Ally Invest marks rise in client activity in Q4 2018, customer assets decline

Ally Invest saw average customer trades per day rise to 19,600 in the fourth quarter of 2018, compared to 19,100 in the preceding quarter.

Ally Financial Inc (NYSE:ALLY) today reported its full year and fourth quarter 2018 financial results. Ally Invest, which offers securities brokerage and investment advisory services, saw client trades rise in the final quarter of 2018 but customer assets fell in quarterly terms.

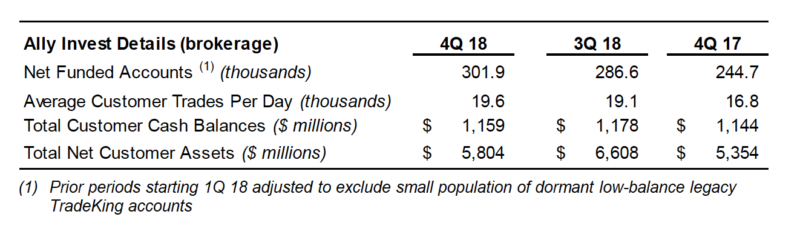

- Ally Invest registered net funded accounts of 301,900 in the fourth quarter of 2018, up from 286,600 in the third quarter and up from 244,700 in the final quarter of 2017.

- Average customer trades per day rose to 19,600 in the fourth quarter of 2018, compared to 19,100 in the preceding quarter.

- Total customer cash balances marked a drop in quarterly terms, as they amounted to $1.16 billion in the final quarter of 2018, compared to $1.18 billion in the third quarter of 2018.

- Total net customer assets at Ally Invest also marked a decline. They were down to $5.8 billion in the final quarter of 2018, compared to $6.6 billion in the third quarter.

Across all segments of Ally Financial, in the fourth quarter of 2018, net income attributable to common shareholders increased $109 million versus the year-ago quarter to $290 million. The rise was attributed to a lower effective tax rate due to the enactment of the Tax Cuts and Jobs Act in the prior year quarter. Pre-tax income declined $42 million year-over-year as higher net financing revenue and lower provision for loan losses were more than offset by higher noninterest expense and a decline in the fair value of equity securities attributable to ASU 2016-01, which went into effect on January 1, 2018, requiring changes in the fair value of equity securities during the quarter to be recognized through net income as compared to prior periods in which such adjustments were recognized through other comprehensive income

Other revenue decline versus the prior year quarter due to a decline in the fair value of equity securities. Other revenue, excluding the impact of ASU 2016-01, increased $14 million year-over-year.

Provision for loan losses decreased $28 million to $266 million, compared to the prior year quarter, driven by lower retail auto net charge-offs and a favorable consumer and macroeconomic backdrop.

For the full year, net income attributable to common shareholders was $1,263 million, compared to net income attributable to common shareholders of $929 million in 2017. The rise was driven by higher net financing revenue, lower provision for loan losses, a lower effective tax rate and a $119 million charge to net income largely due to a revaluation of Ally’s net DTA in 4Q 2017, partially offset by higher noninterest expense and lower other revenue.

Full-year net financing revenue improved to $4.4 billion, up $169 million from the prior year, driven by the expansion of retail and commercial auto yields, higher asset balances and the maturity of high-cost unsecured debt, more than offsetting higher deposit costs and lower lease revenue.

Provision for loan losses declined $230 million over the prior year driven by improved loss experience in our auto portfolio, including a 15 bps year-over- year decline in the retail auto net charge-off rate, as well as a favorable consumer and macroeconomic backdrop.

Other revenue was down year-over-year primarily due to a decline in the fair value of equity securities. Other revenue, excluding the impact of ASU 2016- 01, was roughly flat year-over-year at $1.5 billion.

Non-interest expense increased $154 million in 2018 compared to 2017 levels mainly due to costs associated with the continued growth and investment in Ally’s consumer and commercial product suite, including digital and technological capabilities, as well as higher marketing costs.