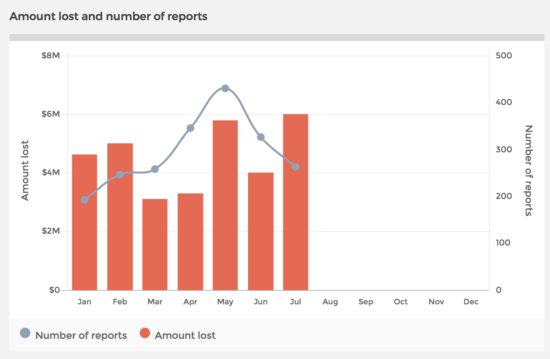

Australians report more than $6m in losses due to investment scams in July 2018

This makes July the month with the biggest losses due to investment fraud in Australia so far this year.

The latest monthly numbers from Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), are out, once again showing that months like July and August may be slow ones for doing legitimate business but not for scammers who continue to target Australian residents.

According to the most recent data, Australians reported losses of more than $6 million due to investment scams in July 2018. This marks a stark rise from June levels and takes the overall amount lost due to investment fraud since the start of this year to massive $31.8 million.

The number of reports about investment fraud was 263 last month, with the most active part of the population submitting such reports being those aged from 35 to 44. They were also the people who suffered the biggest losses.

Let’s note that, in late July, Scamwatch voiced its concerns about the continued expansion of certain investment scams, including binary options and cryptocurrencies. Cryptocurrency trading scams have grown significantly in the past 12 months and are now the second most common type of investment scam offer pushed on victims.

“The rise in popularity in cryptocurrency trading has not been missed by scammers who are latching onto this new trend to con people. These are similar to any other investment scam: the scammer will claim to have inside knowledge about price movements they will use to make you a fortune. If you invest, your money will quickly disappear,” ACCC Deputy Chair Delia Rickard said.

Digital currency exchanges have been required to apply for registration with AUSTRAC since April 3, 2018.

AUSTRAC has informed digital currency exchanges that they must not use their registration status in any way that suggests AUSTRAC or the Commonwealth Government endorses them or any of their services or products. Words including ‘endorsed’, ‘approved’ or ‘licensed’ are examples of inappropriate wording.