Australia to require all financial firms to be members of single dispute resolution body AFCA

The one-stop shop for financial dispute resolution will take over from the Financial Ombudsman Service, the Credit and Investments Ombudsman and the Superannuation Complaints Tribunal.

There have been some interesting developments on the financial services regulation front in Australia this week, affecting all financial services providers, including Forex and CFD brokers.

The Australian government has agreed with the main recommendations in the Ramsay Review regarding the establishment and functions of a single external dispute resolution (EDR) body for the financial services companies.

The single EDR, named the Australian Financial Complaints Authority (AFCA), is set to be established by July 1, 2018 and will replace the Financial Ombudsman Service, the Credit and Investments Ombudsman and the Superannuation Complaints Tribunal.

Importantly, the government agrees to develop legislation to require all financial firms (including superannuation funds) to be members of the approved one-stop shop and comply with its determinations. This means that Forex and CFD brokers will have to become members of the new body too. Currently, the Financial Ombudsman Service (FOS) serves as the EDR for disputes between customers and CFD/FX brokers.

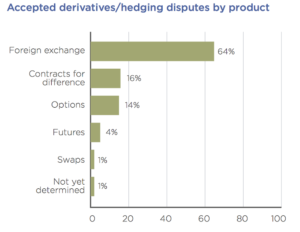

The latest annual report by FOS – for the period between July 1, 2015 and June 30, 2016 shows that the body accepted 118 disputes about derivatives and hedging products, accounting for 10% of investments and advice disputes. About two-thirds (64%) of the derivatives and hedging products disputes involved foreign exchange transactions.

The latest annual report by FOS – for the period between July 1, 2015 and June 30, 2016 shows that the body accepted 118 disputes about derivatives and hedging products, accounting for 10% of investments and advice disputes. About two-thirds (64%) of the derivatives and hedging products disputes involved foreign exchange transactions.

The Australian government agrees with the Ramsay Review that the new EDR body should start operations with a monetary limit of $1 million and a compensation cap of no less than $500,000 for financial disputes (with the exception of superannuation disputes). AFCA will be governed by an independent board, with an independent chair and equal numbers of directors with industry and consumer backgrounds, and will be funded by the industry.

The Australian Securities & Investments Commission (ASIC) will have stronger powers with regards to the oversight of this new one-stop shop and to require financial firms, including superannuation funds, to report on their internal dispute resolution activity. To support this, the Government will provide $4.3 million to ASIC over four years from 2017-18, including capital of $0.9 million in 2017-18.