Australians lose $26.4m to investment fraud in H1 2018

The month with record losses was May, with nearly $5.8 million reported lost due to investment scammers.

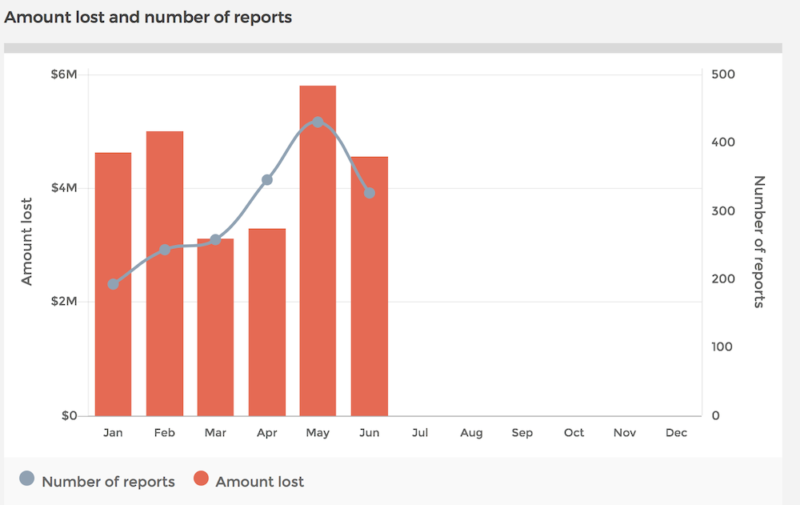

Australians reported losses of $26,378,380 due to investments scams in the first six months of 2018, according to the latest data from Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC). The number of reports reached 1,796 in the first half of the year.

The month with record losses due to such fraud was May ($5.8 million reported lost), whereas June saw a slight decline with the amount lost last month being $4.55 million.

The most active part of the population that reported investment fraud issues were those aged between 25 and 34, whereas those reporting the biggest losses were those from 45 to 54 years of age.

A type of investment fraud that is currently becoming more widespread in Australia involves cryptocurrencies. Earlier in 2018, Consumer Affairs Victoria, a business unit of the Department of Justice & Regulation, within the Victorian government, warned about Bitcoin scams. Victoria’s consumer regulator said it had received reports of people being defrauded through fake Bitcoin websites. The average amount lost is not that large – around $300, but the body sees this type of fraud as worrisome.

In the meantime, the Australian authorities continue to remind cryptocurrency exchange platforms that they are now subject to new regulatory requirements and need to register with AUSTRAC. The registration of such a business with AUSTRAC, however, does not constitute endorsement.

Digital currency exchanges have been required to apply for registration since April 3, 2018 and remittance providers are already required to be registered.

AUSTRAC has warned that businesses must not use their registration status in any way that suggests AUSTRAC or the Commonwealth Government endorses them or any of their services or products. Words including ‘endorsed’, ‘approved’ or ‘licensed’ are examples of inappropriate wording. The new requirements stem from the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2017, also known as the “Bitcoin bill”. In December last year, the legislative piece passed both Houses and got Royal Assent.