ASIC warns CFD, FX and binary options brokers about unsound practices

The Australian regulator is concerned about misleading marketing materials and unclear pricing methodologies.

The Australian Securities and Investments Commission (ASIC) has underlined its concerns about certain practices in the retail over-the-counter (OTC) derivatives sector which fail to meet its expectations.

The regulator warns about the following practices:

- misleading marketing materials;

- unclear pricing methodologies;

- inadequate risk management practices;

- inadequate monitoring of counterparties;

- inappropriate referral arrangements.

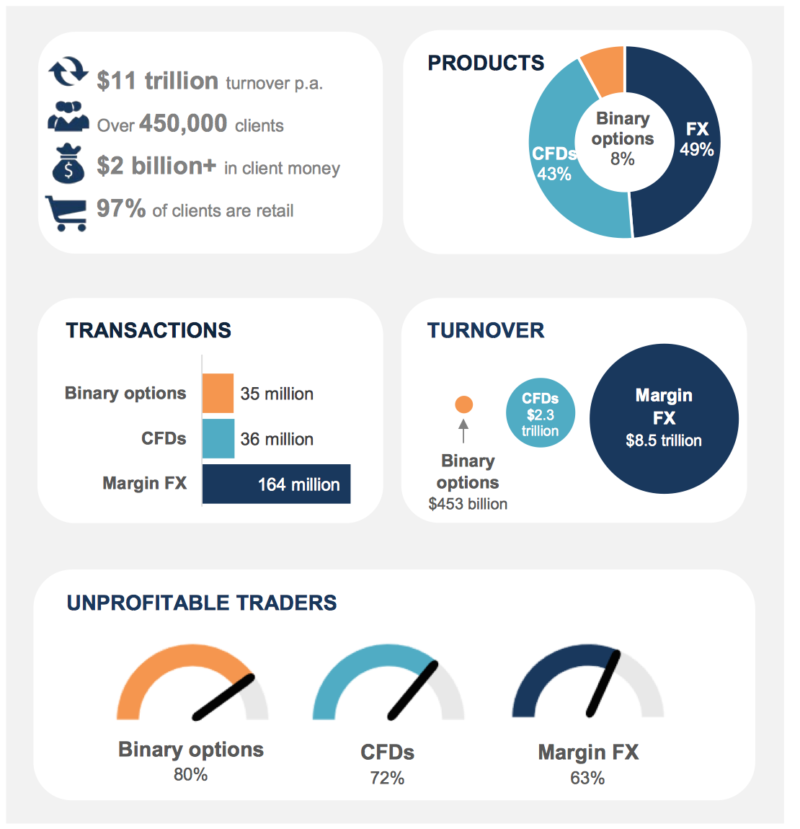

The regulator has recently conducted a review of 57 retail derivative issuers to assess the size of the industry, the products offered and the risks posed to investors. ASIC has identified a number of risks associated with the products offered to retail investors by OTC derivatives issuers. Of these, the lack of clarity around pricing and misleading claims about profitability in marketing material are of most concern.

On top of “traditional CFDs”, cryptocurrency CFDs are now being offered by some issuers. But the price of these products is extremely volatile due to fluctuations in underlying cryptocurrency assets. Adding leverage further magnifies this volatility, the regulator warns.

Pricing and hedging risk from underlying cryptocurrency assets also proves to be difficult. Issuers that offer cryptocurrency CFDs have to make sure their clients understand the pricing and risks associated with these products. They also need to make sure they have adequate risk management frameworks and capital to deal with these risks.

The regulator identified nine issuers offering binary options. Binary options typically offer the least transparency in terms of underlying pricing, strike prices and payout structures, ASIC notes. The regulator reminds issuers offering binary options to retail investors that they have an obligation to make sure their clients know and understand how these products are priced before they purchase them.

With regard to client money, the regulator reminds issuers that from April 4, 2018, they are no longer allowed to use client money to hedge their positions with clients. ASIC’s review identified 25 retail OTC derivatives issuers that were using client money to hedge their positions with clients, or had indicated in their product disclosure statements that they may do so.

Issuers that are subject to the new client money reforms are advised to review their capital needs given the new restrictions on the use of client money. They should also consider whether their disclosure to investors needs to be updated.

The review found that client losses in retail OTC derivatives trades seemed high, with the percentage of unprofitable traders being up to 80% for binary options, 72% for CFD traders and 63% for Margin FX traders. ASIC says it will examine this area further as part of its ongoing focus on the sector.