Australians lose $2.15 million to investment fraud in October 2017

The biggest losses were reported by those between 55 and 64 years of age, whereas those aged 25-34 were the most active in reporting such fraud.

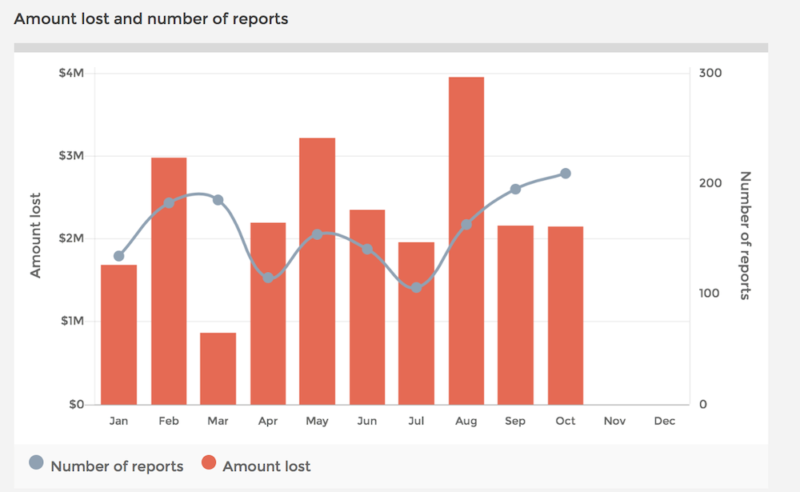

The latest numbers of Scamwatch, the body run by the Australian Competition and Consumer Commission (ACCC), are out, with the data showing losses due to investment fraud that Australians reported in October 2017 amounted to $2.15 million. The sum is a notch lower than the one reported in September 2017, however, let’s note that the number of reports was higher at 209.

The biggest losses due to investment scams were suffered by people aged 55-64, a trend that continues from previous months. Those between 25 and 34 years of age were the most active in reporting this type of fraud. Let’s note that one report was submitted by a person aged below 18.

Since the start of 2017, Australians have reported more than $23.5 million lost due to the activities of investment scammers. The number of reports thus far is 1,583.

The numbers are not conclusive as many investors do not report their losses. In 2016, the ACCC and the Australian Cybercrime Online Reporting Network (ACORN) received a total of 200,103 reports about scams. Losses reported to Scamwatch, ACORN and from other scam disruption programs amount to approximately $300 million.

Scamwatch has recently warned of a rising number of Bitcoin-related scams. The organization received a total of 77 reports about Bitcoin-related scams in the week to October 29, 2017, with the number up 126% from the previous week. A typical example of such a scam is an SMS saying that a person has a certain number of Bitcoins in his/her account and then asking the potential victim to check (log into) the account.

The numbers from Scamwatch are released shortly after the Australian Communications and Media Authority (ACMA) also voiced its concerns about the increased number of fraudulent schemes involving cryptocurrencies. ACMA warned the public of scams targeting people who use crypto currencies like Bitcoin and Ethereum. In particular, the authority noted a number of fake Blockchain URLs and a Bitcoin survey that are indeed scams that aim to collect personal information.