Australian Financial Complaints Authority receives 23,681 complaints in first four months of operations

The body registered a 42% rise in volume of complaints compared to predecessor schemes.

When it comes to transparency and accountability, many institutions have a lot to learn from the recently launched Australian Financial Complaints Authority (AFCA) which has been publishing regular updates about its work. AFCA has earlier today posted data about complaints handled during the first four months of its operations, that is, the period from November 1, 2018 to February 28, 2019.

The external dispute resolution scheme received 23,681 complaints. The volume of complaints was 42% higher when compared to predecessor schemes – the Financial Ombudsman Service, the Credit and Investments Ombudsman and the Superannuation Complaints Tribunal.

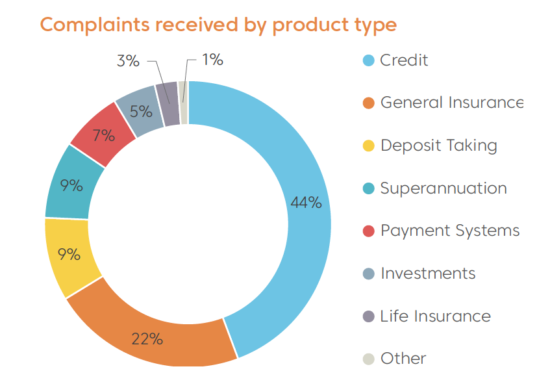

Credit and general insurance topped the list of products at the heart of most complaints. Investments accounted for 5% of all complaints received during the four month period.

The top five issues for complaints concerning investments include:

- Failure to follow instructions or agreement – 259;

- Inappropriate advice – 133;

- Incorrect fees or costs – 87;

- Failure to act in client’s best interests – 86;

- Service quality – 64.

On the brighter side, AFCA has 10,447 members, and 90% of them do not have a complaint lodged against them.

Let’s recall that, in February this year, AFCA provided an update on its powers to deal with legacy complaints. The external dispute resolution scheme welcomed the Government’s announcement to extend AFCA’s remit to review eligible financial complaints dating back to January 1, 2008. Chief Ombudsman and Chief Executive Officer, David Locke explained that AFCA’s remit will be expanded for a period of 12 months to accept eligible complaints regarding conduct dating back to January 1, 2008.

AFCA will consider eligible complaints between July 1, 2019 and June 30, 2020, following the AFCA Rules being updated. AFCA will run a limited consultation regarding required changes to its Rules, which will need to be approved by the Australian Securities and Investments Commission.