Autochartist and ChartIQ partner for real-time technical analysis

Cosaic, the makers of ChartIQ, is proud to announce its recent partnership with Autochartist, a world-renowned technology partner that provides real-time market analysis for traders.

Cosaic, the makers of ChartIQ, is proud to announce its recent partnership with Autochartist, a world-renowned technology partner that provides real-time market analysis for traders. This integration uses proprietary technology to display trading opportunities at a glance, reducing the complexity of chart analysis for traders.

“Autochartist decision support tools highlight the power of technical analysis by providing users with actional information, including critical levels in the market,” says Cosaic Chief Product Officer Eugene Sorenson. “It’s a next-level technical analysis experience.”

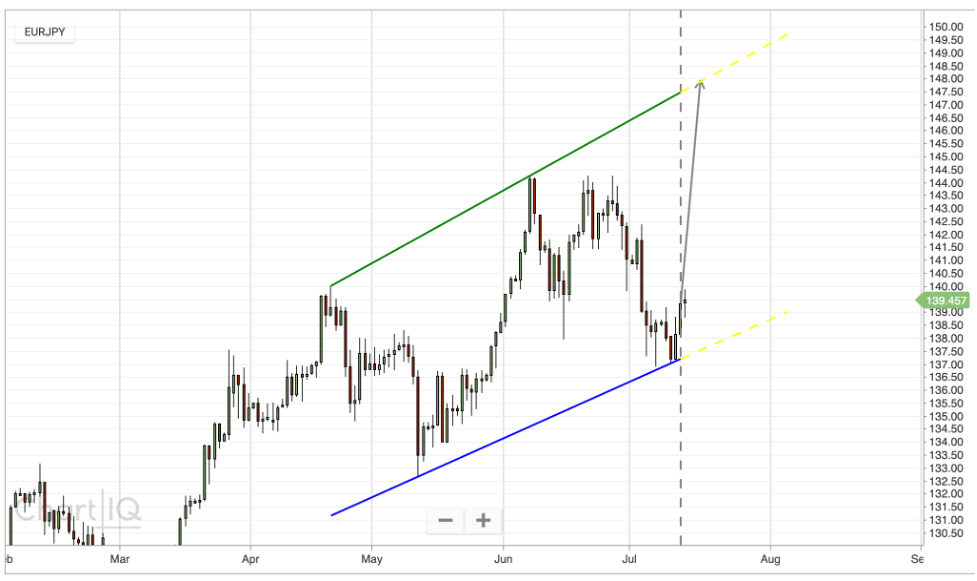

See Autochartist and ChartIQ in action.

Established in 2012, ChartIQ is a world-renowned charting solution used by online brokerages, institutions, and capital markets world-wide. Clients like E-trade, Yahoo Finance, and Zerodha choose ChartIQ’s high-quality charts for their web pages and portals, helping millions of users make smart trading decisions.

“With this ChartIQ partnership we hope to see Autochartist implemented by many leading brokerages,” says Autochartist CEO Ilan Azbel. “We are excited to have millions of traders around the world take advantage of our breadth and depth of market analysis to improve their decision-making process.”

Identifying and acting on patterns to identify opportunities in the market is the backbone of technical analysis. ChartIQ’s technical analysis platform provides a foundation for this analysis with a full suite of drawing tools and analytical indicators, but with Autochartist, users can now isolate trends faster, without having to crunch the numbers or spend time drawing extensive indicators.

Backed by big data, Autochartist’s proprietary pattern recognition technology identifies trends that may be present in a given market dataset by drawing the patterns, such as rising and falling wedges, channel up and down patterns, head-and-shoulder patterns, and flag formations, to enable traders to make smarter trading decisions.

“ChartIQ clients have just been giving another edge over their competitors,” adds Sorenson. “Technology as advanced as Autochartist is another tool for their users’ arsenal.”

Current clients can learn how to integrate Autochartist with this documentation page, or by contacting their account manager at [email protected].

About Autochartist

Since 2004 Autochartist has partnered with many of the world’s leading online brokers across the globe. Autochartist services millions of traders in over 100 countries through its vast broker partnerships. Autochartist distributes thousands of trade setups, articles, and social media posts on a daily basis in more than 30 languages. The company prides itself on its core commitment to service excellence and ongoing market leadership through developing innovative new products.