 million, an increase of 16 million from the 12-month period ended March 31, 2020.

Income from operations was RMB34,705 million (US$4,912 million), an increase of 42% year- over-year. Adjusted EBITDA, a non-GAAP measurement, increased 30% year-over-year to RMB51,039 million (US$7,224 million). Adjusted EBITA, a non-GAAP measurement, increased 31% year-over-year to RMB45,372 million (US$6,422 million).

Alibaba registered net income of RMB46,437 million (US$6,573 million) in the quarter to end-June 2020, an increase of 143% compared to RMB19,122 million in the same quarter of 2019. The year-over-year increase was mainly due to a net gain arising from the increase in the market prices of Alibaba’s equity investments in publicly-traded companies in the quarter ended June 30, 2020, compared to a net loss arising from the decrease in the market prices of these equity investments in the same quarter of 2019.

Diluted earnings per ADS was RMB17.36 (US$2.46) and non-GAAP diluted earnings per ADS was RMB14.82 (US$2.10), an increase of 18% year-over-year. Diluted earnings per share was RMB2.17 (US$0.31 or HK$2.38) and non-GAAP diluted earnings per share was RMB1.85 (US$0.26 or HK$2.03), an increase of 18% year-over-year.

Net cash provided by operating activities was RMB50,099 million (US$7,091 million) and non-GAAP free cash flow was RMB36,570 million (US$5,176 million).