BEQUANT launches index measuring dollar against crypto

“Our research team has worked hard to quantify and capture the latest economic story into the broader crypto market.”

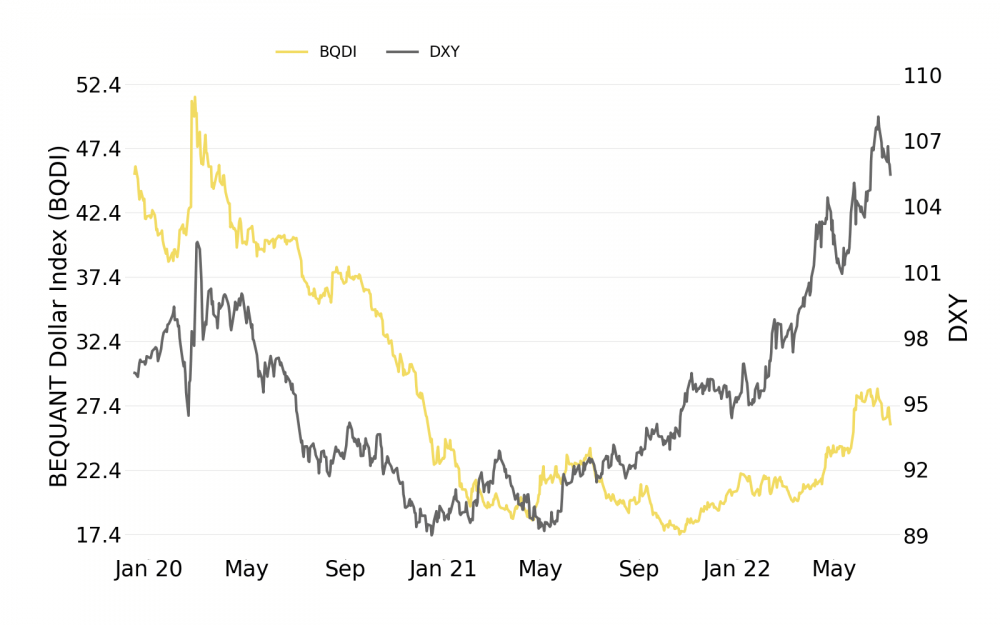

BEQUANT has launched the BEQUANT Dollar Index (BQDI), which measures the dollar’s strength against a basket of top eight cryptocurrencies, with each coin’s weight based on its market capitalization and volumes traded.

The digital asset prime brokerage and exchange says the index is crucial for investors to understand the spillover effects of the US monetary policy on the crypto universe.

For the past 2 years, the evolution of cryptocurrencies was closely tied to monetary and fiscal policy in the US. Low-interest rates mean that ample liquidity conditions will flow into high-risk/high-return assets like crypto while tightening conditions mean that a risk-return portfolio has to be adjusted towards more conservative assets.

By comparing the BQDI to US 10Y yields or traditional the U.S. Dollar Index (DXY) it can already tell the investor if the current economic environment is directly linked to the border crypto market, the firm states. If the link is strong investors can expect new releases of economic data to add volatility to the market like in a traditional finance space. It also implies that investors can find coins that are independent of the volatility coming from the state of the economy, the crypto specialist added.

The basket of coins is updated every month to reflect market movements.

Martha Reyes, the Head of Research at BEQUANT, commented: “The new BEQUANT Dollar Index is another tool to help our clients make more informed investment decisions. Our research team has worked hard to quantify and capture the latest economic story into the broader crypto market. This is another way for investors to analyze the interconnectedness of the two and navigate through fundamental analysis in crypto more clearly”.

DeFi platform for institutional clients

BEQUANT has recently launched a DeFi platform for institutional clients, in partnership with crypto custodian Fireblocks. Uniswap is the first DeFi protocol accessible through BEQUANT’s DeFi offering, but other decentralized exchanges (DEXs) will be integrated in the near future.

The firm’s bespoke platform will enable clients to cross-margin between centralized and decentralized exchanges, making arbitrage trading more efficient, without the need for any additional software and multi-signature security protocols.

BEQUANT already provides direct market access to multiple trading venues, simplified KYC, and compliance verification to more than 150 institutional clients.

The firm’s offering includes transfer management, cross-margining, and leverage as well as access to a dozen crypto exchanges, including KuCoin, Binance, FTX, BitFinex, OKX, and its very own BEQUANT Exchange.

The prime brokerage platform for institutional clients also provides its users with reduced trading costs, up to 9x leverage, dedicated 24/7 customer support, and an individual client manager, as well as OTC block trade execution and fiat-to-crypto trading.

Its breadth of products includes prime brokerage, custody and fund administration, as the Malta-regulated prime brokerage boasts a team of experts from institutional, retail, and digital financial services with experience in banking, derivatives, electronic trading, and prime brokerage.