Belgium’s financial regulator starts compiling “black list” of cryptocurrency websites

Belgium’s FSMA has received complaints about at least 20 cryptocurrency trading platforms.

Over the past couple of years, the length of the “black lists” of fraudulent binary options and Forex brokers compiled by Belgium’s Financial Services and Markets Authority (FSMA) has markedly grown. But the focus of the regulator is now on another type of scam – cryptocurrency-related fraud.

In an announcement, published on its website today, the FSMA notes that it received numerous complaints about trading platforms that claim to be active in the cryptocurrency sector. Consumers who have invested in them complain that they are unable to recover the funds invested, or that they simply have heard nothing further from the company with which they invested their money.

The regulator says that all such entities use the same ruse: they claim to offer the best (or one of the best) trading platform(s), enabling both beginners and professionals to trade in cryptocurrencies in a matter of seconds and with full confidence. Also, some of these platforms offer other financial products with cryptocurrencies as their underlying: savings accounts with supposedly guaranteed returns, servicing rights or derivative products such as CFDs.

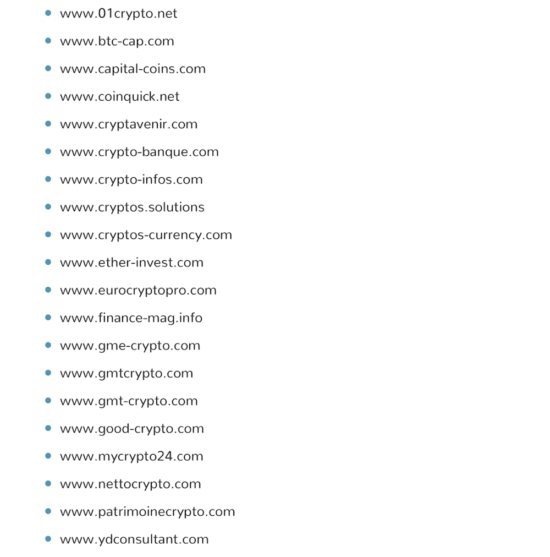

In response to the rising number of complaints, the FSMA has put together a list of cryptocurrency trading platforms about which it has received enquiries/complaints from consumers and has identified signs of fraud. The regulator notes that the list is not exhaustive.

Earlier today, France’s financial markets regulator AMF also made clear its concerns about this market segment by publishing its stance on the regulation of cryptocurrencies and products related to them.

Following an analysis of the legal status of cryptocurrency derivatives, the French regulator has reached the conclusion that the platforms offering these products must abide by the authorisation and business conduct rules, and that these products must not be advertised via electronic means. That is, such products fall within the ambit of the famous Sapin 2 law, which prohibits the digital advertising of binary options and certain CFDs which are deemed toxic for investors.