Australia’s financial dispute resolution body receives 60,687 complaints in first 10 months of operations

According to AFCA’s data, 16% of licensee members had a complaint lodged against them in the first 10 months of its operations.

The Australian Financial Complaints Authority (AFCA), the single external financial dispute resolution scheme in Australia, has posted some metrics regarding its activities during its first 10 months of operations.

In the period from November 1, 2018 to August 31, 2019, AFCA received 60,687 complaints. As at August 31, 2019, 73% of these have been closed. The body has awarded a total of $144.7 million in compensation. This includes matters previously received by AFCA’s predecessor, Financial Ombudsman Service, and resolved by AFCA since November 1, 2018.

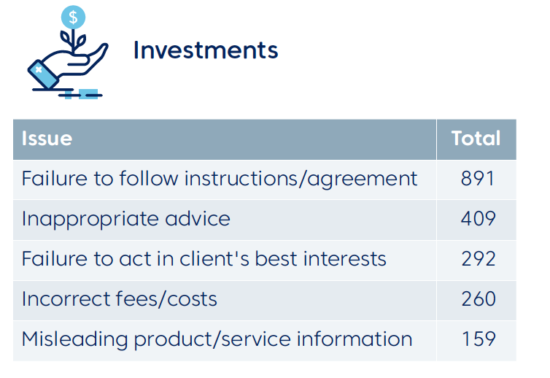

Investments accounted for 5% of all complaints. The main product issues for investment complaints are as follows:

- Failure to follow instructions/agreement – 891;

- Inappropriate advice – 409;

- Failure to act in client’s best interests – 292;

- Incorrect fees/costs – 260;

- Misleading product/service information – 159.

Earlier in September, published a list of 29 financial firms that have failed to pay complaint-related charges, thus violating AFCA membership requirements.

AFCA members are required by law to pay a membership levy, along with fees for every complaint received about them. The 29 members owe AFCA a total of $1.715 million in outstanding charges.

At the top of the list are three FX firms – AGM Markets Pty Ltd, Direct FX Trading Pty Ltd, and Berndale Capital Securities Pty Ltd. The debt of AGM Markets is $483,200, the debt of Direct FX is $397,570, and the debt of Berndale Capital is $364,230.

AFCA noted that it has made numerous attempts to contact the financial firms to recover the amounts owing.