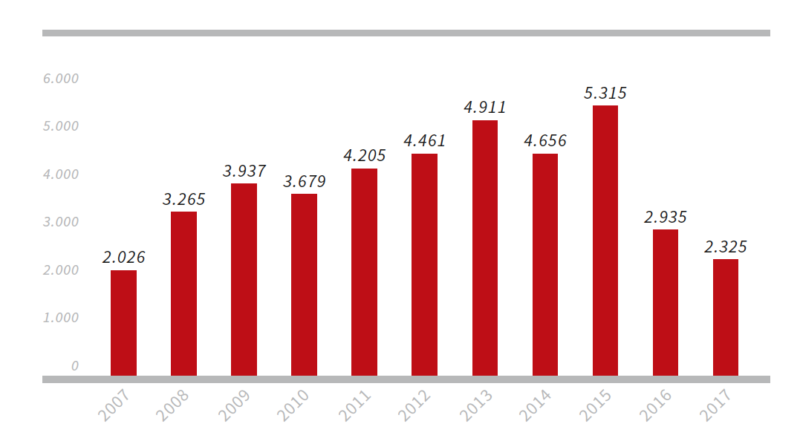

Austrian FMA handles 2,325 complaints in 2017: binary options and cryptos spark investor concerns

The new topic of enquiries and complaints that appeared in 2017 was the one about international investment fraud related to cryptocurrencies.

Austria’s Financial Market Authority (FMA) has earlier today published its Annual Report for 2017, shedding some light on the key areas of its activity, including handling investors’ complaints.

The FMA handles investors’ complaints in line with the European guidelines that came into force in 2016. Under these guidelines, any complaint is first directed to the company whose client is displeased. If the client has not obtained a satisfactory outcome from the company, the client may turn to the FMA. The regulator then reviews the company’s response and decides whether it was appropriate and whether any sanctions have to be imposed.

In 2017, the FMA received 2,325 complaints.

- The topics of the enquiries and complaints were various, but binary options and CFDs were among the dominant ones. The regulator stressed that the aggressive marketing practices associated with these products continue.

- Virtual currencies, like Bitcoin, Ethereum, Ripple and Litecoin, also featured on the list of topics that sparked investors’ questions. FMA advises investors to stay cautious with regard to such products as investment in them carries a high risk.

- Initial Coin Offerings (ICOs) were also among the major topics of enquiries handled by the FMA in 2017. The regulator notes that ICOs are not supervised and that investors cannot make use of the typical protection they are entitled to in case things go awry.

The regulator stressed that the number of enquiries and complaints about unauthorized persons remained consistently high. The new set of enquiries and complaints that appeared in 2017 were those about international investment fraud related to cryptocurrencies.

The FMA has taken action against entities involved in fraudulent activities related to virtual currencies. In January this year, the regulator said that after receiving multiple complaints relating to OPTIOMENT, it has decided to refer the case to the Public Prosecutor’s Office in Vienna. OPTIOMENT, which has been promoted widely online as “a premier global Bitcoin investment project”, has also been blasted for being a Ponzi scheme.

Virtual currencies have also been among the key topics of the enquiries received of the FinTech contact center established in October 2016, the FMA said. The center aims to respond to questions of businesses that develop innovative technologies and business models. Since its launch in October 2016 until the end of 2017, the contact point has handled 112 enquiries from companies. The companies enquired about mobile payment services, automated consulting platforms and crowdfunding.