Australia’s Financial Ombudsman Service marks 6% rise in investment disputes in Q4 2017

The number of disputes related to investments accounted for humble 4.3% of the total in the quarter to December 31, 2017.

Australia’s Financial Ombudsman Service (FOS) received 455 disputes related to investments in the final quarter of 2017, up 6% from the 429 such disputes received in the preceding quarter. The data were revealed in the latest FOS Circular.

Although the number of such disputes marks a rise on a quarterly basis, they still account for a very small portion of the total number of disputes that the FOS received and dealt with during the quarter to December 31, 2017. During final three months of the year, investments disputes accounted for humble 4.3% of all disputes.

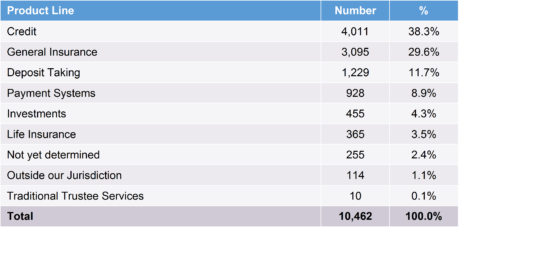

The FOS received 10,462 disputes in the October to December 2017 quarter. This is consistent with the previous quarter but is a 14% increase compared with the same quarter in 2016. Most disputes received were credit disputes (38%), followed by general insurance disputes (30%).

The numbers are released shortly after Scamwatch, the body run by the Australian Competition and Consumer Commission (ACCC), released data showing that Australians suffered losses of more than $31.15 million due to investment scams in 2017. The losses mark a 32% rise from the losses of $23.63 million reported by Australians hit by investment fraud in 2016. Investment schemes dominated the landscape of most widespread scams in Australia in December 2017, at least in terms of losses reported – $2.9 million.

Not all companies comply with FOS’s determinations. The numbers for unpaid determinations for the period between the commencement of FOS’ single Terms of Reference on January 1, 2010 and December 31, 2017, show that 40 financial service providers are unwilling or unable to comply with 157 determinations, affecting 223 consumers. In 118 of these determinations, the consumer received no payments at all, despite the requirement on Australian financial services license holders to have ‘adequate compensation arrangements’ in place.

As a result of this non-compliance, the FOS says, about $14.7 million has not been returned to affected consumers.

These determinations represent 17.05% of all accepted determinations issued in favour of consumers by the Investments and Advice (I&A) team. As a proportion of total compensation awarded by the I&A team, the value of unpaid determinations is 24.04%.

The issue of non-compliance is not spread evenly throughout different sectors of the financial services industry. The top three categories of non-compliant financial services providers include Financial Planners and Advisors (55%), Operators of Managed Investment Schemes (13%) and Credit Providers (10%).