ASIC has 46 financial services matters underway without final result

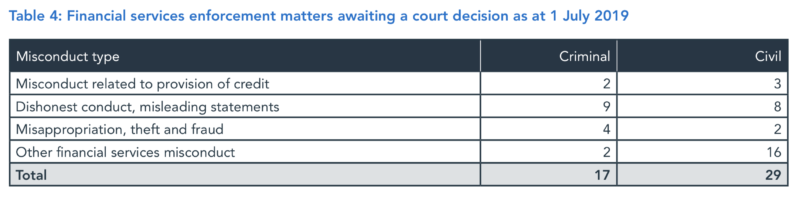

As at July 1, 2019, the regulator had 17 criminal and 29 civil financial services-related matters underway that had not attained a final result.

The Australian Securities and Investments Commission (ASIC) has just posted its Enforcement Update for the January – June 2019 period, with the document showing how the regulator pursues its work via its ‘Why not litigate?’ enforcement approach.

As at July 1, 2019, ASIC had 17 criminal and 29 civil financial services-related matters underway that had not attained a final result because:

- the court/tribunal had determined liability but not decided the penalty or final order;

- a plea was entered but the court/tribunal had not yet made a decision on conviction or sentence, or

- the court had not yet decided if a breach of law or an offence was committed.

Further, in the six months between January 1, 2019 and June 30, 2019, ASIC recorded 51 financial services-related outcomes.

Let’s recall that, in a recent speech, ASIC’s Commissioner John Price noted that the regulator is significantly increasing and accelerating court-based enforcement outcomes driven by its new enforcement strategy, a “why not litigate?” stance, and it is looking to use the full extent of its new penalties and powers.

This means that if ASIC is satisfied that breaches of the law are more likely than not, and it is evident from the facts of the case that the pursuit of the matter would be in the public interest, then the regulator will actively ask itself: why not litigate this matter?

A “why not litigate?” strategy represents a rigorous approach to deciding which tool is the right one, bearing in mind:

- the need to deter future misconduct, and

- community expectations that wrongdoing be pursued and punished through the courts.

ASIC reports that between July 2018 and June 2019 it increased:

- the number of ASIC enforcement investigations by 20%

- enforcement investigations involving the big six (or their officers or subsidiary companies) by 51%

- wealth management investigations by 216%.