Australian losses due to investment scams surpass $50m in first 10 months of 2019

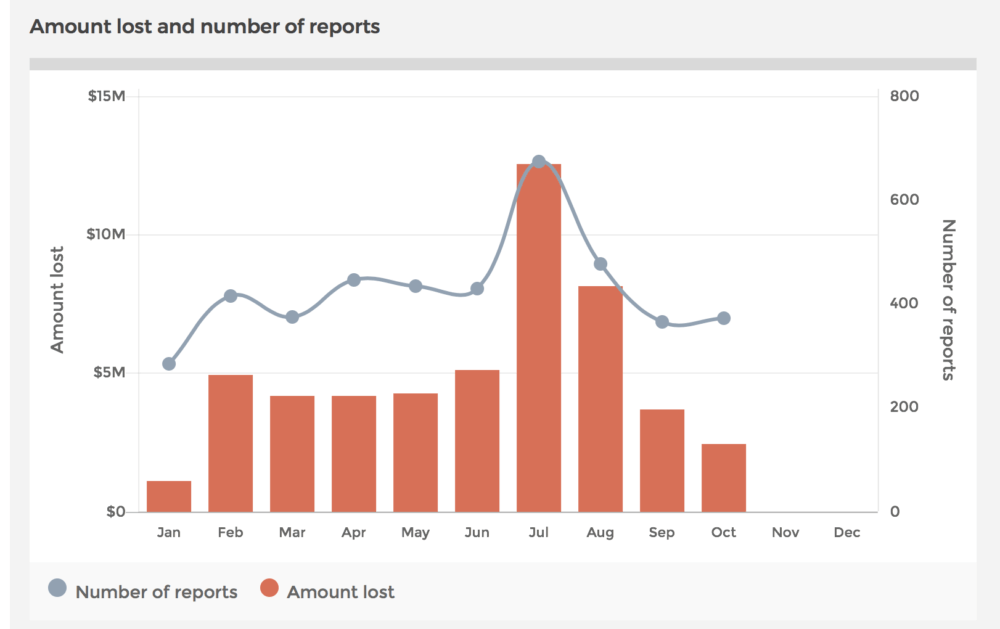

Australians filed 4,270 reports about fraudulent investment schemes in the January-October 2019 period, according to data from Scamwatch.

The latest data from Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), is out with the numbers revealing that Australians reported more than $50.5 million lost to fraudulent investment schemes in the first 10 months of 2019.

During the January-October period, Australians filed 4,270 reports about investment scams, with those from 25 to 34 years of age being the most active in submitting such reports. The biggest losses were reported by those aged from 35 to 44.

Last month, Australians reported $2.4 million lost due to investment fraud. This marks a decrease from the $3.69 million in losses reported in September. Among the 10 months in the reporting period, July was the month with biggest losses.

The risks of investment scams have been recently stressed by Scamwatch, as the body published a warning regarding get-rich-quick schemes.

In 2018, Australians filed a total of 3,508 reports about investment scams and reported losses of $38.85 million. This compares to more than $31 million reported lost to investment scams in 2017. Last year, July was the month with the biggest amount of losses ($6 million) too.

The bulk of investment scams are still focused on traditional investment markets like stocks, real estate or commodities. For instance, scammers cold call victims claiming to be a stock broker or investment portfolio manager and offer a ‘hot tip’ or inside information on a stock or asset that is supposedly about to go up significantly in value. They will claim what they are offering is low-risk and will provide quick and high returns.