Australian Financial Complaints Authority amends list of firms failing to pay complaint-related charges

A few months after AFCA published a list of firms that breach membership requirements, several firms have decided to pay complaint-related charges.

The Australian Financial Complaints Authority (AFCA) has earlier this week updated the list of firms that are in breach of its requirements as they owe money over non-payment of complaint-related charges.

Let’s recall that, in September this year, the dispute resolution body named 29 financial firms that have failed to pay complaint-related charges, breaching AFCA membership requirements. AFCA members are required by law to pay a membership levy, along with fees for every complaint received about them.

The 29 members were estimated to owe AFCA a total of $1.715 million in outstanding charges.

Now, several months after the publication of the initial list, AFCA has updated it, as five firms have paid due charges.

These five firms are:

- Kingston Capital Services Australia Pty Ltd – $1,880.00;

- Ferratum Australia Pty Ltd – $7,865.00;

- Coastal Mercantile Pty Ltd – $2,540.00;

- Qsmart Securities Pty Ltd – $1,090.00;

- In House Finance Group Pty Ltd – $740.00.

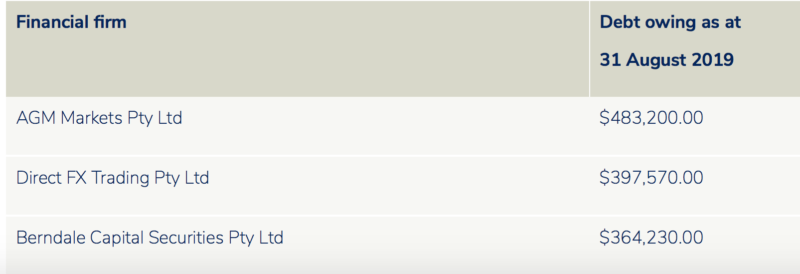

One can see that the sums paid are relatively small, especially when compared to the amounts owed by the leaders of the list of firms in breach of AFCA requirements, such as AGM Markets Pty Ltd, Direct FX Trading Pty Ltd, and Berndale Capital Securities Pty Ltd. The debt of AGM Markets is $483,200, the debt of Direct FX is $397,570, and the debt of Berndale Capital is $364,230.

Let’s recall that the Australian Securities & Investments Commission (ASIC) cancelled the Australian Financial Services Licence (422662) of AGM Markets Pty Ltd in November 2018. The cancellation of AGM’s license followed an ASIC investigation which demonstrated that AGM’s financial services operations involved core elements of unconscionability and unmanaged conflicts of interest and followed a business model that disregarded key conduct requirements.

In October 2018, ASIC said it had cancelled the Australian financial services (AFS) licence of Direct FX Trading Pty Ltd (AFS licence 305539) due to what the regulator dubbed as “serious and continued compliance failures”.

In November 2018, ASIC announced the cancellation of the Australian Financial Services (AFS) licence of Melbourne-based retail OTC derivative issuer Berndale Capital Securities Pty Ltd. ASIC has also banned Berndale’s ex-director Stavro D’Amore, of Middle Park, Victoria, from providing financial services for a period of six years. D’Amore was the sole responsible manager and key person on the AFS licence.